The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Monday, December 20, 2010

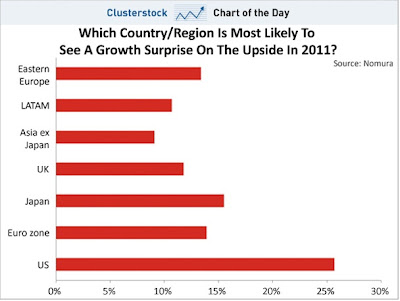

Surprise! The US Economy Is Now Everyone's "Surprise" Pick To Surge

Nomura's 2011 survey of clients suggests investors are suddenly confident in the outlook for the United States, and see it surprising to the upside next year. Maybe I should send them the latest Federal Reserve Bank of Chicago's Economic Index.

Chicago Fed National Activity Index: Economic Activity Slowed in November

The Federal Reserve Bank of Chicago reported its findings for its latest economic index for November: "Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.46 in November from –0.25 in October. For November of 2006, the index was +0.01." Why do I bring this index up? Because I consider this to be the best overall measure of economic activity. Why? Because this index is a weighted average of 85 indicators of national economic activity. The indicators are drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

In other words, the economy is getting weaker, not stronger. (See the following chart.)

In other words, the economy is getting weaker, not stronger. (See the following chart.)

For the full article, click-on Fed of Chicago.

Tuesday, December 14, 2010

Ron Paul: My Monetary Hero

I like Ron Paul. The reason being is his sound money philosophy, which is closely akin to Austrian Economics. Of which, I am a great fan.

Watch the video clip and then you can decide if he is your "monetary hero."

Watch the video clip and then you can decide if he is your "monetary hero."

Wednesday, December 08, 2010

Does This Really Come as a Surprise to Anyone?

Who is Number 1 on test scores in math, reading, and science? Of course, it is students from China. Where do we rank? See the following table. Not too great as we prepare students to compete in a global economy.

Now, what is this abysmal student performance costing us as taxpayers? Well, it depends on where you live. An enlightened video clip from the Cato Institute provides some food for thought on the cost (explicit and implicit) at local level. After viewing the clip, you may want to find out what you local school district's cost per student happens to be. The national average per-student education spending (latest 2007) is approximately $10,000. And, what is the common cry from educators for improving score performances on math, reading, and science? More money, of course. Isn't that the typical response and solution to all of our problems? For the full report, click here.

Senior Health Care Solution

No, I am not endorsing this as a possible solution. So, don't "shoot" the purveyor with one of those bullets.

Jon Stewart on Ben Bernanke

Lies, lies, and more lies. I really don't know if Bernanke knows what the truth is anymore. He states in the clip that the Fed does not print money; and, then, states it does print money. Plus, he has stated as such not only on this "60-Minute" clip but before Congress; and he gets away with these lies. If this clip wasn't so funny, it would be serious. The problem is that it is really serious; but, for most Americans, who are really economic illiterate, will simply laugh it all off. Shame, shame on all of us for allowing Bernanke to not only get away with these bold-face lies but to continue with such lies and not be held accountable.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| The Big Bank Theory | ||||

| www.thedailyshow.com | ||||

| ||||

Tuesday, December 07, 2010

What About That Tax Deal?

First, the tax deal will add a minimum of $500 billion to next year's deficit, which is already projected to be $1.6 trillion. Now, if my math is correct that sums to over $2 trillion, which is approximately 14% of GDP. By the way, this percentage is higher than the levels experienced by Greece and Ireland. And, we all know how well those countries are doing.

Second, don't get me wrong about the tax deal. I am all in favor of the 2% payroll deduction (Social Security and Medicare), extending the Bush tax rates for two years, expensing all business capital expenditures for one year, and extending the 99-week unemployment benefits for a year. (I do have reservations about extending unemployment benefits to almost two years, because I believe it is a disincentive to find work.)

Third, I am for tax cuts of every kind provided that we have corresponding cuts in government spending! However, that is definitely not the case with this proposal. All what we have done, if it becomes reality, is to enlarge the size of the government and, of course, the deficit.

Second, don't get me wrong about the tax deal. I am all in favor of the 2% payroll deduction (Social Security and Medicare), extending the Bush tax rates for two years, expensing all business capital expenditures for one year, and extending the 99-week unemployment benefits for a year. (I do have reservations about extending unemployment benefits to almost two years, because I believe it is a disincentive to find work.)

Third, I am for tax cuts of every kind provided that we have corresponding cuts in government spending! However, that is definitely not the case with this proposal. All what we have done, if it becomes reality, is to enlarge the size of the government and, of course, the deficit.

Friday, December 03, 2010

Selective Comments on the S&P 500

What is the market saying to us near term? Answer: The primary trend continues to be bullish (15-week EMA > 40-week EMA). The 1240 on the S&P 500 is the next resistance zone, which is just 16 points away from today's close. (See the red-horizontal line in the following chart. The nearest support, green line, is at 1150.) There you have it straight from the market's mouth. Critical mass price zones to watch are 1150 and 1240.

Gold Cures Cancer

Do you want a reason to buy gold at these lofty levels? The answer lies in the title of this post. Yes, gold-covered nano-particles appear to defeat cancerous tumors according to The L.A. Times. The sky is the limit. The $ is doomed; Euro is doomed; as a matter of fact, all fiat currencies are doomed. Therefore, gold can only go up. Right?

Oh "Bear," or "Bear" Where Art Thou?

Markets (Bulltarts) continue to celebrate today by closing at 2010 highs. Now, let's go over all the positive aspects that were revealed today that propelled the markets to new highs. First, the unemployment rate edged up to 9.8% from 9.6% in November. Second, "Debt Commission" voted down is own plan. (In other words, we are now back to square one in trying to get government spending under control.) Third, the "Supplemental Nutrition Program (Food Stamps)" reported that the number of poor Americans has never been higher. These food-stamp recipients just hit a fresh all time high of 42.9 million. (Naturally, the market celebrates the record number of poor Americans by closing at 2010 highs.) It is all very logical, isn't it? Bad news, and the market goes to new highs. That is what happens when the primary trend, as indicated by the EMA strategy, is bullish. It doesn't make any difference on what the news is, the market wants to trend higher, not lower. Once again, shame on me for forgetting that the trend is your friend. I definitely forgot to trade with the trend, not what I expected. Saying that, this market will eventually face economic reality and crash. I have no reservations in making such a statement. I will have a market update later in the weekend.

Wednesday, December 01, 2010

Whalen on How the Fed Supported Foreign Banks

Chris Whalen is one of the few pundits out there that definitely knows what he is talking about when it comes to the Fed. Take six-minutes of your time in viewing this video and be educated, especially is comment on Spain!

Subscribe to:

Posts (Atom)