The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Wednesday, February 21, 2007

Calculating Free Cash Flow (FCF)

The relevancy of free cash flow is that it represents “real cash,” earnings do not.

Calculation for free cash flow is as follows:

1. FCF = NOPAT – Net Investment in Operating Capital

a. NOPAT = EBIT(1-Tax Rate)

b. Net Investment in Operating Capital = [Cash + Accounts Receivable + Inventories – (Accounts Payable + Accruals)] (Net Operating Working Capital) + Operating Long-term Assets (Net Plant and Equipment)

2. FCF = (NOPAT + Depreciation) – Gross Investment in Operating Capital

a. NOPAT = EBIT(1-Tax Rate)

b. Gross Investment in Operating Capital = [(Net Operating Working Capital + Operating Long-term Assets) + (Depreciation)]

Uses of FCF

1. Pay interest to debt-holders

2. Repay debt-holders

3. Pay dividends to shareholders

4. Repurchase stock from shareholders

5. Purchase marketable securities or other non-operating assets

MBA 642 Financial Management: Million Dollar Challenge!

Once the facilitator is selected, he or shee will register his/her team on CNBC for the “Portfolio Challenge.” See instruction below. I will the computer lab open so that each group can start the million dollar process. Good luck!

1. Go to CNBC (http://www.cnbc.com)

2. Click-on “Investing Tool.”

3. Click-on “Portfolio Challenge” to register.

4. Complete the registration procedure.

5. Challenge starts March 5, 2007

Stock Market Rallies

As the following chart indicates, the current bullish rally is approximately 4.5 years in duration, which is long by previous market rallies. In addition, its current performance during this rally is approximately +75% over the past 4.5 years, which is lags behind previous market rallies. Also, the current rally is below its linear-regression trend line. Will we have a revision to the mean (point on the line) or will this market rally continue to underperform?

Monday, February 05, 2007

Fama and French Three-Factor (Predictor) Model

Fama and French started with the observation that two classes of stocks have tended to do better than the market as a whole: (1) small caps [SML] and (2) stocks with a high book-value-to-price ratio [HML]. When they tested their hypothesis, they found small companies and companies with high B/M ratios had higher rates of return than the average stock (just as they hypothesized). Somewhat surprising by their research, however, they found no relation between beta and return.

They added two additional factors (predictors) to CAPM to reflect a portfolio’s exposure to size and B/M. The three-factor model is as follows:

ri = rf + bi(MRP) + ci(SMB) + di(HML) + alpha

One thing that is interesting is that Fama and French still see high returns as a reward for taking on high risk. For example, if returns increase with B/M, then stocks with high B/M ratio must be more risky than low B/M. Why?

Buy, Hold, or Sell

OER or It's All About Data Analysis

Sunday, February 04, 2007

January Indicator of Future Stock Performance

Saturday, January 13, 2007

Declining CRB Index Signifies Economic Weakness

In their latest weekly update, Comstock Partners, Inc. provided an interesting analysis of their findings of the recent decline in the "CRB Index." Quote:

"The idea that falling crude oil prices will boost the economy and overcome the plunge in housing is yet another instance of hope replacing reality. Despite its great importance, oil is just another commodity that goes up and down with the business cycle. When the economy begins to weaken commodity prices go down; when the economy is strong commodity prices go up.

Since its May high the CRB commodity index has dropped 22%, only the 7th time this has happened since 1974. According to ISI, since 1974 every decline in the index of 20% or more has been associated with either a recession, a significant slowdown or a financial crisis. Each of these periods has also occurred following a period of tight money and an inverted yield curve. In this regard it is also noteworthy that oil has not been the only commodity declining in price. Recent months have featured significant declines in a wide assortment of commodities such as copper, gold, sugar, hogs, wheat and corn. It is therefore likely that the oil price decline is itself a result of economic softening rather than an impetus to growth.

ISI also points out a number of other factors historically associated with significant economic slowdowns including the lagged effect of 17 rate hikes; the decline of house prices; the plunge in mortgage equity withdrawals (MEW); the inverted yield curve; significant slowing in the leading indicators; tightening by foreign central banks; and nominal GDP growth under the fed funds rate.

Source: http://www.comstockfunds.com

Friday, December 01, 2006

The Economy

"On CNBC, the pundits are talking about how the most recent spate of data has put Goldilocks scenario in danger. I must admit to finding it amusing how much faith so many players had put into Goldilocks, a most unusual and unlikely scenario.

The latest data forces me to revise my 50% possibility of a recession in 2007/08 up to 60%. GDP for Q4 '06 is likely to be between 0.5% - 1.5% (or worse, if Holiday sales keep trending softer).

As far as the Fed, this data suggests that the jawboning about inflation will remain just that -- while we still expect the Fed to cut before 2007 comes to an end, the odds of a hike anytime soon have just dropped significantly.

Given the awful PMI and ISM data -- they both broke the key "50" demarcation -- one may be wondering how GDP data ended up getting revised upwards. The answer comes from the way GDP is constructed. But even more importantly, observe which the components that increased the revised GDP -- these are symptomatic of a slowing economy:

Inventory build, government spending and imports, was responsible for virtually all of the 0.6% upward revision in GDP. Consumption, 70% of the US economy, is slowing.Revised higher:

Government spending (0.05%)

Inventory Build (0.26%)

Imports (0.39%)

Revised lower:

Exports were revised 0.2% lower.Consumption was revised 0.14% lower

Why are Businesses inventories increasing? Some pundits have claimed this is a bullish sign, an "anticipation of increased demand." I doubt this. We have seen recent CEO surveys which point to major negative sentiment amongst the usually cheery Execs; Durable Goods tumbled 8%, and Housing and Autos are likely already in a recession. My guess is that Just-in-time-inventory is easier to ramp than it is to slow down.

And while Reuters reported that "Business spending on inventories rose, increasing sharply to a $58 billion rate from the $50.7 billion earlier estimated." Inventories builds have increased at a faster than usual pace -- implying that this was (whoops!) unintentional.

Given the drop in both Durables and Capex, I am somewhat incredulous over Business spending being revised upward to show a 7.2% gain (versus 6.4% advance)."

Source: http://bigpicture.typepad.comSaturday, November 25, 2006

Determination of Exchange Rates

What is going on with the extreme weakness in the dollar (at a 19-month low)? What is causing the $USD to be so weak? From Chapter 21, which is entitled International Financial Management, we can make an inference as to the recent $USD weakness. Read pages 603-611 that provide insight for each of the following exchange rate determinates of the $USD: Income and taste, Changes in relative interest rates, Changes in relative price levels, Changes in fiscal and monetary policies, Changes in Balance of Payments, and Other Factors such as Oil Prices and SOX or SarbOX Act.

For Tuesday, October 28, be ready to discuss the causes for the $USD weakness.

Saturday, November 11, 2006

Yield Curve Says "Probable" 2007 Recession

John Mauldin notes:

"The yield curve became more inverted this week, with the negative differential between the 3-month and the 10-year at -49 basis points and a -76 basis point differential between the 10-year and the Feds fund rate. According to a Fed paper, that level of an inversion suggests there is now an over 40% probability of recession next year. This same model only predicted a 50% chance of recession in 2000, and as the paper authors acknowledge, the model probably understates risk in recent decades."

The yield curve and interest-rate data looks like this, which is from Bloomberg.com:

Source:

John Mauldin

Investor Insight, November 10, 2006

http://www.frontlinethoughts.com/article.asp?id=mwo111006

Thursday, November 02, 2006

Free Cash Flow (FCF)

To calculate FCF, go to a firm's cash flow statement. There you will find the line item entitled "Total Cash Flow From Operating Activities." From this number, subtract the number from 'Capital Expenditure," which is found in the next section of the Cash Flow statement entitled "Investing Activites."

For your firm, calculate the FCF for the past three fiscal/calendar years and trend the data. What is the trend? Keep-in-mind that a negative FCF is not necessary bad. It could be the result of some large capital expenditures, which in itself could prove to be highly profitable.

Thursday, October 26, 2006

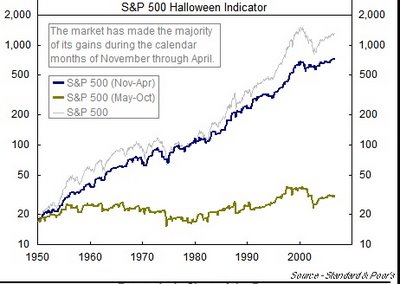

Halloween Indicator

Wednesday, October 25, 2006

Risk and Capital Budgeting

Saturday, October 21, 2006

History Lesson

Thursday, October 19, 2006

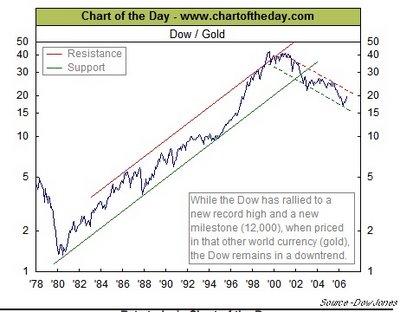

All Time High for the DJIA, or Is It?

May be we should be purchasing gold, like GLD or GDX, and not equity stocks. What do you think? Make your comments during the coming week.

Saturday, October 07, 2006

Goldilocks' Rally?

The reason that I present this chart is because the stock market is indeed anticipating that the Fed will soon be reducing its "Fed Funds" rate (January or March) with the market making a "new" this past week. In addition, the rate on the Ten Year TSY (4.75%) is below the Fed Funds rate (5.25%), which in the past has been an excellent harbinger of lower rates. Go to Bloomberg at http://www.bloomberg.com/markets/rates/index.html to see the current interest rate structures. Also, the decline in energy prices, especially oil and natural gas, along with the expectations that corporate earnings for the third quarter are going to be very robust have helped propel the market higher. But, the stock market has completely ignored the recent inflationary comments by several Federal Reserve members, which does not bode well for a cut in interest rates, along with signs that the economy is slowing, as discussed in last week's post.

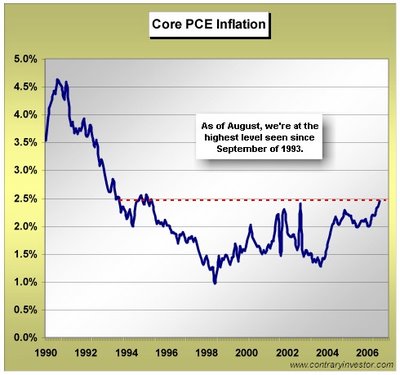

On Tuesday, Fed Vice Chairperson Donald Kohn stated that he is more concerned about inflation than slowing economic growth because a recession is unlikely. On Thursday, Charles Plosser, Federal Reserve Chairperson of the Federal Reserve Bank of Philadelphia, stated that the Fed's very credibility was at stake when it came to keeping prices under control. He was clearly concerned that the core PCE inflation is above 2%, and he expressed the need to raise the Fed Funds rate, not lower it. Please remember that he, who has the gold, in this case the money, makes all the rules! And the Fed has all the money, therefore, it makes all the rules as it pertains to the financial markets and the economy. Therefore, don't count on the Fed reducing rates unless inflation, as measured by the PCE, comes down below 2%.

Monday, October 02, 2006

Risk-adjusted Rate of Return (Beta Analysis)

Friday, September 29, 2006

Wednesday, September 27, 2006

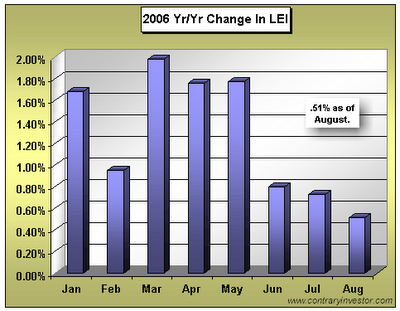

Be Forewarded!

If one combines the track record of the LEI with the current negative to flat Yield Curve, a 2007 slowdown of significance definitely looms on the economic horizon. The probability will increase if the September 2006 LEI comes in under 0.50%, and the Yield Curve remains flat to negative.