The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Wednesday, December 21, 2011

Tuesday, December 20, 2011

Is this the Worse Delivery Ever?

I hope this was not your monitor!

"A Fool and His Money are Soon Parted."

Wow, nice Santa rally going on. Today’s rally reminds me of the famous proverb found in the poem Five Hundred Points of Good Husbandry by Thomas Tusser, which states, "A fool and his money are soon parted.”

I am simply amazed at how Wall Street is blinded by the real reality of Main Street. And, how Wall Street believes that its real Savior is in the Central Bankers of the world. Enjoy “Bulltarts” this bittersweet year-end rally for 2011, because 2012 will show the complete folly of your ways. Therefore, I thought the following Santa video is appropriate for all the Bulltarts that still believe in Santa Claus, Bunny Rabbit, and the Tooth Fairy.

Monday, December 19, 2011

Sunday, December 18, 2011

Saturday, December 17, 2011

Senate Approves Two-month Extension of Payroll Tax Cut

CNN just reported that the Senate voted to extend the payroll tax cut by two months, after both sides were unable to reach a comprehensive agreement to extend the payroll tax cut and unemployment benefits for a full year. The House will vote on the extension next week. That is just great! Let's just kick that can down the road so everyone can go home for the holidays and not worry about it until February 2012. And, then we wonder why our country is going “to hell in a hand basket.” Well, that is my "rant" for the day.

Chevy Volt: A Car for Idiots

Wow! That is strong language. However, those are not my words. They come from Johan de Nysschen, President of Audi of America. He states, "No one is going to pay a $15,000 premium for a car that competes with a Corolla. So there are not enough idiots who will buy it." (So far for 2011, only 5,000 idiots have purchased Volts. Probably most of those sales were to the government idiots.) He further explains his frustration with regulators and policy makers, saying the, "public has been hoodwinked into believing that electrical vehicles are the only answer to global warming. The U.S. government, he said, is pouring billions of dollars into this technology (Chevy Volt), yet diesel technology could deliver a more immediate and dramatic decrease in global-warming emissions. Modern diesels already power half of Audi’s cars in Europe. Diesels have been shown to emit 25 percent less carbon dioxide than gasoline engines, while using 25 to 35 percent less fuel."

Are you listening Department of Energy, EPA, and Obama Administration? You probably should be, since you have such a great track record at picking losers!

Are you listening Department of Energy, EPA, and Obama Administration? You probably should be, since you have such a great track record at picking losers!

Friday, December 16, 2011

Elliott Wave Theorist: Closing the Year on a High Note

The following excerpts are taken from December's "Elliott Wave Theorist Newsletter" by Robert Prechter. I thought you might find it enlightening or, if you are a "Bulltart," unnerving.

“It took awhile, but every market is going our way. The U.S. dollar just broke out to a new 11-month high. U.S. stocks have stayed below their April highs. Foreign stock indexes are down 10%-50%. Gold and silver closed this week at their lowest levels since their peaks. And the CRB commodity index is down 10% on the year.

The best performing market for 2011 is one that nobody wanted. Bulls bet against U.S. Treasury bonds due to forecasts of an economic recovery, and bears bet against bonds due to forecasts of hyperinflation. But U.S. Treasury bonds have registered the best total return (+20%) for the year of any major investment sector. This event makes sense only to deflationists, and a few other scattered iconoclasts hiding around the globe.

The Fed reported on Tuesday that the economy has been “expanding moderately,” but economists waiting for economic reports to indicate contraction will be six to twelve months late. The November issue of EWT used a chart of silver to warn that the economy is already heading back into contraction. In fact, four useful leading indicators of the economy—namely, the prices of stocks, lumber, silver and copper—turned down months ago, between February and April 2011. If the market tries to bounce during the traditionally strong late December-early January period, any rally should stay in the context of a bear market.”

Thursday, December 15, 2011

Critical Price Level: 11,600!

Key support level for the $INDU is still 11,600 for both the "Bears and Bulls." Of course, Bulls want to see that price level hold; Bears want to see that price level broken. As of now, it is really that simple.

Wednesday, December 14, 2011

The Gold Break?

Gold just broke through its 200-day simple moving average, which is the first time since early 2009. Is silver next to break its long-term moving average? So far, the score is "Deflation 1, Inflation 0."

My Rant for the Day

Financial asset inflation is what “Wall Street” loves and wants. That is why “Wall Street” has not balked on the failed monetary policies of the Federal Reserve System. As a matter of fact, it wants more trillions, not less, to continue the price inflation of financial assets. When I make reference to “Wall Street” in this context, I am specifically referring to investment advisory firms, investment bankers, and security firms. In other words, Wall Street would include any security entity that generates revenues by either providing investment advice, manages funds for clients, or buying/selling of securities. Even though these investment entities know full well that the current polices on the fiscal side of deficit spending (spending > tax receipts) have failed. (From a mathematical point of view, the economy cannot generate debt growth (9%) that exceeds income growth (2%) over an extended period of time without going bankrupt.) Never-the-less, they want greater monetary easing on the part of the Federal Reserve System to goose the price of financial assets in order to generate revenues for their benefit, not for the benefit of the economy. I know the counter argument is that these firms really believe that Keynesian economics has not failed us. All what is needed is an additional trillion dollars here and there to get this economy out of its malaise. Yes, some really do believe that by creating something out of nothing is the economic panacea. However, I still believe that there is a greater conflict-of-interest than the investment public fully realizes between the self-interest of these investment firms and the Fed. It is simply the nature of man, which is sad but true.

Tuesday, December 13, 2011

Pennies from Heaven

Anyone looking to make a small investment "right now" might want to look at all those pre-1983 pennies that your have accumulated in your house. I will show you how you can double your money just by counting pennies. Sounds too good to be true? No, it is true! Just thank the Federal Reserve System for providing you with this opportunity through its easy credit (money) policy. These polices have sent the prices for "copper and zinc" on an exponential rise.

Using the latest metal prices for copper and zinc, these are the numbers required to calculate the metal value of pre-1983 pennies:

$3.4592 | = | |

$0.8779 | = | Zinc Price/Pound on Dec 13, 2011. |

.05 | = | Zinc % |

3.11 | = | Total weight in grams |

.00220462262 | = | Pound/gram conversion factor (Prices are quoted in pounds. Therefore, the reason for the conversion.) |

1.

Calculate 95% copper value of Pre-1983 pennies:

($3.4592

× .00220462262 × 3.11

× .95) = $0.0225314

2.

Calculate 5% zinc value:

($0.8779

× .00220462262 × 3.11

× .05) = $0.0003009

3.

Add the two together:

$0.0225314 + $0.0003009

= $0.0228323 (Value of that Penny)

$0.0228323 is the metal value for the

1909-1982 copper pennies as of December 13, 2011, or 128.32% increase from its face value. Therefore, get those "penny jars and penny banks" out and start

going through those pennies to find those pre-1983s. What are you waiting for? Go calculate your new found wealth, now!

Saturday, December 10, 2011

Tuesday, December 06, 2011

What is Backing Your Deposits in Your Bank?

The answer to the question in the title is for all practical purposes "NOTHING." And, of course, therein lies the problem with where you bank. Because U.S. banks are no longer required to hold any of their deposits in reserves. I would gather that the vast majority reading this post did not know that.

The following excerpt, which you just might want to read, is taken from Risks in Banking from Bob Prechter's Conquer the Crash:

"Between 1929 and 1933, 9000 banks in the United States closed their doors. President Roosevelt shut down all banks for a short time after his inauguration. In December 2001, the government of Argentina froze virtually all bank deposits, barring customers from withdrawing the money they thought they had. Sometimes such restrictions happen naturally, when banks fail; sometimes they are imposed. Sometimes the restrictions are temporary; sometimes they remain for a long time.

Why do banks fail? For nearly 200 years, the courts have sanctioned an interpretation of the term “deposits” to mean not funds that you deliver for safekeeping but a loan to your bank. Let’s repeat that in another way. Your bank balance, then, is an IOU from the bank to you, even though there is no loan contract and no required interest payment. Thus, legally speaking, you have a claim on your money deposited in a bank, but practically speaking, you have a claim only on the loans that the bank makes with your money. If a large portion of those loans is tied up or becomes worthless, your money claim is compromised. A bank failure simply means that the bank has reneged on its promise to pay you back. The bottom line is that your money is only as safe as the bank’s loans. In boom times, banks become imprudent and lend to almost anyone. In busts, they can’t get much of that money back due to widespread defaults. If the bank’s portfolio collapses in value, say, like those of the Savings & Loan institutions in the U.S. in the late 1980s and early 1990s, the bank is broke, and its depositors’ savings are gone."

Make sure you check out to see what bank in your state is the safest. You just might want to check these banks out.

Monday, December 05, 2011

Austerity Measures for the Queen

In a further sign of dire economic times, Buckingham Palace is now doing some budget busting with the queen herself due for a pay freeze, and Prince Charles set to foot the bill for some major expenses. According to Ingrid Seward, editor-in-chief of Royal magazine, the queen is going around Buckingham Palace turning off the lights, having fewer staff, and even turning the heat down. She sometimes even writes letters in her very own fur coat. Ingrid also reports that it is quite sad to see the Queen Mother having to act in such a common fashion.

Saturday, December 03, 2011

Analysis of Yesterday's Employment Numbers

How is it possible to have such a major drop in the unemployment rate from 9% to 8.6% when new jobs only came in at 120,000? Answer: Labor Force Participation down from 64.2% to 64.0% as more people leave the work force (315,000 to be exact), because there are no jobs out there. And the beauty of it from a statistical standpoint is that if you are not in the employment pool, you are not counted! Therefore, the unemployment rate will statistically be better. Wow! Don’t you just love statistics and how the BLS uses them? The only reason the unemployment rate went down was because people became so discouraged and frustrated that they could not find work they just gave up. Thus, the BLS considers that to be a positive improvement on the employment front. You got to me kidding me; but, of course, I am not. But, the Administration, news headlines, and mainstream financial pundits simply mentioned that the employment picture vastly improved, because the rate dropped from 9% to 8.6%. With such uninformed utterances for the real truth, I am reminded what Macbeth said: “It is a tale told by idiots, full of sound and fury signifying absolutely nothing.”

Please pay very close attention to my next sentence. U.S. needs to generate 262,500 jobs per month to return to 2007 employment levels over the next five years. This means that unless that number of jobs is created each month for the next five years, America will have a higher unemployment rate in October 2016 than it did in December 2007. Now, how realistic is it that the US economy can create 15.8 million jobs in the next five years with our totally dysfunctional Congress?

Friday, December 02, 2011

Unemployment Rate at 8.6% for November

The economy added 120,000 jobs in November on expectations of 125,000. (I wonder how many of those so-called new jobs resulted from the "Birth/Death Statistic?") The unemployment rate declined from 9% to 8.6% one expectations that it would remain at 9%. (I will have more later after I have a chance to analyze all the numbers.)

Thursday, December 01, 2011

Government Motors Willing to Buy Back Volts

Now this is a vote of confidence to run out and buy that all electric car, which GM admits could catch fire. According to the Associate Press, "General Motors will buy Chevrolet Volts back from any owner who is afraid the electric cars will catch fire." I guess that is why only 6,000 have been sold. I am convinced that the Volt is going the way of the Edsel. The Volt was a government idea from day one. This is what happens when the government tries to pick winners and losers. (Does anyone remember Solyndra?) And, it's track record is lousy. That is the function of a market economy, not the government.

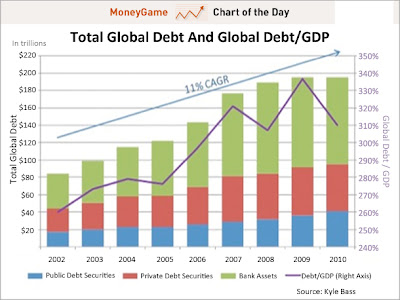

Total Global Debt to GDP

The following chart is presented without any further comment because none is needed. Except for the following statement by Kyle Bass: "Total Debt-to-GDP only breached 200% when nations were spending on war. Today we are at 310%." As I have stated many times on this blog, this whole debt situation is not going to end well. In other words, you can not grow total debt at 11% when GDP is growing at 2%.

Subscribe to:

Posts (Atom)