The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Monday, December 20, 2010

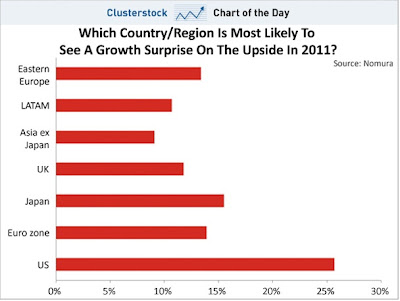

Surprise! The US Economy Is Now Everyone's "Surprise" Pick To Surge

Nomura's 2011 survey of clients suggests investors are suddenly confident in the outlook for the United States, and see it surprising to the upside next year. Maybe I should send them the latest Federal Reserve Bank of Chicago's Economic Index.

Chicago Fed National Activity Index: Economic Activity Slowed in November

The Federal Reserve Bank of Chicago reported its findings for its latest economic index for November: "Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.46 in November from –0.25 in October. For November of 2006, the index was +0.01." Why do I bring this index up? Because I consider this to be the best overall measure of economic activity. Why? Because this index is a weighted average of 85 indicators of national economic activity. The indicators are drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

In other words, the economy is getting weaker, not stronger. (See the following chart.)

In other words, the economy is getting weaker, not stronger. (See the following chart.)

For the full article, click-on Fed of Chicago.

Tuesday, December 14, 2010

Ron Paul: My Monetary Hero

I like Ron Paul. The reason being is his sound money philosophy, which is closely akin to Austrian Economics. Of which, I am a great fan.

Watch the video clip and then you can decide if he is your "monetary hero."

Watch the video clip and then you can decide if he is your "monetary hero."

Wednesday, December 08, 2010

Does This Really Come as a Surprise to Anyone?

Who is Number 1 on test scores in math, reading, and science? Of course, it is students from China. Where do we rank? See the following table. Not too great as we prepare students to compete in a global economy.

Now, what is this abysmal student performance costing us as taxpayers? Well, it depends on where you live. An enlightened video clip from the Cato Institute provides some food for thought on the cost (explicit and implicit) at local level. After viewing the clip, you may want to find out what you local school district's cost per student happens to be. The national average per-student education spending (latest 2007) is approximately $10,000. And, what is the common cry from educators for improving score performances on math, reading, and science? More money, of course. Isn't that the typical response and solution to all of our problems? For the full report, click here.

Senior Health Care Solution

No, I am not endorsing this as a possible solution. So, don't "shoot" the purveyor with one of those bullets.

Jon Stewart on Ben Bernanke

Lies, lies, and more lies. I really don't know if Bernanke knows what the truth is anymore. He states in the clip that the Fed does not print money; and, then, states it does print money. Plus, he has stated as such not only on this "60-Minute" clip but before Congress; and he gets away with these lies. If this clip wasn't so funny, it would be serious. The problem is that it is really serious; but, for most Americans, who are really economic illiterate, will simply laugh it all off. Shame, shame on all of us for allowing Bernanke to not only get away with these bold-face lies but to continue with such lies and not be held accountable.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| The Big Bank Theory | ||||

| www.thedailyshow.com | ||||

| ||||

Tuesday, December 07, 2010

What About That Tax Deal?

First, the tax deal will add a minimum of $500 billion to next year's deficit, which is already projected to be $1.6 trillion. Now, if my math is correct that sums to over $2 trillion, which is approximately 14% of GDP. By the way, this percentage is higher than the levels experienced by Greece and Ireland. And, we all know how well those countries are doing.

Second, don't get me wrong about the tax deal. I am all in favor of the 2% payroll deduction (Social Security and Medicare), extending the Bush tax rates for two years, expensing all business capital expenditures for one year, and extending the 99-week unemployment benefits for a year. (I do have reservations about extending unemployment benefits to almost two years, because I believe it is a disincentive to find work.)

Third, I am for tax cuts of every kind provided that we have corresponding cuts in government spending! However, that is definitely not the case with this proposal. All what we have done, if it becomes reality, is to enlarge the size of the government and, of course, the deficit.

Second, don't get me wrong about the tax deal. I am all in favor of the 2% payroll deduction (Social Security and Medicare), extending the Bush tax rates for two years, expensing all business capital expenditures for one year, and extending the 99-week unemployment benefits for a year. (I do have reservations about extending unemployment benefits to almost two years, because I believe it is a disincentive to find work.)

Third, I am for tax cuts of every kind provided that we have corresponding cuts in government spending! However, that is definitely not the case with this proposal. All what we have done, if it becomes reality, is to enlarge the size of the government and, of course, the deficit.

Friday, December 03, 2010

Selective Comments on the S&P 500

What is the market saying to us near term? Answer: The primary trend continues to be bullish (15-week EMA > 40-week EMA). The 1240 on the S&P 500 is the next resistance zone, which is just 16 points away from today's close. (See the red-horizontal line in the following chart. The nearest support, green line, is at 1150.) There you have it straight from the market's mouth. Critical mass price zones to watch are 1150 and 1240.

Gold Cures Cancer

Do you want a reason to buy gold at these lofty levels? The answer lies in the title of this post. Yes, gold-covered nano-particles appear to defeat cancerous tumors according to The L.A. Times. The sky is the limit. The $ is doomed; Euro is doomed; as a matter of fact, all fiat currencies are doomed. Therefore, gold can only go up. Right?

Oh "Bear," or "Bear" Where Art Thou?

Markets (Bulltarts) continue to celebrate today by closing at 2010 highs. Now, let's go over all the positive aspects that were revealed today that propelled the markets to new highs. First, the unemployment rate edged up to 9.8% from 9.6% in November. Second, "Debt Commission" voted down is own plan. (In other words, we are now back to square one in trying to get government spending under control.) Third, the "Supplemental Nutrition Program (Food Stamps)" reported that the number of poor Americans has never been higher. These food-stamp recipients just hit a fresh all time high of 42.9 million. (Naturally, the market celebrates the record number of poor Americans by closing at 2010 highs.) It is all very logical, isn't it? Bad news, and the market goes to new highs. That is what happens when the primary trend, as indicated by the EMA strategy, is bullish. It doesn't make any difference on what the news is, the market wants to trend higher, not lower. Once again, shame on me for forgetting that the trend is your friend. I definitely forgot to trade with the trend, not what I expected. Saying that, this market will eventually face economic reality and crash. I have no reservations in making such a statement. I will have a market update later in the weekend.

Wednesday, December 01, 2010

Whalen on How the Fed Supported Foreign Banks

Chris Whalen is one of the few pundits out there that definitely knows what he is talking about when it comes to the Fed. Take six-minutes of your time in viewing this video and be educated, especially is comment on Spain!

Sunday, November 28, 2010

Rent Free for "492 Days" and Counting

Boy, do I have a deal for you. All what you have to do is have a financial institution foreclosure on your home. This will allow you to stay rent-free for more than sixteen months. Just think what you can do with all that extra money. According to LPS Applied Analytics, the average borrower in the foreclosure process hadn’t made a payment in 492 days as of the end of October 2010. That compares to 382 days a year ago and a low of 244 days in August 2007. In other words, individuals, who default on their mortgages, can reasonably expect to stay in their homes rent-free more than 16 months. In some states, such as New York and Florida, the number is closer to 20 months. And, who said there isn’t any such thing as a “free lunch” in America?

Most Overhyped Black Friday In History: A Dud!

The Wall Street Journal reports that "The shopping day that was supposed to signal the renaissance of the US consumer, and justify the massive over-hiring by US retailers (not to mention the completely dislocated from reality surge in stock price for razor thin margin retailers like Amazon), is increasingly seeming to be a dud. The primary reason for the disappointment is that Black Friday actually started early on in the month, with most retailers offering comparable loss-leading deals such as those seen on the Friday after the national holiday early in November, reducing the actual purchasing power for the all important day. The smaller than expected increase is due in part to discounts offered earlier in November as well as online-only promotions, stated ShopperTrak." Bottom-line is that "Black Friday" was a dud, which does not portend very well for retailers going forward.

Friday, November 26, 2010

Wednesday, November 24, 2010

CNBC Bull-Tarts

Let’s put things into proper perspective after today’s magical rally of 150.91 points for the DJIA. (Remember that yesterday the DJIA was down 142.21 points.) Why the sharp rally? Well, according to the bull-tarts over at CNBC, the sharp rally was due to the 34,000 drop in “Initial Jobless Claims to only 407,000. Wow! That is really great news when only 407,000 individuals were added to the unemployment rolls. That is really great news for our economy moving forward. Ya, right! We are still not creating jobs. Folks, we just expanded the unemployment rolls by over 400,000 individuals.

Now, what CNBC failed to mention was that U.S. Factory Orders plunged in October by the largest amount in 21 months. (Not good.) Further, we learned Wednesday that Durable Goods Orders fell 3.3 percent in October, the biggest drop since January 2009. Also, we learned today that New Home Sales fell in October to a near record low, down 8.1 percent to 283,000 units, just slightly above August 2010's number of 275,000, which was the worst ever reading since records started in 1963.

Sunday, November 21, 2010

Entitlement America: Sad but True

You can do as well working one week a month at minimum wage as you can working $60,000-a-year, full-time, high-stress job. This according to Wyatt Emmerich of The Cleveland Current. The following table illustrates that $16,000 in today's America is worth more than $60,000.

Now, tell me where the incentive to work in this country is? Emmerich sums it up as follows: "Not surprisingly, it is not only the richest and thieves (Wall Street) that prosper, but also the penny scammers at the very bottom of the economic ladder that rip off the middle class each and every day, courtesy of the world's most generous entitlement system." Have you had enough, yet?

Ailing Ireland Accepts Bailout

Ireland finally sought $110 billion in bailout money from the European Union (EU) and the IMF. I thought this whole debt crisis to stem Europe's sixteen-member common currency from unraveling was resolved last year after the Greece debacle. That is what we were all told! Well, so much for believing the EU, or for that matter, any government pronouncement. We, Americans know that all so well, especially those individuals who have listened and believed all that rhetoric from the Fed. Ok, who is next on the on the so called EU debt crisis hit-parade? Could it be Spain, Italy, or Portugal? My guess is all of them.

So there you have it, another country bites the dust, which, of course, reminds me of that song by Queen.

So there you have it, another country bites the dust, which, of course, reminds me of that song by Queen.

Thursday, November 18, 2010

Greater Fool's Theory: Alive and Kicking

Government Motor's (GM) common stock was priced at $33 a share. The total offering size will be approximately $20.1 billion. Wow! The hype from Wall Street this morning is staggering. You would think that GM has found the cure for the common cold, cancer, obesity and whatever is out there. To say the least, GM is not a bargain at these prices. Who knows when it will pay a dividend. Also, it has some auditing issues to be resolved. But, then again, the government needs GM shares to rise sharply over the coming years for it to be repaid in full for its $49.5 billion loan.

For today, investors will watch for the size of the first-day "pop" of an initial public offering (IPO). If the shares rise more than the usual 10% to 20%, some observers may say GM and the government priced it too low. If the shares falter, it will mean some investors still question GM's future. I, for one, don't consider today's price action that critical. The IPO will be a success! It has to be because of the greater fool's theory. In other words, it is not today but in weeks and months to come. Caveat Emptor!

For today, investors will watch for the size of the first-day "pop" of an initial public offering (IPO). If the shares rise more than the usual 10% to 20%, some observers may say GM and the government priced it too low. If the shares falter, it will mean some investors still question GM's future. I, for one, don't consider today's price action that critical. The IPO will be a success! It has to be because of the greater fool's theory. In other words, it is not today but in weeks and months to come. Caveat Emptor!

Wednesday, November 17, 2010

The Boys (Bears) Are Back in Town???

The following video clip is from Tim Knight over at "Slope of Hope." Enjoy. The bears just might be back in town. If nothing else, a prelude of things to come.

Saturday, November 13, 2010

Thursday, November 11, 2010

Putting QE2 into Perspective: Stock Market

We are looking at close to $100 billion in QE2 purchasing by the Fed each and every month for the next eight months. That number is higher than a good year for U.S. equity fund inflows. That figure alone is bullish for the market. And, as per Bernanke's direct statement, it is clear the Fed is targeting equities as well as bonds with QE2. In other words, he wants QE2 to inflate the price of financial assets in order to increase the wealth effect of individuals. That is, if your perceived wealth increases, you are more liking to spend a percentage of that increase, which will increase GDP through your consumption. That is the game the Fed is playing going forward. With this game plan, the Fed has directly implied that it is willing to destroy the value of the dollar for the sake of increasing the value of financial assets with the ultimate consequences of creating a massive financial asset bubble and rampant inflation. And, then taking "no" responsibility for its actions. Something like Greenspan did leading up to the sub-prime mortgage debacle.

Gold: The Market's Global Currency

Please take the time to read Robert Murphy's excellent article on the historical perspective on gold and fiat currency. The article is not only succinct but is definitely an easy read. If you are concerned at all about Bernanke's QE2, you will want to read this article. To entice you to read it, the following excerpt should do the trick: "Central bankers cannot be trusted with the printing press, especially when there is no formal check on their inflationary policies. It is no coincidence that gold is hitting such heights as investors the world over hunker down for what may very well be a collapse of the dollar system."

Sunday, November 07, 2010

Friday, November 05, 2010

True Confessions (Reflections)

Over the past year, I have been very disappointed in my overall market performance. As a matter-of-fact, I would give myself a big-fat “F.” I always stated that the “trend is your friend.” In other words, stay with the underlying trend of the market and avoid at all cost its daily noise. (I have definitely been guilty of listening to the daily noise of the market and its so-call market pundits.) That was the main reason why I focused on the 15/40-weekly exponential moving average (EMA) strategy. This strategy, if you recall, simply states that when the 15-week EMA > 40-week EMA, the market’s immediate trend is bullish; and when the 15-week EMA < 40-week EMA, the market’s immediate trend is bearish. I even had an article published, entitled “Market Timing with Exponential Moving Averages.” The findings from the article demonstrated that the EMA strategy outperformed the traditional Buy-and-Hold, P/E, and Dividend Yield strategies. Following this strategy in January 2008, one would have avoided the entire market debacle that followed. The strategy reverted to bullish (15-week EMA > 40-week EMA) on August 17, 2009. Then, on August 23, 2010, the EMA strategy turned bearish. Two weeks later (September 7, 2010), the strategy turned bullish. Overall, the EMA strategy has done remarkability well in identifying the underlying trend of the market. As I indicated, I failed to adhere to my own strategy. Becoming way too bearish when the EMA strategy was signaling that the immediate trend was turning from bearish to bullish. For those of you that followed the EMA strategy the way it is suppose to be followed, I give you an “A,” because I know your portfolio has benefited from following the strategy.

Now, what lies ahead for the market near term? Let me start by saying that I firmly believe that the market will do whatever it has to do to prove the majority of investors wrong. Also, the legendary market technician Joe Granville stated, “If it is obvious, it is obviously wrong.” Ok, where am I am going with this? Right now the current investor psychology is so one-sided in favor of overwhelming bullishness that something has to happen. For example, 94% of future traders, as measured by the Daily Sentiment Index believe that the S&P 500 will continue to rally. In regard to gold, 98% of trades, as measured by the Daily Sentiment Index, are bulls, which is an all-time high. For silver, 92% are bullish, which is a record. In regard to dollar, everyone hates it. This belief is so pervasive that it has to be wrong near term. In other words, when the psychology of the market place becomes clear to all that the current trend must continue, it is almost always close to a reversal.

Since I received a “F” in my own market-timing course, I am in the process of going back to the basics and focusing on the EMA strategy. I want an "A."

Thursday, November 04, 2010

Dollar's Limbo Rock

How low can it go? That is the dollar of course.

Now, what does Ben Bernanke and Chubby Checker have in common? Answer: They both do the "Limbo Rock." Trouble is I definitely like Chubby Checker's version better!

Everyday Low Prices

What is wrong with "Everyday Low Prices?" That has been the business model of one of the great American success stories -- Wal-Mart. Nothing, unless you are the Fed. The Fed panics at even the thought of low prices. As a matter of fact, it has done everything ($2 trillion worth and counting) to make sure that you will never find low prices again. Listen to the following Bloomberg's interview with James Grant, who is editor of the Grant's Interest Rate Observer:

The "BULL" Takes Charge

Yesterday, the Fed announced QE2, which will simply be another $600 billion purchase of Treasury Securities. This, of course, is on top of QE1 that totaled $1.7 trillion of purchases

QE1 did nothing to grow the economy. It did help the large money-center banks and Wall Street investment bankers but not the consumer. I guess if you consider the rise in financial assets, stocks and bonds, then the consumer has benefited. The current market condition is very similar, in an eerie way, to the 2007 real estate bubble, which did not end well. Make no mistake that this financial asset (stocks, bonds, and metals) bubble will play out just as poorly as the real estate bubble did.

Once again, one should never under-estimate the power of the Fed, which I did. (I definitely knew better.) From 2008 to 2010, the Fed’s adjusted monetary base increase by 211%, which is unprecedented in the history of the Fed. The consequences of such a massive liquidity inducement into the financial system are the current financial asset bubble and the utter destruction of the dollar. I will have more later this evening.

Wednesday, November 03, 2010

How to Become a Millionaire

Buying 10-year Treasury Notes at 2.6% is a great way to become a millionaire, especially if you’re already a billionaire. The QE2 announcement today by the Fed will hasten that millionaire status. Get ready for the bubble to burst.

Monday, November 01, 2010

Saturday, October 30, 2010

Market Direction?

Short-term market direction continues to favor the upside. Why? For the following three reasons: (See my Twitter for the chart.)

- Price > 200-day MA

- 50-day MA > 200-day MA

- 14-period Monthly RSI > 50.

Wednesday, October 27, 2010

Rational Resolution to Mortgage Crisis or Preservation of the Capital Structure of Banks

Yes, the two are mutually exclusive. I say let's have the mortgage resolution and let the free market take care of the banks.

Are You Bullish at These Price Levels?

The sky is the limit as investors continue to believe that QE2 is the panacea to an ever-rising stock market. This is what the QE1 has given Americans so far this year:

- 1,431,853 bankruptcies

- 90,348 foreclosures

- 132 banks shut down

- 27,347,499 unemployed Americans

- 42,947,425 Americans on food stamps (That is one out of seven Americans.)

Monday, October 25, 2010

Bernanke Must Go and Go Immediately

At the Federal Reserve System and Federal Insurance Corporation Conference on Mortgage Foreclosures and the Future of Housing, Bernanke said the following: “Homeownership is only good for families and communities if it can be sustained, and home purchases that are very highly leveraged or unaffordable subject the borrower and lender to a great deal of risk.” Where is the accountability? Why hasn't Congress held this man responsible for this entire housing debacle and the current demise of the dollar? He helped create and nurture this mess along with Greenspan. Bernanke is the individual who last year launched a controversial $1.25 trillion mortgage-backed securities (MBS) program to help keep mortgage rates low. Why was it controversial? First, the Fed does not have the authority to make such purchases. Second, the quality of those MBS are dubious at best. America, you better wake-up before it's too late. I, for one, believe that it is already beyond midnight.

Dollar Debauchery

On Wednesday, September 22, I posted the following comments:

"To make matters worse, QE has artificially kept interest rates low. The ten-year Treasury Note is currently yielding 2.55%. How? Well, the Federal Reserve System, through its Federal Open Market Operations, has purchased something $1.5 trillion of dubious, quality assets at par from the banking system. In return, those banks have used the proceeds to purchase high-quality Treasury securities. Banks love it, because they have been able to unload questionable assets at par and receive Treasury securities in return. In other words, the Fed has not only propped up the balance sheets of banks but also assisted the Treasury in monetarizing our federal deficits. So, what is the problem? The problem is that such a policy has weakened the dollar to the point that it may decline another 15% or more. (See the following dollar chart.)"

"To make matters worse, QE has artificially kept interest rates low. The ten-year Treasury Note is currently yielding 2.55%. How? Well, the Federal Reserve System, through its Federal Open Market Operations, has purchased something $1.5 trillion of dubious, quality assets at par from the banking system. In return, those banks have used the proceeds to purchase high-quality Treasury securities. Banks love it, because they have been able to unload questionable assets at par and receive Treasury securities in return. In other words, the Fed has not only propped up the balance sheets of banks but also assisted the Treasury in monetarizing our federal deficits. So, what is the problem? The problem is that such a policy has weakened the dollar to the point that it may decline another 15% or more. (See the following dollar chart.)"

From the above chart, I stated the target from September 22 would be $22.25 on the UUP. Well, the low, so far, was $22.17 on October 17. The target has been met; however, the the critical mass is still the level between $21.77 to $22.03. With the current Fed policy of dollar debauchery, which includes QE2, we may just see the $21.77-$22.03 taken out. That range would be approximately 7% from the current price of $22.36.

Dollar at Risk of Becoming Toxic Waste

The Wall Street Journal reports that "The Group of 20 industrialized and developing nations vowed at this weekend's meeting to avoid "competitive devaluation" of their currencies while curbing their external imbalances, in a bid to generate more balanced global economic growth. However, the G-20 didn't announce specific targets for achieving their goal of "rebalancing" the world's economy away from an over-reliance on U.S. consumers buying imported goods." Now, doesn't that announcement sound like something the "Oil Cartel would say?" And, of course, we all know that cartels cheat like crazy. And, who are the biggest cheaters? Answer: Bernanke and Geithner, who are better known as Abbott and Costello. Over the past two months, under the leadership of Bernanke and Geithner, the dollar has been trashed, losing approximately 14% of its value; and soft commodities (cotton, corn, wheat, soy, rise, and oats) have skyrocketed, which simply means that food prices will rise significantly. Great job Abbott and Costello!

This is what I think of the current dollar situation.

This is what I think of the current dollar situation.

Sunday, October 24, 2010

The Adjusted Monetary Base and the S&P 500

The following chart depicts the relationship between the "Adjusted Monetary Base"and the S&P 500. A quick perusal of the chart indicates that the relationship between the Base and S&P 500 has been very close, especially since 2009. Ok, what is the Adjusted Monetary Base? First, it is the one monetary component that is completely under the control of the Federal Reserve System. (That in itself should speak volumes.) Second, it includes the total amount of currency that is either in the hands of the public or in the commercial bank deposits held at the Federal Reserve, which is known as member bank reserves. Of the two components, member bank reserves are the largest.

Since early 2010, the "Base" has been trending downward. Likewise, the S&P 500 topped out approximately one month after the "Base" topped out. This has been one reason why I have been negative on the S&P 500. I would recommend that you not only keep a close eye on the "Base Money" but include it as one of your investment tools.

Since early 2010, the "Base" has been trending downward. Likewise, the S&P 500 topped out approximately one month after the "Base" topped out. This has been one reason why I have been negative on the S&P 500. I would recommend that you not only keep a close eye on the "Base Money" but include it as one of your investment tools.

Saturday, October 23, 2010

What Will This Trip Cost Americans?

President Obama will land in India on November 6 for a two-day state visit. His two-day visit will in all probability shut down vehicular traffic in and around the city. Now, if anyone knows anything about traffic in India, one will immediately come to the conclusion that its citizens are not going to be too happy with the inconvenience put forth by the presence of Obama. (See the video at the end of the post.) Don't get me wrong, I am not against our President traveling to meet with foreign dignities to solve the world's problems. But, this twelve day-junket, two days in India, will accomplish what purpose? (Isn't it interesting that this trip by Obama comes immediately after the mid-term elections? In other words, it appears the purpose of the twelve-day junket is to get out of "Dodge" immediately after the potential demise of the House Democrats on November 2, 2010.)

Now, to the cost of the trip, junket, vacation or whatever you want to call it. The following excerpt is from the "Economic Times of India."

"To ensure fool-proof security, the President’s team has booked the entire the Taj Mahal Hotel, including 570 rooms, all banquets and restaurants. Since his security contingent and staff will comprise a huge number, 125 rooms at Taj President have also been booked, apart from 80 to 90 rooms each in Grand Hyatt and The Oberoi hotels. The NCPA, where the President is expected to meet representatives from the business community, has also been entirely booked. The officer said, 'Obama’s contingent is huge. There are two jumbo jets coming along with Air Force One, which will be flanked by security jets. There will be 30 to 40 secret service agents, who will arrive before him. The President’s convoy has 45 cars, including the Lincoln Continental in which the President travels.' Since Obama will stay in a hotel that is on sea front, the US Navy has made elaborate coastal security arrangements in consonance with the Indian Navy and the Coast Guard. There will be US naval ships, along with Indian vessels, patrolling the sea till about 330-km from the shore. This is to negate the possibility of a missile being fired from a distance,” the officer said."

"To ensure fool-proof security, the President’s team has booked the entire the Taj Mahal Hotel, including 570 rooms, all banquets and restaurants. Since his security contingent and staff will comprise a huge number, 125 rooms at Taj President have also been booked, apart from 80 to 90 rooms each in Grand Hyatt and The Oberoi hotels. The NCPA, where the President is expected to meet representatives from the business community, has also been entirely booked. The officer said, 'Obama’s contingent is huge. There are two jumbo jets coming along with Air Force One, which will be flanked by security jets. There will be 30 to 40 secret service agents, who will arrive before him. The President’s convoy has 45 cars, including the Lincoln Continental in which the President travels.' Since Obama will stay in a hotel that is on sea front, the US Navy has made elaborate coastal security arrangements in consonance with the Indian Navy and the Coast Guard. There will be US naval ships, along with Indian vessels, patrolling the sea till about 330-km from the shore. This is to negate the possibility of a missile being fired from a distance,” the officer said."

Bon Voyage, Mr. President.

Thursday, October 21, 2010

Monday, October 18, 2010

An Absolute Must See Video on the Current State of Economic Conditions

A must watch video conference. I know it is long at almost two hours, but you have some of the key financial and economic individuals on the same stage. Two speakers that you must listen to are Nouriel Roubini @ the 41.55 minute mark and Chris Whalen @ the 1 hour mark. I especially like Whalen's presentation. So, please do yourself a favor and education yourself to what is going on in regard to the banking system, mortgage mess, and the next QE2 phase by watching the video. Your financial well-being depends on it.

Citigroup Profit Soars

"Oct. 18 (Bloomberg) -- Citigroup Inc., the bank 12 percent- owned by U.S. taxpayers, said profit surged, beating analysts’ estimates as the company reduced loan-loss reserves by $1.99 billion.

Third-quarter net income was $2.17 billion, or 7 cents a share, compared with profit of $101 million, or a loss of 27 cents after preferred dividends, in the same period a year earlier, the New York-based bank said today."

Let's see now. The net income was $2.17 billion, but the loan-loss reserves were reduced by $1.99 billion. Oh, almost all of the third quarter net income was due to it reducing its loan-loss reserves. Nice trick, Citigroup. What is your justification in the face of the current mortgage mess? There is the real probability that you are going to have to buy back all those worthless mortgages that you sold. That is, the potential for hundreds of billions of dollars in losses that will have to be eaten by you. If anything, the loan-loss provision should have been increased, not decreased Citigroup.

Third-quarter net income was $2.17 billion, or 7 cents a share, compared with profit of $101 million, or a loss of 27 cents after preferred dividends, in the same period a year earlier, the New York-based bank said today."

Let's see now. The net income was $2.17 billion, but the loan-loss reserves were reduced by $1.99 billion. Oh, almost all of the third quarter net income was due to it reducing its loan-loss reserves. Nice trick, Citigroup. What is your justification in the face of the current mortgage mess? There is the real probability that you are going to have to buy back all those worthless mortgages that you sold. That is, the potential for hundreds of billions of dollars in losses that will have to be eaten by you. If anything, the loan-loss provision should have been increased, not decreased Citigroup.

Sunday, October 17, 2010

What is Wrong with Deflation?

Nothing! I don’t care what the Fed says. For instance, on Saturday, October 16, 2010, Eric Rosengren, President of the Federal Reserve Bank of Boston, stated that “Policymakers must act vigorously to counteract the risk of deflation.”

In the first place, I don’t consider Fed statements as being believable, given its track record. In regard to its track record, let’s look at its recent creditability.

1. March 28, 2007 (Ben Bernanke: “At this juncture … the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.”)

2. October 15, 2007 (Ben Bernanke: “It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.”)

3. June 9, 2008 (Ben Bernanke: (“Despite a recent spike in the nation’s unemployment rate, the danger that the economy has fallen into a substantial downturn appears to have waned.”)

Ok, you now know how I feel about the Fed. Now, what is deflation? Deflation is simply a decline in prices. Simple enough, but what causes a decline in prices? From “Basic Economics 101,” it is caused by either a decrease in demand or an increase in supply or some combination of the two. Nothing diabolic at all, just a shift in the demand and/or supply curves. Therefore, as a consumer, I like to see lower prices, because my purchasing power goes up. In other words, cash is king.

In the first place, I don’t consider Fed statements as being believable, given its track record. In regard to its track record, let’s look at its recent creditability.

1. March 28, 2007 (Ben Bernanke: “At this juncture … the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.”)

2. October 15, 2007 (Ben Bernanke: “It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.”)

3. June 9, 2008 (Ben Bernanke: (“Despite a recent spike in the nation’s unemployment rate, the danger that the economy has fallen into a substantial downturn appears to have waned.”)

Ok, you now know how I feel about the Fed. Now, what is deflation? Deflation is simply a decline in prices. Simple enough, but what causes a decline in prices? From “Basic Economics 101,” it is caused by either a decrease in demand or an increase in supply or some combination of the two. Nothing diabolic at all, just a shift in the demand and/or supply curves. Therefore, as a consumer, I like to see lower prices, because my purchasing power goes up. In other words, cash is king.

Saturday, October 16, 2010

Is America On A Burning Platform?

"The Federal Reserve is pulling out all the stops in attempting to invigorate the American economy. The stock market is surging. Everything is surging. The optimists are crowing that all is well. Deficits don’t matter. We can borrow our way to prosperity. Cutting taxes will not add $4 trillion to the National Debt if not paid for with spending cuts. All is well. So, the question remains. Are we actually on a perfectly sturdy solid platform? Or, are we on the Deepwater Horizon as it burns and crumbles into the sea?"

David Walker, the former Comptroller of the United States from 1998 until 2008, has been warning politicians, the media, and the American public for over a decade that we are off course and headed for disaster. In August 2007, before the financial system meltdown of 2008, Mr. Walker declared:

"The US government is on a “burning platform” of unsustainable policies and practices with fiscal deficits, chronic healthcare underfunding, immigration and overseas military commitments threatening a crisis if action is not taken soon. There are striking similarities between America’s current situation and the factors that brought down Rome, including declining moral values and political civility at home, an over-confident and over-extended military in foreign lands and fiscal irresponsibility by the central government. The fiscal imbalance meant the US was on a path toward an explosion of debt. With the looming retirement of baby boomers, spiraling healthcare costs, plummeting savings rates and increasing reliance on foreign lenders, we face unprecedented fiscal risks. Current US policy on education, energy, the environment, immigration and Iraq also was on an unsustainable path. Our very prosperity is placing greater demands on our physical infrastructure. Billions of dollars will be needed to modernize everything from highways and airports to water and sewage systems."

Please take the time this weekend and read the entire article entitled, "Burning Platform."

David Walker, the former Comptroller of the United States from 1998 until 2008, has been warning politicians, the media, and the American public for over a decade that we are off course and headed for disaster. In August 2007, before the financial system meltdown of 2008, Mr. Walker declared:

"The US government is on a “burning platform” of unsustainable policies and practices with fiscal deficits, chronic healthcare underfunding, immigration and overseas military commitments threatening a crisis if action is not taken soon. There are striking similarities between America’s current situation and the factors that brought down Rome, including declining moral values and political civility at home, an over-confident and over-extended military in foreign lands and fiscal irresponsibility by the central government. The fiscal imbalance meant the US was on a path toward an explosion of debt. With the looming retirement of baby boomers, spiraling healthcare costs, plummeting savings rates and increasing reliance on foreign lenders, we face unprecedented fiscal risks. Current US policy on education, energy, the environment, immigration and Iraq also was on an unsustainable path. Our very prosperity is placing greater demands on our physical infrastructure. Billions of dollars will be needed to modernize everything from highways and airports to water and sewage systems."

Please take the time this weekend and read the entire article entitled, "Burning Platform."

Mortgage Mess

This mess stems from "robo-signers or back-office workers," who approved hundreds of documents daily without reading them, to mortgages that were bundled into pools and sold to investors as securities, which is known as securitization.

Real-estate law requires the physical transfer of paperwork whenever mortgages trade hands, and analysts, according to the Wall Street Journal, are raising questions about how often that happened during the housing boom. One concern is that banks may have lost, or didn't ever have, mortgage certificates. If that happened, banks will have to pause foreclosures for months as they track down certificates and refile paperwork. And, that is the real problem. In other words, did those banks that are currently foreclosing on homes actually own those properties?

The result of this mortgage mess is going to slow the foreclosure process even more but not change the outcome. For example, according to J.P. Morgan Chase, in the state of Florida, which requires banks to foreclosure through the court system, the average borrower had spent 678 days without paying before being evicted through foreclosure. In Florida, 1 out of 7 mortgages are in this situation. [Sidebar: If one applies the Real Estate Rule of 32, which states that the total of all your monthly debt payments cannot exceed 32% of your monthly income to be eligible for a real estate loan, that would be like getting a 32% increase in one's salary for the next 678 days. This is one reason why I believe that consumer spending has been as strong as it has been in the face of economic weakness is because these individuals, who are not making their P&I payments, are redirecting these funds from mortgage payments to other types of consumption.]

Real-estate law requires the physical transfer of paperwork whenever mortgages trade hands, and analysts, according to the Wall Street Journal, are raising questions about how often that happened during the housing boom. One concern is that banks may have lost, or didn't ever have, mortgage certificates. If that happened, banks will have to pause foreclosures for months as they track down certificates and refile paperwork. And, that is the real problem. In other words, did those banks that are currently foreclosing on homes actually own those properties?

The result of this mortgage mess is going to slow the foreclosure process even more but not change the outcome. For example, according to J.P. Morgan Chase, in the state of Florida, which requires banks to foreclosure through the court system, the average borrower had spent 678 days without paying before being evicted through foreclosure. In Florida, 1 out of 7 mortgages are in this situation. [Sidebar: If one applies the Real Estate Rule of 32, which states that the total of all your monthly debt payments cannot exceed 32% of your monthly income to be eligible for a real estate loan, that would be like getting a 32% increase in one's salary for the next 678 days. This is one reason why I believe that consumer spending has been as strong as it has been in the face of economic weakness is because these individuals, who are not making their P&I payments, are redirecting these funds from mortgage payments to other types of consumption.]

Friday, October 15, 2010

Thursday, October 14, 2010

Good Old Fashion American Ingenuity

The Great John Toilet is the creation of a company that designs bathroom products for larger sized people. They're filling a need for a growing America. This toilet is 150% larger contact surface than normal but also allows for children or smaller sized people to use it as well. The toilet seat is 6" longer in front and 17" higher which makes for ease of getting up. The seat is designed so that it will not shift or pinch under the weight. But please, go for a walk and get some exercise!

Banksters (That is the polite name.)

This is the bank that we taxpayers bailed out; and, now, they are foreclosing on homes they do not even own! Folks, this is a major fraud. And guess what, Fannie and Freddie are deeply involved in this entire mortgage-foreclosure crisis. Way to go, Fannie and Freddie!

Sunday, October 10, 2010

Friday, October 08, 2010

DJIA Closes Above 11,000

A lot of people were excited today that the DJIA closed above 11,000, more specifically 11,006.48. Now, let me put this in perspective. Ten years ago, the DJIA stood at 11,000. Therefore, the DJIA over the past ten years has done nothing! I, for one, can not get too excited about the DJIA being dead in the water for ten years. As an investor, it has been a loss decade. Now, let's go one step forward and look at what the DJIA should be today if it just kept pace with inflation over the past ten years. Are you ready? Based on inflation, it should be 14,041.92, or 27.57% higher than what it is today. If you don't believe me or want proof, run the numbers yourself at The Federal Reserve Bank of Minneapolis.

Liar, Liar

This song is dedicated to the Bureau of Labor Statistics (BLS), who simply refuse to be completely honest with the American people about the true employment picture.

The Scariest Jobs Chart Ever

We are so far behind the "eight ball" in creating jobs during this economic expansion, which so far is laughable. However, the majority of economic pundits are still saying the Fed's QE2 will save all of us. Believable, I am not buying it! And, neither should you!

Market's Parapettio Moment Fast Approaching

Let's see now, unemployment at 9.6% (U6 @ 17.1%), one out of eight Americans on food stamps, foreclosures at record number, and the DIJA is above 11,000. Why is this market up? Everyone, except me and a few others, expects QE2 to be our nation's savior.

Food Stamp Nation

Close to 43 million people now receive food stamps. The average recipient of food stamps in June 2010 received more than $133 in assistance. The average household received more than $293. Overall, the USDA distributed more than $4.6 billion in food stamps in June alone. (Congress established the food stamp program in 1964, which was then revised by the Food Stamp Act of 1977. The program now feeds one in eight Americans, and one in four children.)

A once proud and powerful nation is fast becoming a "third-world nation.” The only way out of our dilemma is for the government to foster private-sector job initiatives, not public-sector jobs. As I have been saying for almost two years, "It's all about the jobs, stupid." Today, the BLS reported that the unemployment rate held steady at 9.6%, which is definitely understated. When you look at the number of individuals that have been removed from the employment statistics and/or just given up looking for a job, the unemployment rate is 17.1%. In other words, no private-sector job growth means no income, no consumer spending, and no capital formation & investment, which simply leads to a very bleak picture for our economy going forward.

A once proud and powerful nation is fast becoming a "third-world nation.” The only way out of our dilemma is for the government to foster private-sector job initiatives, not public-sector jobs. As I have been saying for almost two years, "It's all about the jobs, stupid." Today, the BLS reported that the unemployment rate held steady at 9.6%, which is definitely understated. When you look at the number of individuals that have been removed from the employment statistics and/or just given up looking for a job, the unemployment rate is 17.1%. In other words, no private-sector job growth means no income, no consumer spending, and no capital formation & investment, which simply leads to a very bleak picture for our economy going forward.

Thursday, October 07, 2010

Gallup Finds U.S. Unemployment at 10.1% in September

Unemployment, as measured by Gallup without seasonal adjustment, increased to 10.1% in September -- up sharply from 9.3% in August and 8.9% in July. I believe the Gallup number along with the negative employment report that ADP reported yesterday for the private sector employment picture. However, given that everyone will be watching closely to the BLS number tomorrow, I expect the government's (BLS) final unemployment report before the midterm elections will understate the true unemployment rate.

Wednesday, October 06, 2010

Happy Days Are Here Again

Let's see now the private-sector jobs fell by 39,000 in September from August, according to a report released today by ADP and consultancy Macroeconomic Advisers said. The reason why this is important, because it deals specifically with the private sector. This is the sector that we want to see job growth, not the government sector! Also, global growth will slow more sharply than expected in 2011 as advanced economies slash their budgets amid the continuing sovereign debt crisis, the International Monetary Fund (IMF) said today. As a matter of fact, the growth prospects for the U.S. took the IMF's largest downgrade, falling to 2.3% from a previous estimate of 2.9% And, what did the DJIA do today? It was up, of course. Don't worry, be happy. Once again, the market is totally focused on QE2.

This brings me to the theme song for today, which is "Happy Days are Here Again." This song was the quintessential depression era song. By the way, FDR used this song for his 1932 Presidential Campaign. Trouble is with his Keynesian economic policies it took America ten years and WW II to have those happy days again. Then, why is it that we came out of the 1920/21 depression after only one year? Click-on following article entitled, "The Forgotten Depression of 1920" to see what economic policies brought America out the 1920 depression in such a short order. Then, compare those economic policies to our current economic policies. I am a great believer in what Yahusha (Jesus) said in Yohanan (John) 8:32 "And you shall know the truth, and the truth shall make you free." It is true for an individual and for a nation!

This brings me to the theme song for today, which is "Happy Days are Here Again." This song was the quintessential depression era song. By the way, FDR used this song for his 1932 Presidential Campaign. Trouble is with his Keynesian economic policies it took America ten years and WW II to have those happy days again. Then, why is it that we came out of the 1920/21 depression after only one year? Click-on following article entitled, "The Forgotten Depression of 1920" to see what economic policies brought America out the 1920 depression in such a short order. Then, compare those economic policies to our current economic policies. I am a great believer in what Yahusha (Jesus) said in Yohanan (John) 8:32 "And you shall know the truth, and the truth shall make you free." It is true for an individual and for a nation!

Economic Resources

I have two main sources that I utilize to gauge overall economic activity and private employment. In regard to to economic activity, I monitor closely the Chicago Fed National Activity Index, which is a weighted average of 85 existing monthly indicators. The 85 economic indicators that are included in the index are drawn from four broad categories of data: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories. Each of these data series measures some aspect of overall macroeconomic activity.

For private sector employment, I use the ADP National Employment Report. It is a measure of private sector employment derived from an anonymous subset of approximately 500,000 of its U.S. business clients. This is the true measure of job creation within the private sector. Why is this of importance? These private jobs is what grows the economy, not government created job. The problem that I have with the Bureau of Labor Statistics (BLS) is that I don't consider them to be totally objective in reporting monthly employment numbers.

Therefore, if you really want to know the "truth" in regard to the economy and the private sector employment picture, check out those two sites. In other words, become your own economist.

For private sector employment, I use the ADP National Employment Report. It is a measure of private sector employment derived from an anonymous subset of approximately 500,000 of its U.S. business clients. This is the true measure of job creation within the private sector. Why is this of importance? These private jobs is what grows the economy, not government created job. The problem that I have with the Bureau of Labor Statistics (BLS) is that I don't consider them to be totally objective in reporting monthly employment numbers.

Therefore, if you really want to know the "truth" in regard to the economy and the private sector employment picture, check out those two sites. In other words, become your own economist.

Tuesday, October 05, 2010

The Sky is the Limit! Really Now?

This market only knows one way, and that is up, up and away, which is demoralizing all the "Bears" out there, inclusive of myself. I believe the following two reasons explain the current market's behavior:

- The market believes that the Republicans are going to control Congress after the November 2 elections.

- The market loves the prospect of QE2 and beyond. Just today Charles Evans, President of the Fed of Chicago called for aggressive QE creation.

In keeping with my recent tradition of providing music for how the market is behaving, let's hear from the Fifth Dimension. (By the way, instead of "balloon, substitute MARKET.") Enjoy.

Saturday, October 02, 2010

Are You Bearish or Bullish?

Currently, sentiment figures are at peak levels, not trough levels. For example, stock market optimism is at 87%, gold at 90% bulls, silver at 95% bulls, cotton at 97% bulls, and sugar at 98% bulls. And, of course, the poor dollar, which everyone continues to hate, is at 5% bulls. That is probably a good reason to buy the dollar, because everyone has probably already sold it.

The reason for such high bullish sentiment numbers, with the exception of the $, can be summed up with by the acronym QE2. Wall Street believes that as long as QE2 (Quantitative Easing Part 2) is a Fed option, the economy will boom and stocks along with all financial assets (gold, silver, real estate, commodities, etc.) will continue to motor much higher. But, there appears to be a problem. Why does the Fed need QE2, if QE1 did its job? The answer is because QE1 failed, and QE2 will likewise fail. It is as simple as that! Let me explain it this way. Since QE1 started in 2008, the Fed's balance sheet increased by $2.46 trillion, while during the same time horizon U.S. credit market debt declined by $296 billion. (Up until 2008, U.S. credit market debt rose for 63 consecutive years. That in itself should make an inflationist take notice.) All that QE1 expansion could not stem the tide of credit contraction, which is deflation.

Just look at the following chart of the various money measures, especially M3. A negative growth rate for M3 is due to credit market debt contraction. As long as the growth rate for M3 is negative, deflation, not inflation, is the name of the game. That is look for deflating financial assets, not inflating financial assets, going forward.

Friday, September 24, 2010

Fed's Intervention (QE II) Will Make "Everything" Go Up

David Tepper was on CNBC this morning and stated the following (paraphrasing), "If the economy gets better, stocks will go up. It the economy gets worse, the Fed will institute QE II and stocks will go up." In other words, heads you win, tails you win! He believes that the Fed's announcement on Tuesday of this week clearly gives the signal to the markets that the Fed is about to embark on a second round of QE. So far so good, the markets roared ahead today with the S&P 500 up 2.12%. Wow! the equity markets, along with precious metals, definitely believe that QE II is upon us. Maybe with rates, such as the Fed Funds rate at zero, money really is free; and if it takes the Fed to put another $1.8 trillion into the banking system, so be it. The markets love it. Everyone is getting rich. And, who can be against free money.

For those of you whom do not know who David Tepper is, he is the founder and CEO of the hedge fund known as Appaloosa with $12.4 billion assets under management. Last year his fund made $7.5 billion or a return of 132%.

In keeping with our music assortment this week, I want you to sit back and enjoy your new found market gains as you listen to "Money for Nothing" by Dire Straits. It doesn't get any better than this! But make sure you spend some of that prosperity. The economy needs it.

For those of you whom do not know who David Tepper is, he is the founder and CEO of the hedge fund known as Appaloosa with $12.4 billion assets under management. Last year his fund made $7.5 billion or a return of 132%.

In keeping with our music assortment this week, I want you to sit back and enjoy your new found market gains as you listen to "Money for Nothing" by Dire Straits. It doesn't get any better than this! But make sure you spend some of that prosperity. The economy needs it.

Wednesday, September 22, 2010

Ramification of Fed's Quantitative Easing Policies: Debase the Dollar

Albert Einstein said, "Insanity is doing the same thing over and over again and expecting different results. Well, Mr. Bernanke, you are insane. Quantitative Easing (QE), which is just a fancy name for printing money, has not worked; and your next QE II phase will be an absolute disaster. Just look at Japan's failed experience with QE over the past decade. the only thing that it will accomplish is to further debase the dollar.

To make matters worse, QE has artificially kept interest rates low. The ten-year Treasury Note is currently yielding 2.55%. How? Well, the Federal Reserve System, through its Federal Open Market Operations, has purchased something $1.5 trillion of dubious, quality assets at par from the banking system. In return, those banks have used the proceeds to purchase high-quality Treasury securities. Banks love it, because they have been able to unload questionable assets at par and receive Treasury securities in return. In other words, the Fed has not only propped up the balance sheets of banks but also assisted the Treasury in monetarizing our federal deficits. So, what is the problem? The problem is that such a policy has weakened the dollar to the point that it may decline another 15% or more. (See the following dollar chart.)

Let me put it into perspective with this example. Let's say I am a foreign buyer and holder of Treasury Notes at 2.55%. If the dollar declines, say another 15%, I have just lost 12.45% (2.55% yield minus 15% currency-exchange lost) on my Treasury Note investment. If the dollar continues to decline (As I am writing this post, the dollar is down 15 and Euro is up 1.33%.), the Treasury just may not find any foreign takers willing to finance our federal deficits through the purchase of Treasury securities. That will just leave the Fed to monetarize the federal deficits at the expense of an ever decreasing dollar.

To make matters worse, QE has artificially kept interest rates low. The ten-year Treasury Note is currently yielding 2.55%. How? Well, the Federal Reserve System, through its Federal Open Market Operations, has purchased something $1.5 trillion of dubious, quality assets at par from the banking system. In return, those banks have used the proceeds to purchase high-quality Treasury securities. Banks love it, because they have been able to unload questionable assets at par and receive Treasury securities in return. In other words, the Fed has not only propped up the balance sheets of banks but also assisted the Treasury in monetarizing our federal deficits. So, what is the problem? The problem is that such a policy has weakened the dollar to the point that it may decline another 15% or more. (See the following dollar chart.)

Let me put it into perspective with this example. Let's say I am a foreign buyer and holder of Treasury Notes at 2.55%. If the dollar declines, say another 15%, I have just lost 12.45% (2.55% yield minus 15% currency-exchange lost) on my Treasury Note investment. If the dollar continues to decline (As I am writing this post, the dollar is down 15 and Euro is up 1.33%.), the Treasury just may not find any foreign takers willing to finance our federal deficits through the purchase of Treasury securities. That will just leave the Fed to monetarize the federal deficits at the expense of an ever decreasing dollar.

Tuesday, September 21, 2010

Europe Debt Crisis Is Over, Declares Spanish Leader

Yesterday, we had the NBER stating the recession is over. As a matter of fact, the NBER stated that the recession ended in June 2009. Indeed, looked at all the jobs that have been created since June 2009. Right? Besides jobs, I know there has to be more, but I just can not think of any at the moment. Will someone in the Obama Administration please help me out here!

Today, we have Spanish Prime Minister José Luis Rodríguez Zapatero declared that the European debt crisis is over. Wait a minute! Isn't he a politician? Believable, I think not. Does anyone really believe that our recession is over or that the European debt crisis is behind us? Folks, perception is not reality. It's all a confidence game, and no one is buying it this time. As a matter of fact, the worse of the crisis is probably still ahead of us! Now, I am wondering what the announcement will be tomorrow. What about "a chicken in every pot and a car in every garage." No, that has already been used by Herbert Hoover. Well, I am sure that there will be some statement to the tone that claims prosperity for everyone is just around the corner.

Keeping with the spirit of "Letting the Good Times Roll," I thought you might you enjoy the music of the Cars from 1978. Hey, at least it is newer than Louis Jordan's 1930 version from yesterday's post.

Today, we have Spanish Prime Minister José Luis Rodríguez Zapatero declared that the European debt crisis is over. Wait a minute! Isn't he a politician? Believable, I think not. Does anyone really believe that our recession is over or that the European debt crisis is behind us? Folks, perception is not reality. It's all a confidence game, and no one is buying it this time. As a matter of fact, the worse of the crisis is probably still ahead of us! Now, I am wondering what the announcement will be tomorrow. What about "a chicken in every pot and a car in every garage." No, that has already been used by Herbert Hoover. Well, I am sure that there will be some statement to the tone that claims prosperity for everyone is just around the corner.

Keeping with the spirit of "Letting the Good Times Roll," I thought you might you enjoy the music of the Cars from 1978. Hey, at least it is newer than Louis Jordan's 1930 version from yesterday's post.

Monday, September 20, 2010

Illinois' Pension Fund: "10 Years Of Money Left"

This is one analytical reason why I remain bearish not only on the economy (irrespective of today's announcement by the NBER) but on the markets.

Recession Ended in June 2009

The National Bureau of Economic Research (NBER), which is responsible for dating changes in the U.S. business cycle, says the recession ended in June 2009 that started in December 2007. It further stated that "The committee did not conclude that economic conditions since that month (June 2009) have been favorable or that the economy has returned to operating at normal capacity. As worries persist about the struggling U.S. economy and its future path, the NBER warned that any future downturn of the economy would be a new recession and not a continuation of the recession that began in December 2007."

Boy, aren't you relieved! We can now all go out and borrow and spend to our heart's content. To sent the mood for these good times, I thought you might enjoy the following video by Louis Jordan. Now, go out and spend your money. This recession is over. Go on now, what are you waiting for?

Boy, aren't you relieved! We can now all go out and borrow and spend to our heart's content. To sent the mood for these good times, I thought you might enjoy the following video by Louis Jordan. Now, go out and spend your money. This recession is over. Go on now, what are you waiting for?

Sunday, September 19, 2010

Would You be a Buyer at These Current Levels?

The following two charts, SSO and QLD, are bullish ETFs, which are representative of the market. The SSO is the 200% derivative for the S&P 500, while the QLD is the 200% derivative for the QQQ.

Now, for that question, are you buying at these levels?

Now, for that question, are you buying at these levels?

Subscribe to:

Posts (Atom)