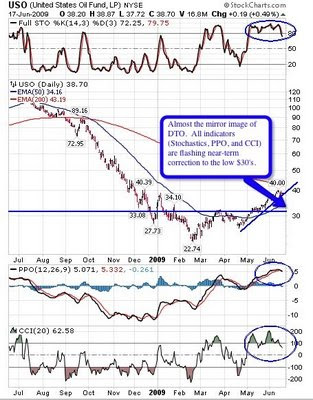

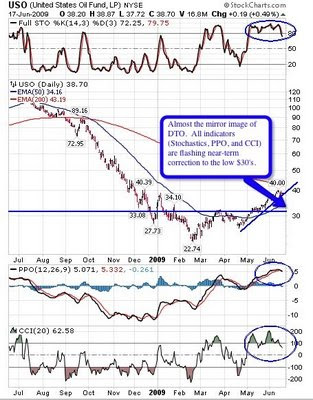

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

No comments:

Post a Comment