The market can stay irrational longer than you can stay solvent.

-John Maynard Keynes (1883 - 1946)

The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Friday, September 29, 2006

Wednesday, September 27, 2006

Be Forewarded!

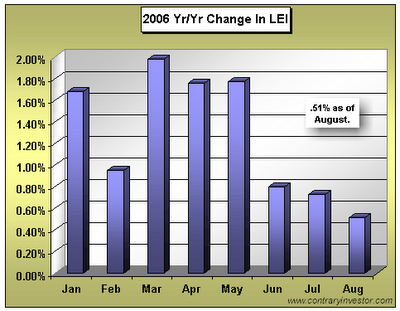

According to ContraryInvestor, every time over the last fifty (50) years that the year over year rate of change in the Leading Economic Indicators (LEI) dropped below 0.5%, either an outright "recession or a meaningful economic slowdown" has occurred. Wow! That is an excellent track record. By the way, the August 2006 LEI rate of change was 0.51%. I will definitely monitor the year over year rate of change for the LEI. The following chart, which is from the ContraryInvestor, illustrates the LEI for 2006 through August.

If one combines the track record of the LEI with the current negative to flat Yield Curve, a 2007 slowdown of significance definitely looms on the economic horizon. The probability will increase if the September 2006 LEI comes in under 0.50%, and the Yield Curve remains flat to negative.

If one combines the track record of the LEI with the current negative to flat Yield Curve, a 2007 slowdown of significance definitely looms on the economic horizon. The probability will increase if the September 2006 LEI comes in under 0.50%, and the Yield Curve remains flat to negative.

Cost of Capital

The "Problem-set Solutions" are now posted for Chapter 11 on the course website.

Our discussion yesterday pertained to historical cost of capital computations. If a company was to issue new preferred and/or common stock, one would have to incorporate a fee that the company has to pay to the investment banker for selling the "new" security. This fee is referred to as the "floatation cost." Since it is a cost, the firm's cost of capital for preferred and/or common will increase. For our equation for "cost of NEW common stock equity," the refinement to our basic equation is as follows: [(EXPECTED DIVIDEND/(PRICE-FLOATATION COST)] + GROWTH RATE OF DIVIDEND. If you were calculating the "Cost of New Preferred," you would make the same adjustment by inserting the floatation cost into the equation.

Our discussion yesterday pertained to historical cost of capital computations. If a company was to issue new preferred and/or common stock, one would have to incorporate a fee that the company has to pay to the investment banker for selling the "new" security. This fee is referred to as the "floatation cost." Since it is a cost, the firm's cost of capital for preferred and/or common will increase. For our equation for "cost of NEW common stock equity," the refinement to our basic equation is as follows: [(EXPECTED DIVIDEND/(PRICE-FLOATATION COST)] + GROWTH RATE OF DIVIDEND. If you were calculating the "Cost of New Preferred," you would make the same adjustment by inserting the floatation cost into the equation.

Friday, September 22, 2006

WTIC (Oil Light Crude) Revisited

I thought it would be a good time to revisit the price of oil from the "post" of September 9. Since then, oil has declined approximately 9% to close Friday at $60.55. My analysis, at that time, projected that the price of oil would decline to its 200-week EMA, which is $51.50; and the price of gasoline at the pumps would be approximately $1.70. Has that analysis changed? Let's look at the following chart, which is WTIC as of Friday, September 22, before I give you my updated analysis.

First, look at the top portion of the chart that is entitled "Full Sto," which is a Stochastic Oscillator. I want to draw you attention to the "arrows" on the oscillator. Notice that the level of the oscillator at each arrow reads "20 or lower." Subsequently, the price of oil rose and in some cases, significantly. Second, look at the bottom portion of the chart that is entitled "CCI," which is the Commodity Channel Index. As before, isolate on the "arrows" and notice that the levels were "-100 to -200" and the subsequent price rise. The Stochastic Oscillator and Commodity Channel Index measure short-term levels of being "overbought or oversold." Therefore, given the current, extremely, oversold readings, oil prices should move higher in the near term. Probably, oil could rise back to its 50-week EMA and the downward sloping resistance line, which is $66 or about 7%. If the $66 level is not significantly penetrated, oil should continue its price decline to the $51 level. Once again, this analysis is based on current world conditions. If the "geo-political" environment deteriorates, all "bets" are off. In the meantime, enjoy these gasoline prices. By the way, I paid $1.99 today to fill by Yamaha Waverunner.

For Tuesday, apply the Stochastic Oscillator and Commodity Channel Index to your stock and indicate if the stock is "overbought or oversold."

First, look at the top portion of the chart that is entitled "Full Sto," which is a Stochastic Oscillator. I want to draw you attention to the "arrows" on the oscillator. Notice that the level of the oscillator at each arrow reads "20 or lower." Subsequently, the price of oil rose and in some cases, significantly. Second, look at the bottom portion of the chart that is entitled "CCI," which is the Commodity Channel Index. As before, isolate on the "arrows" and notice that the levels were "-100 to -200" and the subsequent price rise. The Stochastic Oscillator and Commodity Channel Index measure short-term levels of being "overbought or oversold." Therefore, given the current, extremely, oversold readings, oil prices should move higher in the near term. Probably, oil could rise back to its 50-week EMA and the downward sloping resistance line, which is $66 or about 7%. If the $66 level is not significantly penetrated, oil should continue its price decline to the $51 level. Once again, this analysis is based on current world conditions. If the "geo-political" environment deteriorates, all "bets" are off. In the meantime, enjoy these gasoline prices. By the way, I paid $1.99 today to fill by Yamaha Waverunner.

For Tuesday, apply the Stochastic Oscillator and Commodity Channel Index to your stock and indicate if the stock is "overbought or oversold."

Thursday, September 21, 2006

Technical Analysis

Would you recommend purchasing or selling the following company? Email me your response prior to class tomorrow.

Wednesday, September 20, 2006

Amaranth

Who is Brian Hunter? What is his claim to fame? Read Tuesday's WSJ, Section A, Column 5 for the answer. Also, read Wednesday's WSJ, Section C1.

Monday, September 18, 2006

Williams%R

Developed by Larry Williams, Williams %R is a momentum indicator. It is especially popular for measuring overbought and oversold levels. The scale ranges from 0 to -100 with readings from 0 to -20 considered overbought, and readings from -80 to -100 considered oversold.

Using the EFA chart previously posted, how would you incorporate the "Williams%R and MACD" into generating buy and sell sigals? Be prepared to discuss the "Williams%R and MACD" concepts on Tuesday.

Using the EFA chart previously posted, how would you incorporate the "Williams%R and MACD" into generating buy and sell sigals? Be prepared to discuss the "Williams%R and MACD" concepts on Tuesday.

MACD Formula

According to StockCharts, the most popular MACD formula, which is the one that we will use, is the difference between a security's 26-day and 12-day exponential moving averages. This is the formula that is used in many popular technical analysis programs and quoted in most technical analysis books on the subject. For our purposes, the traditional 12/26 MACD will be used for explanations.

Of the two moving averages that make up MACD, the 12-day EMA is the faster and the 26-day EMA is the slower. Closing prices are used to form the moving averages. Usually, a 9-day EMA of MACD is plotted along side to act as a trigger line. A bullish crossover occurs when MACD moves above its 9-day EMA, and a bearish crossover occurs when MACD moves below its 9-day EMA. The EFA chart below shows the 12-day EMA (thin blue line) with the 26-day EMA (thin red line) overlaid the price plot. The EFA chart below shows the MACD in the box below as the thick black line and its 9-day EMA is the thin blue line. The histogram represents the difference between MACD and its 9-day EMA. The histogram is positive when MACD is above its 9-day EMA and negative when MACD is below its 9-day EMA.

Based on the MACD formula, would you be a purchaser of EFA? Explain.

The URL for a full discussion on the MACD formula can be found at http://stockcharts.com/education/IndicatorAnalysis/indic_MACD1.html.

Of the two moving averages that make up MACD, the 12-day EMA is the faster and the 26-day EMA is the slower. Closing prices are used to form the moving averages. Usually, a 9-day EMA of MACD is plotted along side to act as a trigger line. A bullish crossover occurs when MACD moves above its 9-day EMA, and a bearish crossover occurs when MACD moves below its 9-day EMA. The EFA chart below shows the 12-day EMA (thin blue line) with the 26-day EMA (thin red line) overlaid the price plot. The EFA chart below shows the MACD in the box below as the thick black line and its 9-day EMA is the thin blue line. The histogram represents the difference between MACD and its 9-day EMA. The histogram is positive when MACD is above its 9-day EMA and negative when MACD is below its 9-day EMA.

Based on the MACD formula, would you be a purchaser of EFA? Explain.

The URL for a full discussion on the MACD formula can be found at http://stockcharts.com/education/IndicatorAnalysis/indic_MACD1.html.

Monday, September 11, 2006

Charts

Take a look at the following link to see how nasty today's price action in the energy and gold areas really was: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID530404 .

Commodity Research Bureau Index, Crude Oil, and Gold Plummet

If you visited the blog over the weekend (How Low is Low?), you know that penetrating major support areas did not bode well for oil and gold. Either though I did not show you the chart on gold, its price was behaving just like the CRB Index andcrude oil. Today, the CRB Index was down 6.66 or (2.08%), crude oil was down $.64 or (.97%), and gold dropped $20 or (3.2%).

With today's price action, these markets are in the most "oversold" since last year. Therefore, expect a strong rally back up to the 50-week EMA as shorts cover to lock-in profits. Overall, I am still expecting oil to sell in the low $50's before this decline is over.

Make sure you visit the course Web page, because I have some exercises for you to do for tomorrow's class.

With today's price action, these markets are in the most "oversold" since last year. Therefore, expect a strong rally back up to the 50-week EMA as shorts cover to lock-in profits. Overall, I am still expecting oil to sell in the low $50's before this decline is over.

Make sure you visit the course Web page, because I have some exercises for you to do for tomorrow's class.

Saturday, September 09, 2006

How Low is Low?

Gas is currently selling for $2.19 a gallon and headed under $2. Wow! It was just a short-time ago that eveyone was thinking that we would be paying well over $3 a gallon. Does this mean that the five-year energy bull market is over? If the energy bull market is over, what about the other resource areas that have experienced major bull moves, like gold, silver, copper, etc.? In order to address the above questions, let's look at the following chart of the Commodity Research Bureau (CRB) Index, which is comprised of twenty-two (22) sensitive basic commodities whose markets are presumed to be among the first to be influenced by changes in economic conditions.

CRB Index has penetrated its 50-week EMA average, which does signal an end to its five-year major trend. However, since the 50-week EMA is above the 200-week EMA, the commodity bull market is still intact. What we can expect is a "correction" down to the 200-week EMA, which is currently about 300. Ok, what does this chart have to do with the price of oil? Everything. Take a look at the following $WTIC chart, which is the "Light Crude Oil."

The price ($67.15) has penetrated its 50-week EMA ($67.39). $WTIC is following the price action of $CRB. Like the $CRB, $WTIC is still in a major bull market. Therefore, a reasonable downside price objective for oil is at the 200-week EMA, which is $51. By the way, that should equate to about $1.70 at the pump and still leave the major oil bull market intact.

You may have noticed that the two charts include some additional information (PPO and Full Sto) besides the "price." We will discuss these market indicators next week. In the meantime, enjoy these gas prices!

CRB Index has penetrated its 50-week EMA average, which does signal an end to its five-year major trend. However, since the 50-week EMA is above the 200-week EMA, the commodity bull market is still intact. What we can expect is a "correction" down to the 200-week EMA, which is currently about 300. Ok, what does this chart have to do with the price of oil? Everything. Take a look at the following $WTIC chart, which is the "Light Crude Oil."

The price ($67.15) has penetrated its 50-week EMA ($67.39). $WTIC is following the price action of $CRB. Like the $CRB, $WTIC is still in a major bull market. Therefore, a reasonable downside price objective for oil is at the 200-week EMA, which is $51. By the way, that should equate to about $1.70 at the pump and still leave the major oil bull market intact.

You may have noticed that the two charts include some additional information (PPO and Full Sto) besides the "price." We will discuss these market indicators next week. In the meantime, enjoy these gas prices!

Thursday, September 07, 2006

Quote of the Week

"That men do not learn very much from the lessons of history is the most important of all the lessons of history." -- Aldous Huxley

Sunday, September 03, 2006

Turn-out the Lights

Don Meredith, ex-Dallas Cowboy quarterback and ex-Monday Night Football's Commentator,would say the above phrase after a football team had no chance to win! In regard to the housing market, stock market, and PCE component of GDP, I would refine the statement as follows: "Turn-out the Lights, or, at Least, Let the Reader Beware for 2007!

The following chart that relates the National Association Homebuilders Index to the S&P 500 Index is from David Rosenberg, North American economist for Merrill Lynch.

Quoting Mr. Rosenberg: "The above chart is rather intriging in that the NAHB Index leads the S&P 500 by twelve (12) months and with a near 80% correlation. This relationship has actually strengthened, owing to the growing influence that the real estated market has exerted on the overall economic and financial landscape over the past five years. In fact, we can trace almost 2% points of the 3.5% average annual rate in real GDP over the past five years."

Quoting Mr. Rosenberg: "The above chart is rather intriging in that the NAHB Index leads the S&P 500 by twelve (12) months and with a near 80% correlation. This relationship has actually strengthened, owing to the growing influence that the real estated market has exerted on the overall economic and financial landscape over the past five years. In fact, we can trace almost 2% points of the 3.5% average annual rate in real GDP over the past five years."Lon Witter, writing in the August 13 edition of Barron's, argues that there has not been a housing bubble but a lending bubble. He provides the following data to back-up his thesis:

1. 32.6% of new mortgages and home equity loans in 2005 were interest only, up from 0.6% in 2000.

2. 43% of first-time home buyers in 2005 put no money down.

3. 15.2% of 2005 buyers owe at least 10% more than their home is worth.

10% of all home owners with mortgages have no equity in their homes.

$2.7 trillion dollars in loans will adjust ot higher rats in 2006 and 2007.

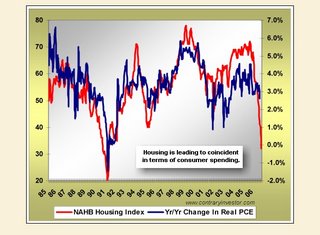

Once again, let the reader beware. Think the above information may foreshadow trouble for financial stocks and the overall equity market? However, it gets more interesting, see the following chart, which is from ContraryInvestor.Com, that relates the NAHB Index to Real Personal Expenditure Consumption (PCE):

The above chart links housing to consumer spending. As you can see, at least in the past, there has been a very high degree of correlation between the NAHB Index and the direction of real PCE. Why is this relationship relevant? In regard to GDP, PCE comprises more than 70% of overall economic activity. If indeed this relationship continues, we may see real PCE in the negative column, which, of course, would result in very weak GDP numbers going forward from here.

We definitely monitor the NAHB Index and real PCE throughout the semester.

Subscribe to:

Posts (Atom)