The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Wednesday, December 21, 2011

Tuesday, December 20, 2011

Is this the Worse Delivery Ever?

I hope this was not your monitor!

"A Fool and His Money are Soon Parted."

Wow, nice Santa rally going on. Today’s rally reminds me of the famous proverb found in the poem Five Hundred Points of Good Husbandry by Thomas Tusser, which states, "A fool and his money are soon parted.”

I am simply amazed at how Wall Street is blinded by the real reality of Main Street. And, how Wall Street believes that its real Savior is in the Central Bankers of the world. Enjoy “Bulltarts” this bittersweet year-end rally for 2011, because 2012 will show the complete folly of your ways. Therefore, I thought the following Santa video is appropriate for all the Bulltarts that still believe in Santa Claus, Bunny Rabbit, and the Tooth Fairy.

Monday, December 19, 2011

Sunday, December 18, 2011

Saturday, December 17, 2011

Senate Approves Two-month Extension of Payroll Tax Cut

CNN just reported that the Senate voted to extend the payroll tax cut by two months, after both sides were unable to reach a comprehensive agreement to extend the payroll tax cut and unemployment benefits for a full year. The House will vote on the extension next week. That is just great! Let's just kick that can down the road so everyone can go home for the holidays and not worry about it until February 2012. And, then we wonder why our country is going “to hell in a hand basket.” Well, that is my "rant" for the day.

Chevy Volt: A Car for Idiots

Wow! That is strong language. However, those are not my words. They come from Johan de Nysschen, President of Audi of America. He states, "No one is going to pay a $15,000 premium for a car that competes with a Corolla. So there are not enough idiots who will buy it." (So far for 2011, only 5,000 idiots have purchased Volts. Probably most of those sales were to the government idiots.) He further explains his frustration with regulators and policy makers, saying the, "public has been hoodwinked into believing that electrical vehicles are the only answer to global warming. The U.S. government, he said, is pouring billions of dollars into this technology (Chevy Volt), yet diesel technology could deliver a more immediate and dramatic decrease in global-warming emissions. Modern diesels already power half of Audi’s cars in Europe. Diesels have been shown to emit 25 percent less carbon dioxide than gasoline engines, while using 25 to 35 percent less fuel."

Are you listening Department of Energy, EPA, and Obama Administration? You probably should be, since you have such a great track record at picking losers!

Are you listening Department of Energy, EPA, and Obama Administration? You probably should be, since you have such a great track record at picking losers!

Friday, December 16, 2011

Elliott Wave Theorist: Closing the Year on a High Note

The following excerpts are taken from December's "Elliott Wave Theorist Newsletter" by Robert Prechter. I thought you might find it enlightening or, if you are a "Bulltart," unnerving.

“It took awhile, but every market is going our way. The U.S. dollar just broke out to a new 11-month high. U.S. stocks have stayed below their April highs. Foreign stock indexes are down 10%-50%. Gold and silver closed this week at their lowest levels since their peaks. And the CRB commodity index is down 10% on the year.

The best performing market for 2011 is one that nobody wanted. Bulls bet against U.S. Treasury bonds due to forecasts of an economic recovery, and bears bet against bonds due to forecasts of hyperinflation. But U.S. Treasury bonds have registered the best total return (+20%) for the year of any major investment sector. This event makes sense only to deflationists, and a few other scattered iconoclasts hiding around the globe.

The Fed reported on Tuesday that the economy has been “expanding moderately,” but economists waiting for economic reports to indicate contraction will be six to twelve months late. The November issue of EWT used a chart of silver to warn that the economy is already heading back into contraction. In fact, four useful leading indicators of the economy—namely, the prices of stocks, lumber, silver and copper—turned down months ago, between February and April 2011. If the market tries to bounce during the traditionally strong late December-early January period, any rally should stay in the context of a bear market.”

Thursday, December 15, 2011

Critical Price Level: 11,600!

Key support level for the $INDU is still 11,600 for both the "Bears and Bulls." Of course, Bulls want to see that price level hold; Bears want to see that price level broken. As of now, it is really that simple.

Wednesday, December 14, 2011

The Gold Break?

Gold just broke through its 200-day simple moving average, which is the first time since early 2009. Is silver next to break its long-term moving average? So far, the score is "Deflation 1, Inflation 0."

My Rant for the Day

Financial asset inflation is what “Wall Street” loves and wants. That is why “Wall Street” has not balked on the failed monetary policies of the Federal Reserve System. As a matter of fact, it wants more trillions, not less, to continue the price inflation of financial assets. When I make reference to “Wall Street” in this context, I am specifically referring to investment advisory firms, investment bankers, and security firms. In other words, Wall Street would include any security entity that generates revenues by either providing investment advice, manages funds for clients, or buying/selling of securities. Even though these investment entities know full well that the current polices on the fiscal side of deficit spending (spending > tax receipts) have failed. (From a mathematical point of view, the economy cannot generate debt growth (9%) that exceeds income growth (2%) over an extended period of time without going bankrupt.) Never-the-less, they want greater monetary easing on the part of the Federal Reserve System to goose the price of financial assets in order to generate revenues for their benefit, not for the benefit of the economy. I know the counter argument is that these firms really believe that Keynesian economics has not failed us. All what is needed is an additional trillion dollars here and there to get this economy out of its malaise. Yes, some really do believe that by creating something out of nothing is the economic panacea. However, I still believe that there is a greater conflict-of-interest than the investment public fully realizes between the self-interest of these investment firms and the Fed. It is simply the nature of man, which is sad but true.

Tuesday, December 13, 2011

Pennies from Heaven

Anyone looking to make a small investment "right now" might want to look at all those pre-1983 pennies that your have accumulated in your house. I will show you how you can double your money just by counting pennies. Sounds too good to be true? No, it is true! Just thank the Federal Reserve System for providing you with this opportunity through its easy credit (money) policy. These polices have sent the prices for "copper and zinc" on an exponential rise.

Using the latest metal prices for copper and zinc, these are the numbers required to calculate the metal value of pre-1983 pennies:

$3.4592 | = | |

$0.8779 | = | Zinc Price/Pound on Dec 13, 2011. |

.05 | = | Zinc % |

3.11 | = | Total weight in grams |

.00220462262 | = | Pound/gram conversion factor (Prices are quoted in pounds. Therefore, the reason for the conversion.) |

1.

Calculate 95% copper value of Pre-1983 pennies:

($3.4592

× .00220462262 × 3.11

× .95) = $0.0225314

2.

Calculate 5% zinc value:

($0.8779

× .00220462262 × 3.11

× .05) = $0.0003009

3.

Add the two together:

$0.0225314 + $0.0003009

= $0.0228323 (Value of that Penny)

$0.0228323 is the metal value for the

1909-1982 copper pennies as of December 13, 2011, or 128.32% increase from its face value. Therefore, get those "penny jars and penny banks" out and start

going through those pennies to find those pre-1983s. What are you waiting for? Go calculate your new found wealth, now!

Saturday, December 10, 2011

Tuesday, December 06, 2011

What is Backing Your Deposits in Your Bank?

The answer to the question in the title is for all practical purposes "NOTHING." And, of course, therein lies the problem with where you bank. Because U.S. banks are no longer required to hold any of their deposits in reserves. I would gather that the vast majority reading this post did not know that.

The following excerpt, which you just might want to read, is taken from Risks in Banking from Bob Prechter's Conquer the Crash:

"Between 1929 and 1933, 9000 banks in the United States closed their doors. President Roosevelt shut down all banks for a short time after his inauguration. In December 2001, the government of Argentina froze virtually all bank deposits, barring customers from withdrawing the money they thought they had. Sometimes such restrictions happen naturally, when banks fail; sometimes they are imposed. Sometimes the restrictions are temporary; sometimes they remain for a long time.

Why do banks fail? For nearly 200 years, the courts have sanctioned an interpretation of the term “deposits” to mean not funds that you deliver for safekeeping but a loan to your bank. Let’s repeat that in another way. Your bank balance, then, is an IOU from the bank to you, even though there is no loan contract and no required interest payment. Thus, legally speaking, you have a claim on your money deposited in a bank, but practically speaking, you have a claim only on the loans that the bank makes with your money. If a large portion of those loans is tied up or becomes worthless, your money claim is compromised. A bank failure simply means that the bank has reneged on its promise to pay you back. The bottom line is that your money is only as safe as the bank’s loans. In boom times, banks become imprudent and lend to almost anyone. In busts, they can’t get much of that money back due to widespread defaults. If the bank’s portfolio collapses in value, say, like those of the Savings & Loan institutions in the U.S. in the late 1980s and early 1990s, the bank is broke, and its depositors’ savings are gone."

Make sure you check out to see what bank in your state is the safest. You just might want to check these banks out.

Monday, December 05, 2011

Austerity Measures for the Queen

In a further sign of dire economic times, Buckingham Palace is now doing some budget busting with the queen herself due for a pay freeze, and Prince Charles set to foot the bill for some major expenses. According to Ingrid Seward, editor-in-chief of Royal magazine, the queen is going around Buckingham Palace turning off the lights, having fewer staff, and even turning the heat down. She sometimes even writes letters in her very own fur coat. Ingrid also reports that it is quite sad to see the Queen Mother having to act in such a common fashion.

Saturday, December 03, 2011

Analysis of Yesterday's Employment Numbers

How is it possible to have such a major drop in the unemployment rate from 9% to 8.6% when new jobs only came in at 120,000? Answer: Labor Force Participation down from 64.2% to 64.0% as more people leave the work force (315,000 to be exact), because there are no jobs out there. And the beauty of it from a statistical standpoint is that if you are not in the employment pool, you are not counted! Therefore, the unemployment rate will statistically be better. Wow! Don’t you just love statistics and how the BLS uses them? The only reason the unemployment rate went down was because people became so discouraged and frustrated that they could not find work they just gave up. Thus, the BLS considers that to be a positive improvement on the employment front. You got to me kidding me; but, of course, I am not. But, the Administration, news headlines, and mainstream financial pundits simply mentioned that the employment picture vastly improved, because the rate dropped from 9% to 8.6%. With such uninformed utterances for the real truth, I am reminded what Macbeth said: “It is a tale told by idiots, full of sound and fury signifying absolutely nothing.”

Please pay very close attention to my next sentence. U.S. needs to generate 262,500 jobs per month to return to 2007 employment levels over the next five years. This means that unless that number of jobs is created each month for the next five years, America will have a higher unemployment rate in October 2016 than it did in December 2007. Now, how realistic is it that the US economy can create 15.8 million jobs in the next five years with our totally dysfunctional Congress?

Friday, December 02, 2011

Unemployment Rate at 8.6% for November

The economy added 120,000 jobs in November on expectations of 125,000. (I wonder how many of those so-called new jobs resulted from the "Birth/Death Statistic?") The unemployment rate declined from 9% to 8.6% one expectations that it would remain at 9%. (I will have more later after I have a chance to analyze all the numbers.)

Thursday, December 01, 2011

Government Motors Willing to Buy Back Volts

Now this is a vote of confidence to run out and buy that all electric car, which GM admits could catch fire. According to the Associate Press, "General Motors will buy Chevrolet Volts back from any owner who is afraid the electric cars will catch fire." I guess that is why only 6,000 have been sold. I am convinced that the Volt is going the way of the Edsel. The Volt was a government idea from day one. This is what happens when the government tries to pick winners and losers. (Does anyone remember Solyndra?) And, it's track record is lousy. That is the function of a market economy, not the government.

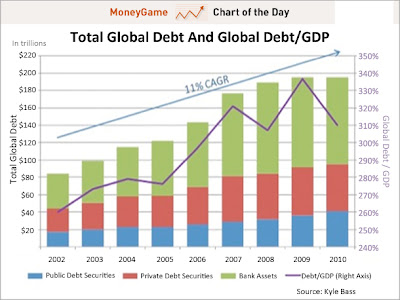

Total Global Debt to GDP

The following chart is presented without any further comment because none is needed. Except for the following statement by Kyle Bass: "Total Debt-to-GDP only breached 200% when nations were spending on war. Today we are at 310%." As I have stated many times on this blog, this whole debt situation is not going to end well. In other words, you can not grow total debt at 11% when GDP is growing at 2%.

Tuesday, November 29, 2011

Twitter Post

This is what I said on my Twitter account (twitter.com/debauche) last Wednesday, November 23, "$INDU should bounce back (Bear Rally) to 11,600 from these very oversold levels." And, sure enough, the market came back from Thanksgiving with a bang. Main reasons are, as indicted on Twitter, oversold levels and seasonality. (See the following chart.) Today, the high on the $INDU was 11,624 but closed at 11,556. Can it go higher? Of course, it can. However, the 200-day EMA now stands at 11,693, which is the new resistance level. Saying all this, the fact is still that the long-term of the market is still down.

Eurozone Finance Ministers OK $10.7 Billion Greek Loan

You are going to love this one! The Associated Press reports that "Eurozone finance ministers have approved $10.7 billion bailout loan installment for Greece." Now get this. "The EU had demanded, and received, letters from the leaders of Greece's main political parties pledging support for tough austerity measures to get the loan." How often have we heard this statement by Greece? To be honest with you, I can not count that high! And, where will the EU get the $10.7 billion? Oh, it will simply print it, just like our Fed. The game is just about up. No one believes that the EU will survive. Who are they really trying to fool? I guess themselves. Good luck with plan, but there is always the next plan.

Tuesday, November 22, 2011

SuperDud

As everyone knows by now, the so-called "Supercommittee" has been a total disaster, failure. It, of course, should come as no surprise, since it was doomed from the start because of the partisan composition of the committee. It is very sad that we have come to the point where it is all about politics, not what is best for America. Here we have a committee that could not agree on how to cut government spending by $120 billion, or something like 3%, from total government spending of $3.6 trillion. Maybe, just maybe, Congress could learn something from a drug addict. However, I doubt it, because we haven't hit rock bottom yet.

Monday, November 21, 2011

Sunday, November 20, 2011

Federal Reserve Now Largest Owner of U.S. Government Debt—Surpassing China

The Federal Reserve said that as of September 2011, it owned $1.665 trillion in U.S. Treasury securities. That was more than double the $812 billion in U.S. Treasury securities the Fed said it owned as of September 2010. Meanwhile, China owned $1.1483 trillion in U.S. Treasury securities, which was down slightly from the $1.1519 trillion in U.S. Treasury securities the Chinese owned as of the end of September 2010.

Given our fractional-reserve banking system, that $1.7 trillion of Fed credit has the potential to expand liquidity in our economy by a factor of 10, or approximately $16 trillion. That is a lot of moola, which can be equated to a lot of inflation if it wasn't for the decline in money velocity. See the following chart.

Given our fractional-reserve banking system, that $1.7 trillion of Fed credit has the potential to expand liquidity in our economy by a factor of 10, or approximately $16 trillion. That is a lot of moola, which can be equated to a lot of inflation if it wasn't for the decline in money velocity. See the following chart.

As long as the velocity of money is trending down and below its long-term average of 1.68, price deflation rules the day.

Saturday, November 19, 2011

Recessions and Silver Prices

The November 2011 issue of Robert Prechter's Elliott Wave Theorist draws an interesting relationship between recessions and silver prices. His conclusion is that if one is bearish on the economy, one should be bearish on silver. Likewise, if one is bullish on the economy, one should be bullish on silver. In other words, being bearish on the economy, but bullish on silver would go against history. See the following chart from the Elliott Wave Theorist. He does point out that during hyper-inflationary periods, precious metals would be the investment of choice. However, we are not at that hyper-inflationary zone yet, according to Mr. Prechter. He sees further weakness in silver, likewise with gold.

Thursday, November 17, 2011

Two-Thirds of Senate, Nearly Half of House Rank as Millionaires

According to the Center for Responsive Politics, "Being a millionaire typically qualifies you as part of the American financial elite. But in Congress, it only makes you average. About 47 percent of Congress, or 250 current members of Congress, are millionaires. The median net worth of a current U.S. Senator stood at an average of $2.63 million in 2010, while the median net worth among House Members was $756,765."

I wonder if "insider trading," which is legal for a member of Congress to do, had anything to do with the millionaire status. That is, the net wealth of a member coming into Congress verses net worth leaving Congress. That would be a great study. I wonder if I could get a government grant to undertake such a study. Oh, it would have to be approved by Congress. On second thought, I don't think such a grant would be approved. Do you?

I wonder if "insider trading," which is legal for a member of Congress to do, had anything to do with the millionaire status. That is, the net wealth of a member coming into Congress verses net worth leaving Congress. That would be a great study. I wonder if I could get a government grant to undertake such a study. Oh, it would have to be approved by Congress. On second thought, I don't think such a grant would be approved. Do you?

What is 19 Feet High?

The fact that GE paid no taxes in 2010 was widely reported earlier this year, but the size of its tax return was not reported. Are you really for the "size of its tax return?" It will literally blow you away. For 2010, GE's tax return would have been 57,000 pages had it been filed on paper, which would equate to 19 feet high if printed out and stacked. No, that is not a misprint. 57,000 pages are correct.

On its $14 billion in profits, $9 billion dollars came from overseas, outside the jurisdiction of U.S. tax law. Also, GE wasn't taxed on $5 billion in U.S. profits; because it utilized numerous deductions and tax credits, including tax breaks for investments in low-income housing, green energy, and research & development, as well as depreciation of property.

Wednesday, November 16, 2011

National Debt Rises Over $15 Trillion

It is official our National Debt is now above $15 trillion. Keep-in-mind the "Debt Ceiling" that was put into place in August is $15.194 trillion. Also, our GDP is $15.024 trillion, or our National Debt equals GDP. Now, what are you going to do, Washington? No, what are we, as Americans, going to demand from Washington to resolve our debt crisis?

I am calling for a "National Week of Mourning," which will commence tomorrow, November 17, 2011. All American flags should be flown at "half staff" for the next week. It is truly a very sad day for all Americans.

I am calling for a "National Week of Mourning," which will commence tomorrow, November 17, 2011. All American flags should be flown at "half staff" for the next week. It is truly a very sad day for all Americans.

Tuesday, November 15, 2011

Postal Service Reports $5 billion Loss

The loss could have been worse, to the amount of $10.6 billion. However, through the graciousness of your Congress, a $5.5 billion payment that was required to fund retiree health benefits was postponed. I wonder who is going to pay that amount? Oh, silly me, you, of course, as the U.S. taxpayer. Hopefully, your friendly postal carrier will thank you with tomorrow's mail delivery.

Monday, November 14, 2011

I Wonder Why?

Did you know that Congress is exempt from insider trading laws? Maybe it is about time that we change the way Congress does business.

Sunday, November 13, 2011

Thursday, November 10, 2011

French and Germans Explore Idea of Smaller Euro Zone

On Thursday, September 22, 2011, I posted the following message, which was entitled, “Member Countries of the European Union (EU).”

The EU currently has 27 member countries, which have transferred some of their sovereignty, or lawmaking authority, to the EU. I believe that very shortly we will have something far less than 27 EU members. The number that I have in mind is "10." Which ten will eventually make up the EU?

Well now, Reuters report, "German and French officials have discussed plans for a radical overhaul of the European Union that would involve establishing a more integrated and potentially smaller euro zone. French President Nicolas Sarkozy gave some insight to his thinking during an address to students in the eastern French city of Strasbourg on Tuesday, when he said a two-speed Europe -- the euro zone moving ahead more rapidly than all 27 countries in the EU -- was the only model for the future. Also, the discussions among senior policymakers in Paris, Berlin and Brussels go further, raising the possibility of one or more countries leaving the euro zone, while the remaining core pushes on towards deeper economic integration, including on tax and fiscal policy."

Now, where did I come up with my “10 nations?” I arrived at it from Biblical prophecy. Look up and read for yourself in Daniel 7: 19-27 and Revelation 17: 12-13.

Wednesday, November 09, 2011

President Obama Calls Off Christmas Tree Tax

Friday, November 04, 2011

Unemployment Rate Drops to 9% with the Creation of 80,000 Jobs for October

Now, I will give you the real truth of the employment numbers. The infamous "Birth/Death Model" of the BLS added 103,000 jobs, which is a statistical adjustment, not real jobs! Therefore, if we back out that statistic, we lost 23,000 jobs for the month of October. So far for 2011, the "Birth/Death Model" has added something like 530,000 jobs, or 42% of all jobs created. And yet, people still believe what comes from the BLS. Well, stupid is as stupid does.

Thursday, November 03, 2011

Do You Know Your Fannie from Your Freddie?

Fannie Mae and Freddie Mac are Government Sponsored Enterprises (GSE) in the home mortgage business. They have the exact same business model, and they do the exact same thing. That is, they buy mortgages on the secondary market, pool them, and then sell them as mortgage-backed securities to investors on the open market. Everything else regarding government guarantees, explicit guarantees, implicit guarantees, subsidies and direct government funding is exactly the same for Freddie Mac as it is for Fannie Mae.

The main difference between Freddie Mac and Fannie Mae is that Fannie Mae primarily buys mortgages issued by banks and Freddie Mac primarily buys mortgages issued by thrifts (savings and loans).

The Associated Press (AP) reported today that Freddie Mac has requested $6 billion in additional aid after posting a wider loss in the third quarter. Freddie Mac said that it lost $6 billion in the July-September quarter. That compares with a loss of $4.1 billion in the same quarter of 2010.

The government rescued Freddie Mac and sibling Fannie Mae in September 2008 after massive losses on risky mortgages threatened to topple them. Since then, a federal regulator has controlled their financial decisions. (We can all see what good that has done!)

Taxpayers have spent about $169 billion to rescue Fannie and Freddie, which is the most expensive bailout of the 2008 financial crisis. The government estimates it will cost at least $51 billion more to support the companies through 2014, and maybe as much as $142 billion in the most extreme case.

Fannie and Freddie own or guarantee about 50% of all U.S. mortgages, or nearly 31 million home loans worth more than $5 trillion. Along with other federal agencies, they backed nearly 90 percent of new mortgages over the past year.

As mentioned previously, Fannie and Freddie buy home loans from banks and other lenders, package them into bonds with a guarantee against default, and then sell them to investors around the world. When property values drop, homeowners default, because they are unable to afford the payments or because they owe more than the property is worth. Because of the guarantees, Fannie and Freddie must pay for the losses. (That would of course be you, acting as the American taxpayer.)

Tuesday, November 01, 2011

Mark-to-Market Accounting (FAS 157), Greece, Credit Default Swaps (CDS), and Sabanes Oxley

It all started on March 16, 2009 when FASB proposed that companies use more flexibility in valuing their assets under "mark-to-market" accounting. A move that financial institutions said would ease balance-sheet pressures many were feeling during the economic crisis of the subprime debacle. On April 2, 2009, after a 15-day public comment period, FASB eased the mark-to-market rules. Financial institutions are still required by the rules to mark transactions to market prices but more so in a steady market and less so when the market is inactive. In other words, companies, especially financial institutions, can do whatever they like. Today, you cannot trust any balance sheet given to you today. (One reason why I am a technical analyst, not a fundamental analyst.) It is really that simple. The reason is that the government demanded that FASB allow these lies as a business practice when it comes to the alleged value of securities.

Then, on April 9, 2009, FASB issued the official update to FAS 157 that eases the mark-to-market rules when the market is unsteady or inactive. Early adopters were allowed to apply the ruling as of March 15, 2009, and the rest as of June 15, 2009. It was anticipated that these changes could significantly boost banks' statements of earnings and allow them to defer reporting losses. The changes, however, affected accounting standards applicable to a broad range of derivatives, not just banks holding mortgage-backed securities.

Opponents argue that the implications for investors are that the valuation of assets underlying such securities will be increasingly difficult to analyze, not less so. An example would be determining a company's actual assets, equity and earnings, which will be overstated if the assets are not allowed to be marked down appropriately.

As expected today (October 27, 2011), here is ISDA with the most farcical of decisions, similar to FASB in 2009. From Reuters: "A new voluntary deal for holders of Greek debt to accept deeper losses is unlikely to trigger a 'credit event' that would cause a payout on default insurance (CDS), said a top lawyer at the International Swaps and Derivatives Association. Greek bondholders face losses of 50 % under a plan to lower the country's debt burden and contain the euro zone's long-running debt crisis. The aim is to complete negotiations on the package by the end of the year. But because participation in the deal is voluntary rather than forced, it would typically not trigger payment on CDS contracts."

And now we have MF Global (October 31, 2011), who is missing something like a billion dollars of client funds. Or, should I simply say that MF Global stole its clients’ funds, which is exactly what happened. Once again, where are the regulators? MF Global was not just your common “Ma and Pa Brokerage Company.” It was a “Primary Government Security Dealer,” who is supposed to have unquestionable financial strength. By the way, I thought Dodd-Frank was supposed to put in place checks and balances to stop this type of activity. And, then there is Sarbanes Oxley. There have been multiple bank failures by public companies that filed balance sheets under penalty of criminal prosecution just weeks before they failed. These banks had balance sheets that showed perfectly, healthy institutions. The FDIC has documented dozens of bank failures, privately-held and publicly-traded, where those balance sheets were proven to be factually false, as the losses have been 20%, 30%, 40% or even more just a few weeks later. It is beyond comprehension that the assets in question could have actually lost 30% or 40% of their value within that period of time. The only explanation is that these financial statements were indeed falsified. Sarbanes-Oxley makes this a criminal matter. Where are the indictments against the CEOs of these institutions? (Sources: Market-Ticker and Wall Street Journal)

Subscribe to:

Posts (Atom)