Note: To enlarge chart, double-click inside of it.

Note: To enlarge chart, double-click inside of it.

The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Monday, June 29, 2009

TSY and Agency Securites: Who is Buying?

The following two charts, curiosity of Contrary Investor, depicts the overall trend of foreign purchases of Treasury and Agency securities. My comments are provided within each chart.

I firmly believe that "Quantitative Easing (QE) through debt monetarization will not only continue but will be expanded. QE is a main reason why I have become more bullish to gold (GLD) and silver (SLV). GLD and SLV, based on technical analysis, are both looking very attractive. Stay tuned!

I firmly believe that "Quantitative Easing (QE) through debt monetarization will not only continue but will be expanded. QE is a main reason why I have become more bullish to gold (GLD) and silver (SLV). GLD and SLV, based on technical analysis, are both looking very attractive. Stay tuned!

Sunday, June 28, 2009

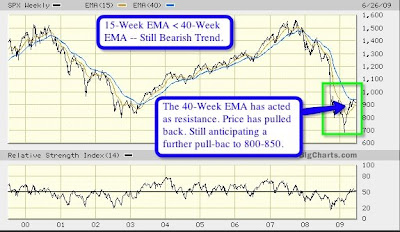

Weekly Update on S&P 500: 15- and 40-Week EMAs

Note: To enlarge the chart, double-click inside of it.

Note: To enlarge the chart, double-click inside of it.I will be watching UGL and AGQ very closely this week for potential buy signals. Alignment between and among PPO, Stochastics, and CCI are just about in place for those 200% leverage ETFs. I still have a position DTO. I will be updating on Twitter. Therefore, if you want to follow my inter-day market updates on ETFs and ETNs that I am following, go to Twitter.Com/DeBauche.

Thursday, June 25, 2009

UGL (Ultra-Gold): 200% Leverage

I mentioned on Twitter today that gold and silver are starting to "look" attractive. The only part of the puzzle that is not in alignment is PPO. Full Stochastics and Community Channel Index (CCI) are already "flashing" a buy signal. Let's wait until that final piece of the puzzle is in place before committing any financial resources. See the details about UGL in the following chart: Note: To enlarge the chart, double-click inside of it.

Note: To enlarge the chart, double-click inside of it.

Note: To enlarge the chart, double-click inside of it.

Note: To enlarge the chart, double-click inside of it.

Wall Street Journal: Climate Bill Biggest Tax in American History

The Wall Street Journal reports that the Cap and Trade would cost the economy $161 billion in 2020, which is $1,870 for a family of four. As the bill's restrictions kick in, that number rises to $6,800 for a family of four by 2035. For the full article, click-on Cap and Tax Fiction.

What a great way to grow the economy! Where is our sanity?

What a great way to grow the economy! Where is our sanity?

Wednesday, June 24, 2009

$100,000 of Your Tax Money to Breed Wyoming Toads

Once again, I am not that creative to make this stuff up. Read all about it at Grants.Gov.

Warren Buffett to CNBC: U.S. Economy In "Shambles"

"In a live interview on CNBC today, Warren Buffett said there has been little progress over the past few months in the "economic war" being fought by the country. "We haven't got the economy moving yet." While the economy is a "shambles" and likely to stay that way for some time, he remains optimistic there will eventually be a recovery over a period of years. Despite his negative view on the economy, Buffett still believes the stock market is attractive "over the next 10 years" when compared to alternatives like Treasury bonds." For the full interview, click-on CNBC.

Tuesday, June 23, 2009

Updates on Specific ETFs and ETNs

Tomorrow is FOMC day! I can not imagine much will happen until the magical time of 2:15 EST. The dollar is still crucial going forward for my bearish thoughts on oil. Today was not a good day for the dollar. As measured by UUP, it was down 1.18%. I still believe the dollar has a little more on the upside, which would correspond to oil moving into oversold territory as measured by PPO, Stochastics, RSI, and CCI. The same statement can be made for the metals, gold and silver.

The following comments are updates on those ETFs and ETNs that I am currently following or have positions:

GLD ($90.92) -- Support is right at its 200-day EMA of $88. If dollar strengths, GLD will sell off towards support at $88.

GLL ($15.34) -- It is right at support. It's 50-day EMA is at $15.44, which has been resistance. In addition, it has moved into overbought territory as measured by PPO, Stochastics, RSI, and CCI. I have a small position in GLL, which I may decide to liquidate tomorrow morning.

SLV ($13.63) -- Silver has support at $13.50. PPO, Stochastics, RSI, and CCI are moving into oversold territory. If it can hold the $13.50, I may be tempted to purchase it with a price object near term of $17, which is a major overhead resistance zone.

ZSL ($9.11) -- Support is at $9. However, PPO, Stochastics, RSI, and CCI are all over bought at the current price. Near term, I am negative.

DTO ($76.69) -- This double-inverse oil ETF has been my favorite trading vehicle recently. I liquidated this position on Monday at an average price of $79.01 for a 10.8% profit. Depending on the dollar, I could see DTO trading at $90. It is still on my radar.

UNG ($14.48) -- I have small position in UNG, which was part of my paired trade with DTO. DTO leg was lifted at a profit. However, I decided to hold UNG. It has been trading right at its 50-day EMA for the past week. I still like UNG, because I believe it is cheap in relation to oil (USO:UNG). That is the price spread will work in the favor of UNG.

The following comments are updates on those ETFs and ETNs that I am currently following or have positions:

GLD ($90.92) -- Support is right at its 200-day EMA of $88. If dollar strengths, GLD will sell off towards support at $88.

GLL ($15.34) -- It is right at support. It's 50-day EMA is at $15.44, which has been resistance. In addition, it has moved into overbought territory as measured by PPO, Stochastics, RSI, and CCI. I have a small position in GLL, which I may decide to liquidate tomorrow morning.

SLV ($13.63) -- Silver has support at $13.50. PPO, Stochastics, RSI, and CCI are moving into oversold territory. If it can hold the $13.50, I may be tempted to purchase it with a price object near term of $17, which is a major overhead resistance zone.

ZSL ($9.11) -- Support is at $9. However, PPO, Stochastics, RSI, and CCI are all over bought at the current price. Near term, I am negative.

DTO ($76.69) -- This double-inverse oil ETF has been my favorite trading vehicle recently. I liquidated this position on Monday at an average price of $79.01 for a 10.8% profit. Depending on the dollar, I could see DTO trading at $90. It is still on my radar.

UNG ($14.48) -- I have small position in UNG, which was part of my paired trade with DTO. DTO leg was lifted at a profit. However, I decided to hold UNG. It has been trading right at its 50-day EMA for the past week. I still like UNG, because I believe it is cheap in relation to oil (USO:UNG). That is the price spread will work in the favor of UNG.

Summers for Bernanke as Fed Chairman?

Rumor has it that Larry Summers will replace Ben Bernanke as Fed Chairman when his term is up in January. Summers is Obama's Director of the National Economic Council (NEC). Further, the rumor on Wall Street is that Summers agreed to be Obama's Director of the NEC as long as Obama appointed him as Fed Chairman in January 2010. I don't have a problem with replacing Bernanke but NOT with Summers. Now, lets work on a replacement for Tim Geithner as Treasury Secretary.

Monday, June 22, 2009

DTO (Double-short Oil)

Those of you that track my Twitter account knew that I sold my positions early this morning for an average price of $79.01, which equates out to a 10.8% return.

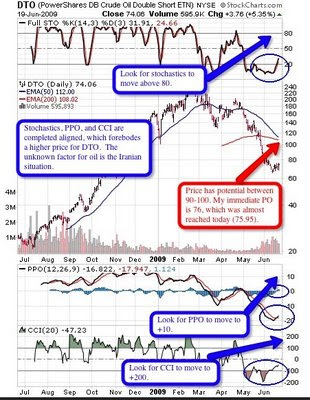

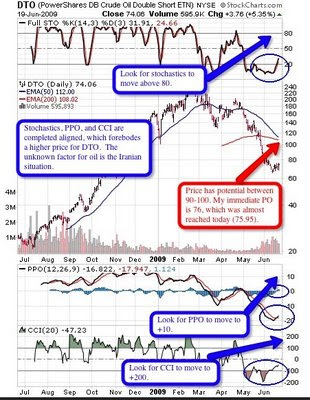

It had a gap open of $4. From a technical perspective, it has not reached the overbought area as measured by Stochastics, PPO, RSI, and CCI. See the following chart. If it closes the gap, I just might be interested in trading it again.

To enlarge the chart, double-click inside of it.

To enlarge the chart, double-click inside of it.

It had a gap open of $4. From a technical perspective, it has not reached the overbought area as measured by Stochastics, PPO, RSI, and CCI. See the following chart. If it closes the gap, I just might be interested in trading it again.

To enlarge the chart, double-click inside of it.

To enlarge the chart, double-click inside of it.

Saturday, June 20, 2009

Congress and the International Monetary Fund (IMF)

This week in Washington the House approved $106 billion supplemental appropriations bill to fund our troops in Irag and Afghanistan, which also included $108 billion for the IMF. Umm! A vote against the IMF funding would be a vote against our troops. This should be an outrage to every American. These bills should be separate and voted as such. The argument that the Administration is putting forth is that it is in our vital economic interest and global security to fund the IMF $108 billion. Why? Is anyone really home out there?

It's not like the IMF doesn't have any financial resources. The IMF holds 3,217 metric tons of gold (103.4 million ounces).

Now, I am all for the funding of our troops, but I can not justify funding the IMF; which, by the way, is not such a great supporter of the United States.

This bill will now be voted on in the Senate. If you feel that funding for our troops and the IMF should be separate bills and debated on their own merits, contact your Senators and tell them as much!

It's not like the IMF doesn't have any financial resources. The IMF holds 3,217 metric tons of gold (103.4 million ounces).

Now, I am all for the funding of our troops, but I can not justify funding the IMF; which, by the way, is not such a great supporter of the United States.

This bill will now be voted on in the Senate. If you feel that funding for our troops and the IMF should be separate bills and debated on their own merits, contact your Senators and tell them as much!

S&P 500 Update for the Week Ending June 19, 2009

Note: To enlarge chart, double-click inside of it.

Note: To enlarge chart, double-click inside of it.Federal Open Market Committee (FOMC) meets next Wednesday. We could have volatility going into Wednesday; but, then again, that could be good for traders. However, I would settle for a trending market, either up or down. It would make one's investing life that much easier.

From an investing standpoint, that is the great benefit of using exponential moving averages (EMA), such as the 14-Week EMA and 40-Week EMA, to make investment decisions. Simply point, investors should be in stocks when the 15-Week EMA is above its 40-Week EMA; and of stocks and into money market instruments when the 15-Week EMA is below its 40-Week EMA. It doesn't get any more complicated than that.

Friday, June 19, 2009

Update on DTO

For those of you that follow me on Twitter, know that I have a position in DTO (double-inverse oil. I am in with an average cost of $71.31. DTO closed at $74.06. See my comments my comments in the following DTO chart:

Note: To enlarge chart, double-click inside of it.

I will update my weekly S&P 500 comments over the weekend.

Note: To enlarge chart, double-click inside of it.

I will update my weekly S&P 500 comments over the weekend.

Washington is Wall Street and Wall Street is Washington

Please take the time to review the following video! It pretty much sums up my believe that the "Financial Oversight Bill" being proposed by the Fed is all about control that will further enhance the relationship between Washington and Wall Street. Main Street, you are screwed! Forgive my vulgarity, but how can we trust those individuals who put us in our current economic/financial debacle to come up with solutions to rectify the problem? Those individuals are the problem, not the solution.

Wednesday, June 17, 2009

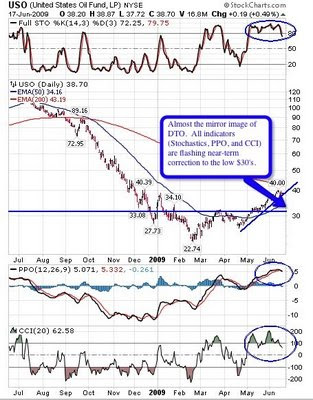

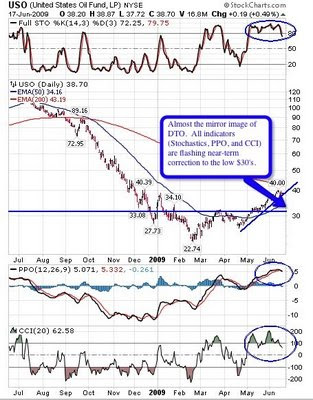

Reflection on DTO (Double-short Oil) and USO (OIL)

I entered a trade on DTO today at $71.81 with a stop at $71.09, which turned out to be a very quick trade (loss of 1%). Saying that, I still like its potential. Please refer to the following chart for my rationale on entering the trade. On reflection, I would have done it again, because all the key technical indicators (stochastics, PPO, and CCI) were all in alignment. Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

Now, take a look at USO, which is the mirror image of DTO, and tell me do you want to be long or short oil based on these two charts?

Buy China Policy

The "Financial Times" reports today that "China has introduced an explicit “Buy Chinese” policy as part of its economic stimulus program in a move that will amplify tensions with trade partners and increase the likelihood of protectionism around the world. In an edict released jointly by nine government departments, Beijing said government procurement must use only Chinese products or services unless they were not available within the country or could not be bought on reasonable commercial or legal terms."

Anyone remember the names of Smoot and Hawley? If not, you probably better brush up on your history, especially after the government just announced that the CPI had biggest annual drop in nearly 60 years.

Anyone remember the names of Smoot and Hawley? If not, you probably better brush up on your history, especially after the government just announced that the CPI had biggest annual drop in nearly 60 years.

Obama's Iran Abdication to Sarkozy

"The President yesterday denounced the "extent of the fraud" and the "shocking" and "brutal" response of the Iranian regime to public demonstrations in Tehran these past four days. "These elections are an atrocity," he said. "If [Mahmoud] Ahmadinejad had made such progress since the last elections, if he won two-thirds of the vote, why such violence?" The statement named the regime as the cause of the outrage in Iran and, without meddling or picking favorites, stood up for Iranian democracy."

No, those words were not spoken by President Obama but France's President Nicolas Sarkozy. "The French are hardly known for their idealistic foreign policy and moral fortitude. Then again many global roles are reversing in the era of Obama."

For the complete text of the opinion expressed by the "Wall Street Journal," go to Obama's Iran Abdication.

No, those words were not spoken by President Obama but France's President Nicolas Sarkozy. "The French are hardly known for their idealistic foreign policy and moral fortitude. Then again many global roles are reversing in the era of Obama."

For the complete text of the opinion expressed by the "Wall Street Journal," go to Obama's Iran Abdication.

Twitterrific

For those of you that have an "iPhone," you can follow my inter-day market updates by downloading a free application called "Twitterrific." It is a mobile Twitter. IMHO, it is a great application for the iphone.

Tuesday, June 16, 2009

ZSL: Ultra-short Silver

I sold my ZSL positions today for the reasons depicted in the following chart.

Note: To enlarge chart, double-click inside of it.

Note: To enlarge chart, double-click inside of it.

Note: To enlarge chart, double-click inside of it.

Note: To enlarge chart, double-click inside of it.

Monday, June 15, 2009

DTO (Double-short Oil), UNG (Natural Gas), and ZSL (Double-short Silver)

I removed the DTO leg at $71.61 of the DTO:UNG paired-trade today. The trade netted 5% for a 24-hour investment. As I mentioned on Twitter, I may learn to regret removing the leg. Matter of fact, in after-hour trading, DTO closed at $72.24. UNG closed the day at $15.71, which was up 7%. I still like the natural gas story and its technical picture. The other trade from Friday was ZSL, which closed at $8.79 (+10%). (See the following chart on SLV.) To say the least, it was a good day. However, I realize what the market gives, it can take!

The main reason for selling DTO, besides the 5% gain, was due to the unrest with aftermath of the Iranian election situation. If this situation implodes within Iran, oil will definitely rally.

I still maintain these markets (equities, bonds, oil, and metals) are all tied directly to what happens to the dollar. Therefore, one must pay very close attention to what happens at the BRIS meetings tomorrow.

Note: To enlarge, double-click inside the chart.

Note: To enlarge, double-click inside the chart.

The main reason for selling DTO, besides the 5% gain, was due to the unrest with aftermath of the Iranian election situation. If this situation implodes within Iran, oil will definitely rally.

I still maintain these markets (equities, bonds, oil, and metals) are all tied directly to what happens to the dollar. Therefore, one must pay very close attention to what happens at the BRIS meetings tomorrow.

Note: To enlarge, double-click inside the chart.

Note: To enlarge, double-click inside the chart.

The American Empire is Bankrupt

Please read this very important article of the BRIS meetings being held today and tomorrow by Chris Hedges in the Truthdig. An excerpt from the article is as follows:

"There are meetings being held Monday and Tuesday in Yekaterinburg, Russia, (formerly Sverdlovsk) among Chinese President Hu Jintao, Russian President Dmitry Medvedev and other top officials of the six-nation Shanghai Cooperation Organization. The United States, which asked to attend, was denied admittance. Watch what happens there carefully. The gathering is, in the words of economist Michael Hudson, “the most important meeting of the 21st century so far.”

"It is the first formal step by our major trading partners to replace the dollar as the world’s reserve currency. If they succeed, the dollar will dramatically plummet in value, the cost of imports, including oil, will skyrocket, interest rates will climb and jobs will hemorrhage at a rate that will make the last few months look like boom times. State and federal services will be reduced or shut down for lack of funds. The United States will begin to resemble the Weimar Republic or Zimbabwe."

Now, you should understand why I thought the Federal Reserve and Treasury would do everything in their power to strengthen the dollar going into the BRIS sessions. Tomorrow and Wednesday could prove very interesting for the dollar (UUP). By the way, UUP closed up 1.83% today. That for any currency is one major move.

"There are meetings being held Monday and Tuesday in Yekaterinburg, Russia, (formerly Sverdlovsk) among Chinese President Hu Jintao, Russian President Dmitry Medvedev and other top officials of the six-nation Shanghai Cooperation Organization. The United States, which asked to attend, was denied admittance. Watch what happens there carefully. The gathering is, in the words of economist Michael Hudson, “the most important meeting of the 21st century so far.”

"It is the first formal step by our major trading partners to replace the dollar as the world’s reserve currency. If they succeed, the dollar will dramatically plummet in value, the cost of imports, including oil, will skyrocket, interest rates will climb and jobs will hemorrhage at a rate that will make the last few months look like boom times. State and federal services will be reduced or shut down for lack of funds. The United States will begin to resemble the Weimar Republic or Zimbabwe."

Now, you should understand why I thought the Federal Reserve and Treasury would do everything in their power to strengthen the dollar going into the BRIS sessions. Tomorrow and Wednesday could prove very interesting for the dollar (UUP). By the way, UUP closed up 1.83% today. That for any currency is one major move.

Extended Stay Hotels Seeks Chapter 11

Extended Stay Hotels, saddled with a huge debt burden from its $8 billion top-of-the-market buyout, filed for Chapter 11 protection Monday, in one of the largest bankruptcy filings by a commercial real-estate company.

I have been warning about the problems in the commercial real-estate area for the past six months. These toxic loans will have a very negative impact on "regional banks." Extended Stay Hotels is just the "tip-of-the-iceberg."

If you want to short the commercial real-estate sector, take a look at SRS, which is a double-short ETF on this sector. It is currently trading at $19.83, which is up 9% so far today. Upside potential is at its 200-day EMA at $28. If you take the trade, set your stop at two ticks below today's low of $18.63, or $18.61.

I have been warning about the problems in the commercial real-estate area for the past six months. These toxic loans will have a very negative impact on "regional banks." Extended Stay Hotels is just the "tip-of-the-iceberg."

If you want to short the commercial real-estate sector, take a look at SRS, which is a double-short ETF on this sector. It is currently trading at $19.83, which is up 9% so far today. Upside potential is at its 200-day EMA at $28. If you take the trade, set your stop at two ticks below today's low of $18.63, or $18.61.

Twitter Comments

The following comments are from "Twitter:"

You can follow my inter-day comments by going to Twitter.

You can follow my inter-day comments by going to Twitter.

USO to UNG: Spread Trade

As mentioned on my Twitter (twitter.com/debauche), here are the details of this paired trade:

Since the vehicle of choice is DTO, double-short oil, purchase 10 shares of UNG for each DTO. Let's see what happens.

Since the vehicle of choice is DTO, double-short oil, purchase 10 shares of UNG for each DTO. Let's see what happens.

S&P 500 Weekly Update for June 12, 2009

Note: To enlarge chart, double-click inside of it.

Keep-in-mind that this is OPX option expiration week. Therefore, expect volatility! Also, the dollar's direction will determine the short-term direction for the equities, metals, and oil. That is, higher dollar, lower equities, metals, and oil.

Friday, June 12, 2009

ZSL: Ultra-short Silver

The inverse relationship between the dollar and metals (gold and silver) is playing out today. If ZSL can say above it opening price of $7.91, it can be purchased. I would rather buy ZSL than GLL. If executed, place a stop at $7.30. Upside potential for ZSL is $9.70. Overall, this is a high-risk trade.

Silver (SLV) has the potential of selling-off to $13.40-$13.90, which would be extremely positive for ZSL.

Silver (SLV) has the potential of selling-off to $13.40-$13.90, which would be extremely positive for ZSL.

House Representatives Personal Financial Disclosures

If you want to find out what your Representative disclosed in his/her financial report to Congress, check out Legistorm. Great site!

Thursday, June 11, 2009

No Executions Today on GLL and ZSL

Criteria were not met again today to take positions in GLL and ZSL. Let's see what tomorrow brings. This trade is tied directly to a stronger dollar, which would be negative for gold, oil, and silver. Long term, I am bullish on the metals and oil. Near term, I do see weakness in the metals and oil, not only because I believe the dollar will strengthen, but the metals and oil are very overbought at their respective current price levels. Could I be wrong? You bet. It would not be the first time. But I would definitely be caution near-term investing in metals and oil.

Once again, if you have a Twitter account, you can follow my inter-day updates there, especially as we approach the close.

Once again, if you have a Twitter account, you can follow my inter-day updates there, especially as we approach the close.

Today's Setup for GLL and ZSL

No execution yesterday for GLL (double inverse gold) and ZSL(double inverse silver). Both closed exactly at Tuesday's close. For today, purchase GLL and ZSL if today's close is above their open and yesterday's close (GLL @ $14.49 and ZSL @ $7.63). Enter orders only if the price going into the close (last five minutes) is above today's open and yesterday's close.

If you want an update going into the close each day, I will Twitter what I am doing. Therefore, if you have a Twitter account, you can follow me. If you don't have a Twitter account, you may want to join.

If you want an update going into the close each day, I will Twitter what I am doing. Therefore, if you have a Twitter account, you can follow me. If you don't have a Twitter account, you may want to join.

Wednesday, June 10, 2009

GLL and ZSL

No execution occurred yesterday for GLL and ZSL. GLL and ZSL closed yesterday at $14.49 and $7.63, respectively. For today, purchase GLL and ZSL if today's close is above their open and close going into the close of the day. (These orders are suppose to be entered during the last five minutes of trading.) Therefore, review price status, as indicated above, during the last thirty minutes of trading but only enter orders if the price going into the close (last five minutes) is above today's open and yesterday's close.

Tuesday, June 09, 2009

Spam Blog

I have been notified by "Blogger" that my blog is suspect of being a possible spam blog. You got to be kidding me! Therefore, those of you who have been receiving email updates of new posts will not be receiving any further such notifications.

Update on Euro Versus Dollar

Note: To enlarge the chart, double-click inside of it.

Note: To enlarge the chart, double-click inside of it.The following two charts are GLL and ZSV, which are double-inverse bearish ETFs. These ETFs should move higher as the dollar continues to strengthen in relation to the Euro.

Thursday, June 04, 2009

EURO vs. Dollar: Near Term Impact for Gold, Oil, Silver, and Stocks

Wednesday, June 03, 2009

President Obama: United States is one of the largest Muslim countries in the world!

In an interview with France's Canal Plus Television that was released on Tuesday evening, President Obama suggested that the United States might be a Muslim country. (You can read the entire transcript at Canal Plus Television.)

Wait a minute! Does anyone in the media take the time to check Obama's facts or do they simply accept his facts as gospel? The U.S. in fact has less than 1% of the world’s Muslim population of an estimated 1 billion people. The top 50 Muslim nations by percentage is here (with Muslim population figures), and the United States is not even close to being a Muslim country, let alone close to being anywhere near the top 50.

With an estimated 5 million to 8 million Muslims, Muslims are less than 3% of the U.S. population. By sheer number, the United States is far behind Indonesia (213 million), Pakistan (156 million), and Bangladesh (127 million). And, at least 23 nations have more Muslims.

Wait a minute! Does anyone in the media take the time to check Obama's facts or do they simply accept his facts as gospel? The U.S. in fact has less than 1% of the world’s Muslim population of an estimated 1 billion people. The top 50 Muslim nations by percentage is here (with Muslim population figures), and the United States is not even close to being a Muslim country, let alone close to being anywhere near the top 50.

With an estimated 5 million to 8 million Muslims, Muslims are less than 3% of the U.S. population. By sheer number, the United States is far behind Indonesia (213 million), Pakistan (156 million), and Bangladesh (127 million). And, at least 23 nations have more Muslims.

Tuesday, June 02, 2009

Ethanol's Exorbitant Cost

The "Wall Street Journal" reported today (page A11) that "The Obama Administration is pushing a big expansion in ethanol, including a mandate to increase the share of the corn-based fuel required in gasoline to 15% from 10%. Apparently no one in the Administration has read a pair of new studies, one from its own EPA, that expose ethanol as a bad deal for consumers with little environmental benefit.

The biofuels industry already receives a 45 cent tax credit for every gallon of ethanol produced, or about $3 billion a year. Meanwhile, import tariffs of 54 cents a gallon and an ad valorem tariff of four to seven cents a gallon keep out sugar-based ethanol from Brazil and the Caribbean. The federal 10% blending requirement insures a market for ethanol whether consumers want it or not -- a market Congress has mandated will double to 20.5 billion gallons in 2015.

The Congressional Budget Office reported last month that Americans pay another surcharge for ethanol in higher food prices. CBO estimates that from April 2007 to April 2008 "the increased use of ethanol accounted for about 10 percent to 15 percent of the rise in food prices." Ethanol raises food prices because millions of acres of farmland and three billion bushels of corn were diverted to ethanol from food production. Americans spend about $1.1 trillion a year on food, so in 2007 the ethanol subsidy cost families between $5.5 billion and $8.8 billion in higher grocery bills."

Readers, this is governmental absurdity. Now, I want you to visualize an America whereby the government is producing cars (Government Motors, formally General Motors), making mortgages (Fannie Mae and Freddie Mac), and running our health care systems and along with managing our postal system and Amtrak. I, for one, don't like that picture.

The biofuels industry already receives a 45 cent tax credit for every gallon of ethanol produced, or about $3 billion a year. Meanwhile, import tariffs of 54 cents a gallon and an ad valorem tariff of four to seven cents a gallon keep out sugar-based ethanol from Brazil and the Caribbean. The federal 10% blending requirement insures a market for ethanol whether consumers want it or not -- a market Congress has mandated will double to 20.5 billion gallons in 2015.

The Congressional Budget Office reported last month that Americans pay another surcharge for ethanol in higher food prices. CBO estimates that from April 2007 to April 2008 "the increased use of ethanol accounted for about 10 percent to 15 percent of the rise in food prices." Ethanol raises food prices because millions of acres of farmland and three billion bushels of corn were diverted to ethanol from food production. Americans spend about $1.1 trillion a year on food, so in 2007 the ethanol subsidy cost families between $5.5 billion and $8.8 billion in higher grocery bills."

Readers, this is governmental absurdity. Now, I want you to visualize an America whereby the government is producing cars (Government Motors, formally General Motors), making mortgages (Fannie Mae and Freddie Mac), and running our health care systems and along with managing our postal system and Amtrak. I, for one, don't like that picture.

Obama's New Deal is Really Roosevelt's "Old" New Deal

I had posted this several months ago, but I thought a little bit of redundancy is always a good technique to solidify one's learning.

Roosevelt's Treasury Secretary, Henry Morgenthau, angry at the Keynesian spenders, wrote in is his diary May 1939: "We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and now if I am wrong somebody else can have my job. I want to see this country prosper. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises. I say after eight years of this administration, we have just as much unemployment as when we started. And enormous debt to boot."

Roosevelt's Treasury Secretary, Henry Morgenthau, angry at the Keynesian spenders, wrote in is his diary May 1939: "We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and now if I am wrong somebody else can have my job. I want to see this country prosper. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises. I say after eight years of this administration, we have just as much unemployment as when we started. And enormous debt to boot."

Weekly Update: S&P 500 and Dollar-debased Index

Dollar-debased Fund was up 1.4% for the week. The big winner was DXO, which was up 14%, and the big loser for the week was SDS, which was down 8%. You might want to go back and review the Dollar-debased Fund from the posting of May 25, 2009.

Subscribe to:

Posts (Atom)