Don Meredith, ex-Dallas Cowboy quarterback and ex-Monday Night Football's Commentator,would say the above phrase after a football team had no chance to win! In regard to the housing market, stock market, and PCE component of GDP, I would refine the statement as follows: "Turn-out the Lights, or, at Least, Let the Reader Beware for 2007!

The following chart that relates the National Association Homebuilders Index to the S&P 500 Index is from David Rosenberg, North American economist for Merrill Lynch.

Quoting Mr. Rosenberg: "The above chart is rather intriging in that the NAHB Index leads the S&P 500 by twelve (12) months and with a near 80% correlation. This relationship has actually strengthened, owing to the growing influence that the real estated market has exerted on the overall economic and financial landscape over the past five years. In fact, we can trace almost 2% points of the 3.5% average annual rate in real GDP over the past five years."

Quoting Mr. Rosenberg: "The above chart is rather intriging in that the NAHB Index leads the S&P 500 by twelve (12) months and with a near 80% correlation. This relationship has actually strengthened, owing to the growing influence that the real estated market has exerted on the overall economic and financial landscape over the past five years. In fact, we can trace almost 2% points of the 3.5% average annual rate in real GDP over the past five years."Lon Witter, writing in the August 13 edition of Barron's, argues that there has not been a housing bubble but a lending bubble. He provides the following data to back-up his thesis:

1. 32.6% of new mortgages and home equity loans in 2005 were interest only, up from 0.6% in 2000.

2. 43% of first-time home buyers in 2005 put no money down.

3. 15.2% of 2005 buyers owe at least 10% more than their home is worth.

10% of all home owners with mortgages have no equity in their homes.

$2.7 trillion dollars in loans will adjust ot higher rats in 2006 and 2007.

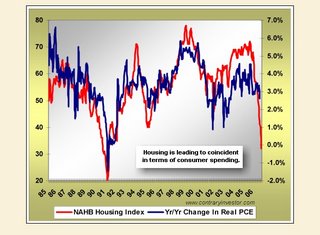

Once again, let the reader beware. Think the above information may foreshadow trouble for financial stocks and the overall equity market? However, it gets more interesting, see the following chart, which is from ContraryInvestor.Com, that relates the NAHB Index to Real Personal Expenditure Consumption (PCE):

The above chart links housing to consumer spending. As you can see, at least in the past, there has been a very high degree of correlation between the NAHB Index and the direction of real PCE. Why is this relationship relevant? In regard to GDP, PCE comprises more than 70% of overall economic activity. If indeed this relationship continues, we may see real PCE in the negative column, which, of course, would result in very weak GDP numbers going forward from here.

We definitely monitor the NAHB Index and real PCE throughout the semester.

No comments:

Post a Comment