The U.S. Treasury takes in approximately $250 billion a month, which is 10 times what the monthly Treasury interest payments are on our debt. The United States will not default on its debt. The 14th Amendment (Sections 4 and 5) of the U.S. Constitution spells out that, as a nation, we must pay off our Treasury debts (interest) first, before we pay anything else. So, we not only have sufficient revenue coming into the Treasury to pay the interest due but the 14th Amendment, which spells out what must be paid first.

The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Monday, October 07, 2013

What to Know if You Opt Out of Buying Health Insurance Under Obamacare

One can calculate how much your health insurance premium would cost by using the Kaiser Family Foundation Subsidy Calculator, and then you can compare the tax you would be assessed for having no insurance.

America's Laziest Postwoman?

Did you notice that she drove all the way across the front lawn to the door to deliver the small package. And, by the way she looks, she could have used a little exercise by walking from the street to the porch.

Saturday, October 05, 2013

What Government Shutdown?

Based on estimates drawn from the Congressional Budget Office (CBO) and Office of Management and Budget (OMB) data, government operations continue to function at 83%. So, this government shutdown, as measured by money spent, is really only a 17% government shutdown.

Friday, October 04, 2013

Happy Birthday Federal Income Tax on Being 100 Years Old

In 1913, the tax code consisted of 400 pages. By 2012, the tax code was 73,608 pages. Today, we have a very complex tax system that is far from its inception 100 years ago. It is time for the current tax system to be replaced with the Fair Tax.

Thursday, October 03, 2013

Who Says the Economy is in Bad Shape? Not the One Percenters!

Tuesday, October 01, 2013

Wednesday, September 25, 2013

Doing Your Best Doesn't Really Count Anymore

Schools took away playing tag in our school yards; then dodge-ball was outlawed from those school yards. Schools then removed the recognition of being a valedictorian and salutatorian from our outstanding scholarly students, because those schools wanted to tell all students that they are all academically exceptional. In other words, students' self esteem had to be protected. Well, now it has really gone way too far. The Northern California Federation Youth Football League has imposed a $200 fine and possible suspension of any coach who allows his team to win a game by 35 points or more under its "Mercy Rule."

Saturday, September 21, 2013

Food Stamp Nation: Who Benefits?

Who really is the major beneficiary of our food stamp program (EBT)? View the following video, and you just might learn something that will really make you mad. Why is that? Well, you will just have to watch the video!

Friday, September 20, 2013

Insanity Continues

The insanity continues in the auto and home lending business. In other words, we have not learned absolutely anything from the 2008 financial debacle in sub-prime auto loans and home loans. Why do I state this? Well, let's look at today's sub-prime auto loans. You can now get a 97-month sub-prime auto loan if you have bad credit. The average loan to value on vehicle sale to individuals that have bad credit is 114.5%. And, car loans to individuals with bad credit have doubled since 2009 to reach over $18 billion.

Now, let's look at the current sub-prime mortgage area. You say, "Who in their right mind would again be pushing sub-prime mortgages?" Oh, that is an easy question to answer. The Government, of course, or more specifically the Federal Housing Administration (FHA). FHA recently went so far as to cut to one year from three how long borrowers

must wait after losing a home to foreclosure or a short sale before

qualifying for a new mortgage. Further, FHA states that lenders are to ignore all the talk about large down payments, and ensuring

mortgage borrowers’ ability to repay on loan applications.

Does anyone really believe that things are different this time around from 2008? I guess they do, because the insanity of the past continues into 2013.

Thursday, September 19, 2013

Tuesday, September 17, 2013

Do You Know What Goes Into the CPI Numbers?

The following pie chart and graph are extracted from Doug Short. The pie chart gives the components and its weights. That is, food is weighted at 15.3% of the CPI; while housing is weighted at 41%.

The next chart shows the annualized rate of change (solid lines) and the cumulative change (dotted lines) in CPI and Core CPI, or core inflation, since 2000. Core inflation is the overall inflation rate (CPI) excluding Food and Energy, which doesn't make any sense at all to exclude those two components. Why? Well, it would only make sense if you do not eat nor heat your home or put gasoline into your car. But, then again, what do I know. However, I am sure that our policy makers at the Bureau of Labor and Statistics and the Federal Reserve System would provide you with a perfectly sane and rational explanation.

Looking at the bottom part of the above chart, one just might conclude that an annualized CPI rate of 2.5% is not that bad to your wallet. However, when you look at the cumulative (dotted) lines, it takes on a whole new perspective. That is, what cost you $100 in 2000 would now cost you $140, or a 40% increase. Now, tell me has your "real" income and/or wages gone up by at least 40% since 2000? I didn't thing so!

Wednesday, September 11, 2013

Student Loan Debacle

Direct Federal Loans to students have exploded higher, from $93 billion in 2007 to $560 billion in early 2013, or a 602% increase. This dollar amount exceeds the Gross Domestic Product (GDP) of entire nations, such as Sweden ($538 billion) and Iran ($521 billion) just to name tow countries. Now, if you add in non-Federal student loans of $500 billion, you get a grand total of $1.081 trillion.

The following chart illustrates just another "financial bubble" that is going to burst. Does anyone remember the "sub-prime mortgage" debacle of 2007/08? What is the common denominator between the student loan bubble and sub-prime mortgage bubble? Look no further than the monetary polices of the Federal Reserve System. Does anyone really care? I do! But, then again, my rants wouldn't matter to anyone until they matter to everyone.

The following chart illustrates just another "financial bubble" that is going to burst. Does anyone remember the "sub-prime mortgage" debacle of 2007/08? What is the common denominator between the student loan bubble and sub-prime mortgage bubble? Look no further than the monetary polices of the Federal Reserve System. Does anyone really care? I do! But, then again, my rants wouldn't matter to anyone until they matter to everyone.

Tuesday, September 10, 2013

How to Make the Dow Jones Industrial Average Stay Permanently Higher

Simply eliminate the losers. And, that is exactly what Dow Jones will do! The DJIA will eliminate such recent losers as Alcoa, Hewlett Packard, and Bank of America, and they will be replaced by Goldman, Nike and Visa. Next, I guess the Dow Jones will be adding such companies as Herbalife, Tesla, Netflix, and, of course, Apple. By the way, of the 30 Dow stocks in the Dow Jones Industrial Average, only 10 are industrial stocks. That alone should tell us something about our manufacturing base in America.

Friday, September 06, 2013

Wednesday, September 04, 2013

Syria: Our Achilles Heel

What is the difference, if any, between the "Free Syrian Army and the Al Nusra Front?" What is the media not telling us about the Syrian chemical attack? If you want to know the answers to those questions, you better watch the following video by Ben Swann.

Tuesday, August 27, 2013

Friday, August 23, 2013

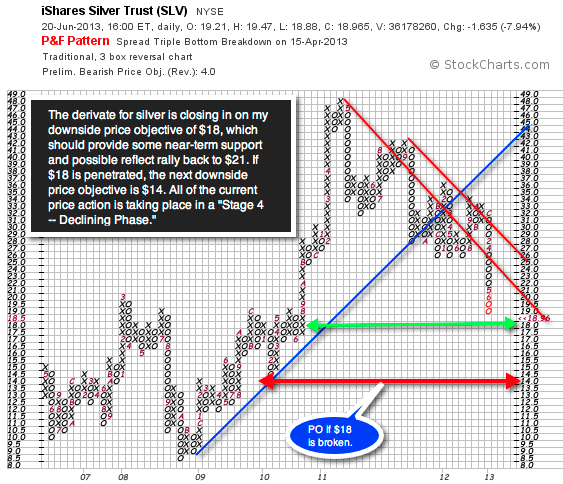

Friday's Update on $SLV

Point & Figure Charts are really good at identifying a stock's stage. That is, accumulation (Stage 1), advancing (Stage 2), distribution (Stage 3), and selling (Stage 4). For $SLV, its current stage is "selling, or Stage Four." That is why the recent rally would simply be categorized as a throw-back to resistance at $24 to relieve an overbought condition within a Stage 4 phase, which is clearly observed with a Point & Figure Chart.

Detroitification

Detroit has over 150,000 abandoned buildings. It has 11,000 unsolved homicides. Police response times average almost an hours. Forty percent of the city's stoplights don't work. Almost half of all property owners are refusing to pay property taxes. In other words, Detroit is America's first third-world city. However, it is not going to be the only city to collapse. Other cities in various stages of Detroitification are Chicago, Baltimore, New York, Los Angeles, Oakland, San Diego, Portland, Providence, and Houston. Welcome to Eschaton!

Wednesday, August 21, 2013

Tuesday, August 20, 2013

Vulnerability of the Economy Based on Wal-Mart's (WMT) Performance

Monday, August 19, 2013

Common Core for Math: New National Curriculum for Public Schools

The emphasis on the "New Math Common Core" is moving more towards the explanation, and the how, and the procedures at arriving to get an answer, rather than on the correct solution. In other words, as long as a student can explain the process to a math problem, say 3*4, but arrives at 11, not 12, it would be close enough, because the student was able to explain the process involved. Welcome to the new "normal." Please tell me what was wrong with the basic fundamentals of "reading, writing and arithmetic?"

Friday, August 16, 2013

Thursday, August 15, 2013

DJIA: Short-term Price Objective Has Been Reached!

On July 26, 2013, my comments on the DJIA were as follows: "DJIA is in the early phase of declining to its 50-day EMA at 15,198, or 360 lower! Full Stochastics and PPO are in "overbought" and turning down from these levels." Currently, we have reached that level on the DJIA (15,136). On a daily basis, the DJIA has just reached oversold levels, based on Full Stochastics and Wm%R. Further weakness is still possible; but, given these oversold readings, a relief rally should occur over the next several days to relieve the current selling pressure. However, what happens after any sort of relieve rally needs to be watched carefully. Why? Because it's 200-day EMA is currently 14,526, which would be the next major support level.

The Day of Cheap Money is Over!

Over the past month or so, my focus has been on the outlook for interest rates, specifically the rate on the 10-year Treasury Note. This is the "key rate" that determines the rates on car loans, consumer loans, and mortgages. During this time, my forecast has called for a major trend change in interest rates. If you are not convinced that rates are heading higher, you may want to go back and read my following posts: "Interest Rates Going Forward from July 3, 2013," "$TNX: Stage 2 Advancing Phase for 10-Year Treasury Rate Confirmed from July 5, 2013," "Don't Buy Bonds from July 30, 2013," and "Avoid Bonds, Period from August 2, 2013."

I believe you have now been sufficiently warned. How you use this information is totally up to you.

$SLV: No Change in My Price Forecast Since June 21, 2013

My post on $SLV from June 21, 2013 stated the following: "The derivative for silver is closing in on my downside price

objective of $18, which should provide some near-term support and possible

reflect rally back to $21. If $18 is penetrated, the next downside price

objective is $14. All of the current price action is taking place in a Stage 4 -- Declining Phase." Since June 21, $SLV did reach $18 and has retraced back to a close of yesterday at $21.09. Currently, $SLV has entered into the overbought levels, based on the Full-Stochastics and Wm%R. If $SLV weakens from the $21 level, $18 remains the key support price. The proverbial bottom-lines remains that $SLV is in a "Stage 4 Selling Phase."

Saturday, August 10, 2013

Gallup: President Obama Falls to a 41% Approval Rating

Watch out President Obama, because you are fast approaching the average approval ratings for a second-term President set by Presidents Bush, Nixon, and Truman.

Second-Term Approval

Averages

|

President

|

Dates of second term

|

Ave. Rating

|

|

|

|

%

|

|

Harry Truman

|

January 1949-January 1953

|

36.5

|

|

Dwight Eisenhower

|

January 1957-January 1961

|

60.5

|

|

Lyndon Johnson

|

January 1965-January 1969

|

50.3

|

|

Richard Nixon

|

January 1973-August 1974

|

34.4

|

|

Ronald Reagan

|

January 1985-January 1989

|

55.3

|

|

Bill Clinton

|

January 1997-January 2001

|

60.6

|

|

George W. Bush

|

January 2005-January 2009

|

36.5

|

Tuesday, August 06, 2013

Government Motors (GM) Cuts Volt's Price by $5,000 Plus Free Fire Insurance

The first Volt, a 2010 model, cost $41,000. Today, you can purchase a Volt for $34,995 with free fire hazard insurance for 100,000 miles or 10 years, which ever comes first. Volt sales in July totaled 1,788. For the first seven months of the year, Volt sales were 11,643. I really like that free fire insurance.

Friday, August 02, 2013

Tuesday, July 30, 2013

Friday, July 26, 2013

Thursday, July 18, 2013

Wednesday, July 17, 2013

The Great Bamboozle Perpetuated by the Financial Accounting Standards Board (FASB) and Wall Street

Yes, you, “Main Street,” have been bamboozled into believing that all is well with the “Too Big to Fail Financial Institutions.” (Why do you think they are called “Too Big to Fail Institutions”? There must be a reason.) And, that reason is due to “Mark-to-Market” accounting, which went away in 2009. Securities, such as mortgages, with exposure to interest rates are now defined as being “Available For Sale (AFS)” as per FAS 115, which in turn prevents any profits or losses from hitting the income statement even if they did impact retained earnings through the “Accumulated Other Comprehensive Income (AOCI) line. In other words, as interest rates rise, prices of debt securities like mortgages will decline. However, with the elimination of “Mark-to-Market” accounting, financial institutions do not have to reflect those losses as such. Therefore, the financial position of those institutions will appear to be healthier that what they are.

Case in point is

Bank of America’s most recent quarterly financial report. It reported a profit of $4.012 billion. Well done, indeed! Not so fast, “Main

Street.” See, this is the great

bamboozle. That profit of $4,012 billion

absent of “Mark-to-Market” accounting should

have been a loss of $221 million. (See

the following Chart). Oh, since

the fourth quarter of 2011, Bank of America has effectively swept under the rug

some $7.6 billion in cumulative losses, which are not losses only thanks to the

demise of “Mark-to-Market.”

Thursday, July 11, 2013

Which Is Greater: Full Time Jobs or Americans on Food Assistance and Disability?

The answer is "full-time jobs." I bet you thought I was going to say that Americans on "Food Assistance and Disability." I can hear you give a sigh of relieve. Be careful! Why? According to the Bureau of Labor Statistics (BLS), there are 116 million Americans with full-time jobs, which includes 21.9 million government workers. (Keep-in-mind that government workers are not the productive ones within our society when it comes to increasing ones standard of living. That is, these workers do not produce goods and services that we Americans buy. If anything, these workers are to some extent a necessary evil.) Now, on the other hand, there are 112.5 million individuals on food assistance and disability, or something like 1 out of 3 Americans. Therefore, there are only 3.5 million more Americans with full-time jobs than there are Americans who are reliant on the government for their daily bread. And, if you exclude government workers from the productive side of society, then, you have 40.3 million more Americans on government support than those Americans who actually produce something of value. Let me be very clear on the state of the economy, given these statistics, it is dismal and only going to get worse.

Too Big to Fail Banks Now Extended to the U.S. Economy

"If the economy is so fragile that the government cannot allow failure, then we are indeed close to collapse. For if you must rescue everything, then ultimately you will be able to rescue nothing." So, stated Seth Klarman. Who is Mr. Klarman. He is an American billionaire who founded the Baupost Group, a

Boston-based private investment partnership and the author of Margin

of Safety: Risk-Averse Value Investing Strategies for the Thoughtful

Investor.

Saturday, July 06, 2013

Friday, July 05, 2013

Wednesday, July 03, 2013

Interest Rates Going Forward

Tuesday, July 02, 2013

Please, Tell Me This is Not True

Electric cars, despite their supposed green credentials, are among the environmentally dirtiest transportation options, a U.S. researcher, Zehner, suggests. Writing in the journal IEEE Spectrum, Dr. Zehner says electric cars lead to hidden environmental and health damages and are likely more harmful than gasoline cars and other transportation options. He further states, "Upon closer consideration, moving from petroleum-fueled vehicles to electric cars starts to appear tantamount to shifting from one brand of cigarettes to another." Dr. Zehner is a visiting scholar at the University of California, Berkeley, which is definitely not a bastion of conservatives.

Saturday, June 29, 2013

Thursday, June 27, 2013

Government Motors (GM) to Invest $691 Million in Mexico

Monday, June 24, 2013

You Think Now is a Good Time to Buy That House Because Rates Are So Low -- Well, You Better Think Again!

Realtors love to claim that today's low interest rate environment is the best time to purchase your dream home. Well, I contend that propaganda from realtors

will lead directly to your next nightmare.

So here is the economic reality from Wells Fargo, in which the national

average 30-year Fixed Mortgage has gone from 3.40% on May 1, 2013 to 4.875%, as

of today. The matching affordability

collapse (See the following graph.) has gone from $450,000 to $375,000, or a 16%

equilibrium price drop in under two months!

What

this graph definitely illustrates, absent an increase in disposable

income, is the average home affordability plunges as rates go

up; and, of course, the value of your home declines!

Saturday, June 22, 2013

Questions That American Taxpayers Would Like to Know the Answers

Friday, June 21, 2013

Tuesday, June 18, 2013

The Mandate of the Federal Reserve System

"The

Board of Governors of the Federal Reserve System and the Federal Open

Market Committee shall maintain long run growth of the monetary and

credit aggregates commensurate with the economy's long run potential to

increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." Now, stable is defined as not subject to sudden or extreme change or fluctuation. With that definition in mind, let's see how the Federal Reserve System has performed since 1913 in regard to its goal of stable prices.

A dollar in 1913 would be worth only four cents today, or it has lost 96% of its value. (So much for stable prices!)

In other words, its performance on stable prices has been a complete disaster. Why the comparison with 1913? That is the year of the birth of the

Federal Reserve System. Therefore, my recommendation would be to eliminate the

Federal Reserve System, which is based on a fiat currency, and replace

it with a sound currency system, such as gold. See, the Federal Reserve

System can inflate, create, as many dollars as they want without

anything backing those dollars. By the way, that is what we mean by

monetary inflation, which must be distinguished from price inflation.

Price inflation is the rise in the prices we pay for goods and services.

Price inflation is caused by monetary inflation, which is solely

controlled by the Federal Reserve System. That is why monetary inflation is so insidious, because it may take years before it shows up as price inflation.

Don't expect Congress to make the Federal Reserve System accountable for its utter failure to defend the stability of the dollar. Why? Because Congress is as complicit and culpable as the Federal Reserves System. If it wasn't for the Federal Reserve System providing the trillions of dollars to finance the federal deficits year after year, Congress would not be able to deficit spend. And, therein lies why Congress is complicit and culpable to the actions of the debasement of the dollar by the Federal Reserve System.

Monday, June 17, 2013

You've Lost That Loving Feeling

Back on September 13, 2012, my post, which was entitled, "And the Winner of the 2012 Presidential Election Is?" made the following statement: (Pay close attention to the last sentence.)

"Underlying social mood as manifested in the stock market remains

positive going into the November election.

Therefore, the probability of President Obama being re-elected is high! So, how can one use the above information against

the backdrop that the next four years will usher in the largest

economic/financial disaster known to man with the DJIA selling for 1,000? (Yes, the coming economic downturn will be

greater than the Great Depression of the 1930s.) Given the scenario, I don’t consider who ever

occupies the White House will win any popular contests. Remember that over the next four years the

expected social mood of this country will change from positive to very

“bleak.” Therefore, the man that

occupies the Presidency will undoubtedly be highly despised."

Here we are eight months into President Obama's second term, and his popularity has drastically shifted against him. CNN reports that for the first time in his presidency, half of the public doesn't think that Barack Obama is honest and trustworthy. So far into his second term, we have had one scandal after another -- "Associated Press, IRS, Unwarranted Electronic Surveillance of U.S. Citizens, and Benghazi." And, this is after only eight months. So, the trend change in social mood for President Obama and Wall Street is only going to get much worse. In regard to Wall Street, the manipulation of financial assets (stocks and bonds) by the Federal Reserve System will end in disaster over the next three years, specially the date to watch is September 13, 2015. (See my post of November 19, 2012 by clicking here for the reason why September 13, 2015 is significant.)

Tuesday, June 11, 2013

Forget Gold and Silver, Buy Ammo!

Since May 2012, 22 ammunition is up over 400%. It was approximately $21 to $23 per 500 rounds (full brick) in May 2012, and it is now $100 to $135 for 500 rounds, if you can find it. Over the same time period, gold and silver are down approximately 15% and 27%, respectively. So what we have in place is a de-facto gun control in the United States. That is, one can buy all the guns one wants; however, buying the ammo for those guns is another matter! Therefore, if one does not have the ammo for one's gun, what good is it?

Monday, June 10, 2013

Too Good to be True, But This is True!

The Federal Reserve System and Wall Street, i.e, "Too Big to Fail Financial Institutions," have devised another real estate scam in which you, the American tax payer will be left holding the proverbial bag of toxic paper. Their scam goes as follows: First, these financial institutions (Bank of America, JPMorgan Chase, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley) buy a house, say for $100,000. Then sell the house to someone who has absolutely no money and only a marginal credit history, taking a loan of $120,000 in return. In real estate terms, this is called a 120% LTV (loan-to-value). Second, the Federal Reserve enters the picture to monetize the loan from the above mentioned financial institutions. The Fed buys $45 billion of such mortgages at face value (LTV) every month. These financial institutions just sell these mortgages in the example to the Fed for $120,000 and pocket a $20,000 profit, all with no risk. The victim is the family who is paying interest on a 120% LTV loan on a house that may never be his unless the value appreciates by at least 20%.

Tuesday, June 04, 2013

Friday, May 31, 2013

Institute for the Works of Religion or The Vatican Bank

"God’s new banker brings Teutonic thoroughness to Vatican." That is a headline in today's (May 31, 2013) Financial Times. That title sparked by interest. Why? Ask a Natsari!

Saturday, May 25, 2013

Is Bernanke Out as Chairperson of the Federal Reserve System?

Bernanke's term as a "Board Member" does not end until January 31, 2020. However, as the chair of the Fed, that ends on January 31, 2014. Now, the question to ponder is as follows: Will Obama reappoint Bernanke again? My response to that question is "no!" Why? Under Bernanke, the Fed has injected more than $3 trillion into the financial system since March of 2009. What has been the results of all this liquidity? No sustainable economic improvement. That in itself should be reason enough to not appoint Bernanke. However, since Obama does ascribe to Bernanke's monetary policies, why the change? Obama has to blame the failed monetary policies on someone, and that someone is Bernanke. Will such a move to appoint a new Fed Chair make a difference? Absolutely not, in my humble opinion.

Who does the smart money say will be appointed as the new "Chair," if Bernanke is not reappointed? That individual would be Janet L. Yellen, who is the current Vice Chair of the Board of Governors of the Federal Reserve System. Dr. Yellen earned her Ph.D. in Economics from Yale University in 1971. (In other words, she would be another elitist just like Bernanke with the same failed monetary approach to the economy. To make matters worst, she is a member of the Council on Foreign Relations.) Therefore, nothing will change for the better, just a name change at the top.

Who does the smart money say will be appointed as the new "Chair," if Bernanke is not reappointed? That individual would be Janet L. Yellen, who is the current Vice Chair of the Board of Governors of the Federal Reserve System. Dr. Yellen earned her Ph.D. in Economics from Yale University in 1971. (In other words, she would be another elitist just like Bernanke with the same failed monetary approach to the economy. To make matters worst, she is a member of the Council on Foreign Relations.) Therefore, nothing will change for the better, just a name change at the top.

Thursday, May 16, 2013

The Real Truth of the Operational Federal Deficit for 2013

Yesterday's economic comments centered on the approximate ($488) billion in operational deficits from October 1st to April 30th of this year, which is a complete falsehood. The so-called economic/financial pundits were declaring that this was a major accomplishment for the Obama Administration. Why? Because Obama stated during his 2007 campaign that he would reduce the size of the federal deficit by half during his first administration.

Let's look at the real truth of the size of the federal deficit for the past seven months from the following table:

Let's look at the real truth of the size of the federal deficit for the past seven months from the following table:

The above table is taken directly from "Treasury Direct," which was reproduced from the Market Ticker. The first column is the public debt, the next is Social Security and Medicare, and the third is the total federal debt. What does it illustrate? Since September 28, 2012, there has been a net $762.6 billion of new debt added to the Federal balance sheet, not $488 billion! And, if one extrapolates the remaining five months for the current fiscal year, the federal deficit is $1.307 trillion.

Remember the "real truth" always comes out.

Monday, May 06, 2013

Pet Food Stamps

Friday, May 03, 2013

Taking the Lemmings' Wealth

I am going to be more than happy to acquire the wealth of all those financial lemmings, who have not learned a thing from 2008. Therefore, I have taken on the following positions: "SPY 70 December 2015 Puts."

The Significance of the Decrease in the "Average Work Week" for April 2013

The Bureau of Labor Statistics (BLS) reported that "Total nonfarm payroll employment rose by 165,000 in April, and the unemployment rate was little changed at 7.5%." The BLS also reported the following information on the number of hours worked: "The average workweek for all employees on private no-farm payrolls decreased by 0.2 hour in April to 34.4 hours." Now, why is the decrease in the number of hours significant? Thanks to Karl Denninger over at the Market Ticker, he explains the decrease in hours worked this way: " If we look at the "employed" figure of 143,724,000 people, a drop of 0.2 hours is a full-time-equivalent decrease of 1/2% (.2/40 hour work week = .005). Applied to the employed population, this amounts to an imputed economic decrease of 718,620 jobs (143,724,000 x .005)!" He further mentions that this is a huge problem going forward, because the trend of cutting hours back to get under Obamacare limits (30 hours) is picking up steam and will continue for the rest of 2013 and into 2014.

Subscribe to:

Posts (Atom)