The focus of the blog is on the economic and financial uncertainties that the world economies will face over the next five years along with demonstrating how investors can profit and survive during the upcoming manipulated economic chaos. Please keep-in-mind that I don't provide investment advice. I am simply posting what my investment views of the market happen to be. Your investment decisions are solely your own responsibility.

Saturday, September 20, 2008

FASB 157 Primer

Level 1 Assets have readily observable prices and therefore a reliable fair market value. These assets include listed stocks and bonds or any assets that have a regular “mark to market” mechanism for pricing. Publicly traded companies must classify all of their assets based on the ease that they can be valued, with Level 1 assets being the easiest.

Level 2 Assets that do not have regular market pricing, but whose fair value can be readily determined based on other values or market prices. Sometimes called “mark to model” assets, these asset values can be closely approximated using simple models and extrapolation methods using known, observable prices as parameters. Part of an overall requirement of publicly traded companies is that they are required to report to investors the makeup of their assets based on certainty of fair value calculations.

Level 3 Assets whose fair value cannot be determined by using observable measures, such as market prices or models. These assets are typically very illiquid, and fair values can only be calculated using estimates or risk-adjusted value ranges. I like this method of determining fair value assets as "mark to myth," or "mark to management's best guest," or "mark to a hope and a prayer."

Prior to the implosion of the past several weeks, Merrill Lynch stated that it's most difficult to value Level 3 assets (First Quarter of 2008). Its percentage of Level 3 assets to total shareholders' equity was 130%. Bear Stearns' percentage of Level 3 assets to total shareholders' equity was 314%. Goldman Sachs' percentage of Level 3 assets to shareholders' equity was 192%. Lehman Brothers' percentage of Level 3 assets to shareholders' equity was 171%. Morgan Stanley' percentage of Level 3 assets to shareholders' equity was 235%.

The dynamics of the past couple of months demonstrate that the financial community has forgotten what they should have learned in any basic finance course is that leverage is a "two-edged sword." It enhances profits during the expansion phase of the economy but exacerbates the overall profitability during economic downturns.

All companies must immediately disclose the dollar amount of Level 1, 2, and 3 assets to the public. I am not talking about this disclosure in the 8-Ks, 10-Q's or 10-Ks. What I am recommending is that financial service sites, such as Morningstar, Yahoo Finance, Wall Street Journal Online, Barron's Online, etc., incorporate this data when they provide balance sheet information to the public.

SEC and Financial Leverage

Barry Ritholtz wrote in the Big Picture: "So while the SEC runs around reinstating short selling rules, and clueless pension fund managers mindlessly point to the wrong issue, we learn that it was the SEC who was in large part responsible for the reckless financial leverage that led to the current crisis." (Don't get me started on blaming the short sellers. Let's put the blame on where it directly belongs. That is the SEC for allowing investment banks to increase their leverage and the individuals who leveraged their companies 40 to 1 with bad investments to enhance profits.)

What the SEC has to do immediately is to have all investment banks reduce their leverage factor to the pre-2004 level of 12:1 from the current 30-40:1.

Thursday, September 11, 2008

Don't Bail Them Out!

Wednesday, September 10, 2008

The Spending Explosion: Will it ever stop?

Oil Prices: WTIC (West Texas Intermediate Crude)

Tuesday, September 09, 2008

Fannie and Freddie: Understanding the Financial Crisis

What this means is that for every $1 million in capital (net worth), Fannie and Freddie can lend out $50 million. The profit is the difference in the cost in acquiring the debt and the interest rate that Fannie and Freddie received. Let's assume that Fannie and Freddie earned 8% on its assets and had to pay 4% for its debt. The difference of 4% is its gross profit, or 4% times $50 million is $2 million. Now keep-in-mind, Fannie and Freddie had $1 million in equity but earned $2 million. Nice profit!

Of course, you have to be able to take some losses, which, of course, Fannie and Freddie were not prepared to do given the sub-prime debacle of the past year. If they had a $3 million loan go bad, they would have completed depleted their profits and wiped-out all their capital. If Fannie and Freddie were going to exist, they would have had to raise additional capital, which no one wanted to do, or sell off their assets (mortgages), which, of course, no one wanted. And that is the reason why the government intervened. The government is not calling it a "bail-out," but else would you call it.

Monday, September 08, 2008

Dollar, Gold and Oil "Price" Relationships

From the chart, one can observe that the peak in oil and gold corresponded to the low in the dollar in July 2008. Since then, the dollar has rallied and both oil and gold have decline. The key going forward from this point must be to track what happens to the dollar. We will definitely follow this relationship.

From the chart, one can observe that the peak in oil and gold corresponded to the low in the dollar in July 2008. Since then, the dollar has rallied and both oil and gold have decline. The key going forward from this point must be to track what happens to the dollar. We will definitely follow this relationship.

GDP: Growth Adjusted Upward by 3.3% for Second Quarter

Monday, September 01, 2008

Future Price of Oil

Price of Gas: Facts and Economic Logic

Sunday, May 11, 2008

How does one identify the underlying trend of the market for optimizing profits?

Clearly, the 15-week EMA lies below the 40-week EMA. Therefore, from a market trend perspective, the market is in a major correction. Over the past ten years, this investment approach has been excellent. If the investor would have sold his/her S&P 500 investment in late 2000 at approximately 1,450 and then purchase it back in early 2003 at approximately 925, that investor would have eliminated a 36% lost. Purchasing at 925, early 2003, and holding the investment until January 2008, you investment return would have been 57%.

Currently, investors would be out of the market and in a money market fund or an inverse ETF, such as DOG, DXD, SDS, or QID.

Saturday, May 03, 2008

It's Not Over Until It's Over

Over the twelve plus year period the 50- and 200-day EMA lines have crossed four times. Once in 1998, the 50-day EMA briefly pierced the 200-day EMA to the downside, suggesting a move into bear territory. The next cross to the downside was seen in late 2000 (dot.com debacle), warning of an equity market plunging into its largest and most extended bearish episode in many years. It was not until May of 2003 that the 50-day EMA crossed back up through the 200-day EMA. And, in January 2008, we have seen a cross to the downside. Until the 50-day EMA moves back up above the 200-day EMA, my position is to assume a defense investment position, such as being invested in a money market fund and/or inverse ETFs like DOG, SDS, DXD, and QID. Also, had one followed this very simple indicator over time, one’s financial health could have been greatly enhanced.

Thursday, May 01, 2008

Double Your Pleasure or Double Your Pain

Since January 2008, my position has been that the market is either in a major correction or the start of a "Bear Market." Therefore, I thought it was about time to revisit that position.

Monday, March 17, 2008

Assurance from President Bush

The Impudent Boldness of Greenspan

Monday, March 10, 2008

Market Update

Monday, February 18, 2008

Double Jeopardy

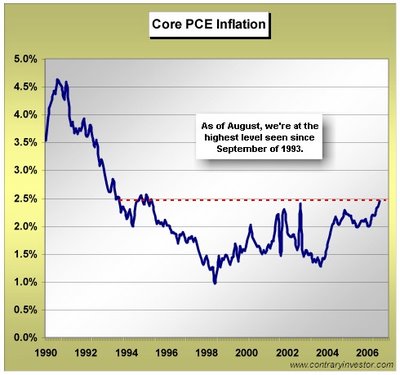

Source: Contrary Investor

Tuesday, February 12, 2008

Çredit Crisis: Precursor of Great Inflation

Thursday, February 07, 2008

Bear Market Rallies

Monday, February 04, 2008

Tuesday, January 29, 2008

The Great Fiscal Stimulus Package of 1929

Tuesday, January 22, 2008

Saturday, January 19, 2008

The Market Has Spoken!

Since the market is extremely oversold, we should expect the market to rally short-term. Keep-in-mind that this is not a time to me looking for a major bottom. Don't get sucked in by those pundits who will be screaming that this is a golden opportunity to buy. Prepare yourself mentally to either short the market or purchase inverse ETFs, like SDS. The best chance for the market to make some kind of a bottom, based on market cycles, is around March 27, 2008.

Source: Jack Chan's "Simply Profits"

Wednesday, January 16, 2008

Inflation Jumps in 2007

Tuesday, January 15, 2008

Market: Critical Junction

Investment Trend

Wednesday, October 31, 2007

S&P 500 Index: Home Building vs. Department Stores

Source: The Big Picture

Tuesday, October 30, 2007

Today's FOMC Meeting

Today, the Fed will cut the Fed Funds rate by 25 basis points. At least this is the betting line over at the Chicago Board of Trade. 98% of the traders are pricing in a 25 basis point cut, while only 8% are pricing in a 50 basis point cut. I am firmly in the camp of another rate cut, because our credit problems (subprime mortgages and SIV's) are still with us.

The importance today is not the Fed's action but the reaction of the markets, currency and equity. Rates cuts are generally considered bullish for the equity market, except when a recession is looming on the economic horizon. Thanks to the Contrary Investor for providing the following insight on the rates cuts that preceded the previous recession.

Learning point is that not all rate cuts are bullish, but rather the key is the reaction of the financial markets to any change in monetary policy.

Friday, October 05, 2007

Washington Mutual's Earnings To Suffer From Mortgage Woes

Thursday, October 04, 2007

Technical Analysis: Would You Purchase this Stock?

Answer: In your response, indicate the reason for your decision. [There is neither a right or wrong answer.]

Monday, October 01, 2007

Dollar Strategy

Wednesday, September 26, 2007

What is the Dollar Worth?

Since the Fed cut the Fed Funds rate, it seems every currency, inclusive of Third World currencies, in the world has rallied against the dollar. The Euro is at an all time high, recently the dollar was trading at $1.412 to the Euro. Even the Canadian dollar (loonie) is now at par against the dollar, which is the first time in three decades. However, take solace, the dollar did hold its own against the Zimbabwean dollar where inflation in that country is only running at 15,000% a year.

In addition to the dollar's weakness against currencies in general, the price of oil exceeded $84 a barrel; and with the prospects of reflation, the price of gold went to $740.

Don't worry. The Fed has everything under control. Just look at how well they have protected the value of the dollar.

Tuesday, September 18, 2007

August Wholesale Prices Fall Sharply (What about core inflation?)

The reason that I posted this information is to inform you that the market will do anything to justify a rate cut by the Fed. The whole emphasis in today's financial press is on the decline of wholesale prices, which in effect is saying that inflation at the wholesale level is in check. Therefore, the Fed can go ahead and cut interest rates. However, what is completely ignored is the fact that just a month ago the emphasis by the financial media was on "core inflation." And, if you noticed the last sentence in the first paragraph, you read that core inflation rose .2%, which on an annual basis is 2.4%. This was double from the previous month. The Fed generally would like the core inflation to be between 1% and 2%.

Will the Fed cut the Fed Funds rate? You bet! Will the equity markets be satisfied? Probably not. That is why the old Wall Street adage will probably be true, which is "Buy the rumor and sell the news."

Thursday, September 13, 2007

Root Causes of Financial Bubbles

Another question to ask is why and when did the Federal Reserve increase reserves to the banks? The Fed started its current monetary expansion program after the last recession, 2002. The Fed realized that since the consumer is such an important component of GDP, something like 71%, it needed a catalyst to stimulate the economy. The consumer was that catalyst. By providing and injecting reserves to the banking system, the Fed knew that the desired outcome of GDP growth would occur through the assistance of the banking system and individual borrowers. However, this contrived real estate bubble has finally burst, as all bubbles do, and the consequences are going to be felt for many years to come. The Fed's solution will be to simply reinflate the economy and create another bubble.

What I find interesting about this current subprime mess is that no one or a very small fraction of the financial world is looking at the Fed as the real culprit or villain. However, I do hear that the subprime mess is the fault of mortgage banks, credit agencies, and hedge funds. But I firmly believe that these entities are not the "root" cause of the problem. For that, simply look at the Federal Reserve and its expansionary monetary policies.

By the way, the chart from my post of September 3, which was entitled, “Picture is Worth a Thousand Words,” is that of the Money Supply. The chart can be accessed at the following URL: http://research.stlouisfed.org/fred2/series/MZMNS.

Saturday, September 08, 2007

The Next Subprime Mess

These investment vehicles are entities that banks use to issue commercial paper, which is a money market instrument. With the proceeds, banks purchase corporate receivables, auto loans, credit card debt, and, yes, mortgages. Why is this so alarming? Take Citigroup, for example. Citigroup owns about 25% of the market for SIVs, which is approximately $100 billion according to the "Wall Street Journal" in its September 5, 2007 edition. Yet, in its 2006 filing with the SEC, there is no mention of it. What? How can this be? Well, accounting rules don't require banks to separately record these type of off-balance sheet investment vehicle on their main financial statements. One would have thought that the accounting profession would have learned something from Enron, World Com, and Global Crossing. The demise of each of these companies was directly tied to off-balance sheet vehicles.

The Federal Reserve System has a major challenge ahead of itself in trying to bring stability and trust back to the financial markets. In my opinion, these challenges are a direct result of their own polices instituted during the past five years. The banks and financial markets did not create this subprime mess or pending SIV mess. The Fed did that all by themselves. The banks and financial markets were just reacting to what the Fed was doing. That is, when the Fed reinflated the banking system with reserves (money), banks made loans. Because interest rates were low, which was caused by the Fed reinflating the banking system, individuals were more than happy to refinance their homes and draw down their home equity. This resulted in real GDP growth. However, the consequence of all this liquidity has been the inflation of all financial assets. Like all bubbles, they do burst; and we have already seen the subprime bubble burst. The next one just could be those nasty SIVs.

Monday, September 03, 2007

Picture is Worth a Thousand Words

What is the name the above chart?

Thursday, August 30, 2007

Did Someone Say, Volatility?

This market is just waiting for Bernanke and friends to make of their minds on what to do about the Fed Funds rate. First, the discount rate was cut to 5.75%, which did calm the markets somewhat. However, you can not tell that by the past Tuesday and Wednesday. Second, the market is now anticipating that the Fed is going to cut the Fed Funds rate before its next scheduled meeting, which will be held on September 18. The cut in the discount rate was nothing but symbolic. The discount rate, a lagging rate, follows money market rates. So, if anything, it was probably a shrewed move by the Fed. I guess market participants should go back an revisit their Money and Banking course to get a quick refresher on Monetary Tools. If the Fed really wants to be serious about providing liquidity to the banking system, the recommended policy would be to reduce the reserve requirement ratio that depository institutions (banks) must hold on their deposits (liabilities). This action would immediately provide instant liquidity by way of excess reserves. These are the reserves that banks can loan out. May be the Fed could surprise us a cut these requirements, which would immediately tell me that the subprime and condo problem is a whole lot worse than most investors think it is.

If we get the cut in the Fed Funds rate or reserve requirement ratio, investors must watch the performance of the financial sector, consumer sector, and utility sector for clues of the overall strength to the economy. However, these three sectors need to start out performing the S&P 500 and penetrate their well defined resistance lines. So far, they have not outperformed the market. The following charts depict the performance of the three sectors relative to the S&P 500:

Stay tone. Things are going to get really interesting, very shortly.

Tuesday, August 28, 2007

Housing Prices: Steepest Drop in 20 Years

Here is another sober thought to ponder that was stated in the recent issue of Barron's on August 27, "Up & Down Wall Street," There are over $1 trillion of securitized low-grade mortgages (subprime) outstanding and nearly three-quarters of a trillion dollars worth of mortgages whose adjustable rates are stated to rise over the next year."

The message from the above two reports assures us that the economy is about to experience an appreciably larger magnitude of pain in the months ahead. This is why I am now totally convinced that the Fed will not only cut the Fed Funds rate by 50 basis points but will provide sufficient liquidity (money) to save the entire banking system. When the Fed re-inflates, and they will, with a passion, the dilemma for them is the negative impact such a monetary policy has on the dollar.

Stay tone because all of this will come to the forefront in September. Oh, I forgot to mention that September will also bring earnings reports from banks and brokerages that will reveal the extent of their "losses" from subprime investments.

Monday, August 27, 2007

Markets at a Glance

What about this week? The subprime real estate bubble will continue to dominate the market. Last week's infusion of $2 billion into Countrywide Financial by Bank of America still leaves more unanswered questions, especially in the funding area for Countrywide. Now, we are hearing that condominiums have their own set of defaults and foreclosures. Major markets across the country, especially in parts of Florida, California, and Washington, D.C., are seeing rising foreclosures and bankruptcies of entire condo projects.

Another concern, near term, is that the market has been rising on low volume, which equates to lack of conviction. Also, the months of September and October have not been kind to the markets.

Monday, August 20, 2007

Presidential Cycle: Third-Year Correction

Time for an Update: Bear Market, Yet?

I also said on Friday, March 2, 2007, "Now, at what levels on the DJIA and S&P 500 will negate or call into question this current bull market? For the DJIA, the level is 11,783, or 4.5% from the current level. For the S&P 500, the level is 1,358 or 3.2% from the current level. At these levels, I would definitely become concern."

Given the market's frenzy over the past two weeks, are we to those levels on the DJIA and S&P 500 that I mentioned back in March 2007 where I would get very concerned? The answer is "NO." The low on August 16 for the DJIA was 12, 455.92. For the S&P 500, the low on August 16 was 1370.60. Since August 16, the DJIA and S&P 500 are up 5% and 6%, respectively, from their lows. Keep-in-mind that corrections during bull markets are usually 10% to 12%. So far, the recent corrections from the July 19 high to the August low on the DJIA and S&P 500 have been 11.79% and 11.87%, respectively.

Saturday, August 11, 2007

S&P 500: Long-Term Perspective

How is this investment strategy implemented? The following chart gives the specifics. It illustrates the 17-week and 43-week moving averages of the S&P 500 over the past decade. When the 17-week moving average is above the 43-week moving average, the market is in a "Bull" phase; and an investor should be fully invested. When the 17-week is below the 43-week, the market is in a "Bear" phase; and an investor should either be short or in cash (money market fund). There you have it. This investment strategy is very simple but, yet, very profound. Just check it out. Its performance has been excellent. By the way, an investor would have been out of the market debacle during 2001 and 2002 and in since 2003 following this strategy.

One other feature of the above chart is the index on the bottom. It is the "Relative Strength Index (RSI)" of the S&P 500. Its significance is that the index remains consistently above 50 during the "Bull" phase and consistently below 50 during the "Bear" phase.

Thursday, August 02, 2007

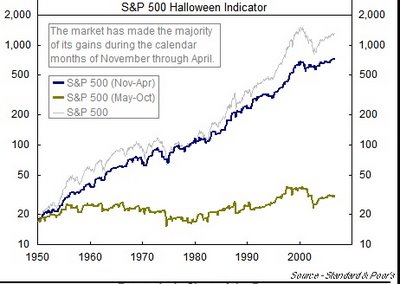

Seasonal Performance: Halloween Indicator Update

Thursday, May 03, 2007

Halloween Indicator Performance Record Since 1950

With the raw data, I calculated the mean return, standard deviation, and the coefficient of variation. The results are as follows: May/October had a mean return of 1.52%, standard deviation of 8.55%, and a coefficient of variation of 5.64. November/April had a mean return of 7.30%, standard deviation of 10.08%, and a coefficient of variation of 1.38. Finally, a Buy/Hold strategy had a mean return of 0.74%, standard deviation of 4.07%, and a coefficient of 5.53.

With the raw data, I calculated the mean return, standard deviation, and the coefficient of variation. The results are as follows: May/October had a mean return of 1.52%, standard deviation of 8.55%, and a coefficient of variation of 5.64. November/April had a mean return of 7.30%, standard deviation of 10.08%, and a coefficient of variation of 1.38. Finally, a Buy/Hold strategy had a mean return of 0.74%, standard deviation of 4.07%, and a coefficient of 5.53.Any questions about the power of seasonality within the stock market? I didn't think so. Another way of looking at the above performance is as follows: "One dollar invested in 1950 using only November through April investment periods each year has grown to just shy of $43 today. Alternatively, one dollar invested only in the May through October periods since 1950 is today worth less than $2."

Thursday, April 26, 2007

MBA 642: May 1 Assignments and Readings on Interest Rate Parity and Arbitrage

For example, say $856.90 is converted to Canadian dollars at an exchange rate of 1.1670 CDW to $1 to buy a CDW1,000 6-month bond that pays an annual rate of 4%. At the end of 6 months, the investor would receive CDW1,020. If the exchange rate remains the same, the Canadian dollars can be converted into $874.03 (1,020/1.1670), which translates into a 4% annual rate of return. But suppose the Canadian dollar is expected to appreciate against the U.S. dollar, and so the forward rate is 1.1614 CDW per U.S. dollar. Then, the CDW1,020 will buy $878.22 (1,o20/1.614). This gives an annual rate of return of 4.98%. Thus, the investor earns 4% on the Canadian investment and then gains 0.98% on the appreciation of the CDW that leaves the net return of 4.98%. Therefore, given the prior assumptions, a 4% Canadian rate implies that the U.S. riskless rate on a 6-month bond should be 4.98%. If the U.S. and Canadian rates were the same 4%, then U.S. money would flow to Canada, driving down Canadian rates and driving up U.S. rates, until equilibrium has been reached (interest rate parity).

For Tuesday, May 1, read pages 944-966 of Chapter 27 "Multinational Financial Management." Focus your attention on the section entitled, "Trading in Foreign Exchange -- Interest Rate Parity." Do the following problems for Chapter 27: 2, 3, 9, 10, and 11.

In addition, refer back to the post of April 23 entitled, "Interest Rate Parity" and answer the question on the Indian INR arbitrage. Also, complete the arbitrage question from the handout on the Dollar and SF.

Monday, April 23, 2007

MBA 642: Interest Rate Parity

A good site for a currency converter on over 164 currencies is at Oanda.

Wednesday, April 18, 2007

MBA 642: De-Leverage ???

For Tuesday, April 24, be prepared to comment on the outlook for the Yen and Dollar.

You may want to check out the following link for the dollar.

Monday, April 16, 2007

MBA 642 Financial Management

In addition, we will review for your assessment next week. You will be responsible for the following concepts: DuPont Formula and its Applications, P/E Valuations, Cost of Capital Applications, Evaluating Cost of Equity through CAPM, NPV with Replacement Chain Analysis, and Coefficient of Variation.

Note: Please remember those families who have lost love ones at Virgin1a Tech.

Friday, April 13, 2007

Risk Management Indicators

Along with the Halloween Indicator, this indicator has proven to be a real “winner.”

Thursday, April 05, 2007

MBA 642: Assignments

In addition, read pages 454 to 464 (Chapter 13) on "Techniques for Measuring Stand-Alone Risk." Then, do problems 7 and 8.

Saturday, March 31, 2007

FINC 431 Finance: Assignment

In addition, we will have some lab time so that each group can calculate its stock "beta."

Friday, March 30, 2007

Market Quote

DJIA Monthly Gains

Wednesday, March 28, 2007

MBA 642: Yen Carry Trade

MBA 642 Financial Management: April 3 Assignment

1. Calculate the "Forward Looking Market Risk Premium" for your stock.

2. Determine the price set-up for your stock using "Technical Analysis."

3. Chapter 12 Capital Budgeting (Problems 1, 2, 3, 5, 7, and 12)

Wednesday, March 21, 2007

MBA 642 Financial Management: Assignments

1. Chapter 8 Analysis of Financial Statements (Problems 3, 4, and 5)

2. Chapter 10 Determining the Cost of Capital (Problems 1, 2, 3, 5, 6, 9, and 10). In estimating the risk-adjusted rate of return, our authors use the rate on the 10-Year TSY Note as the risk-free rate of return. Why? What is the rationale for using the 90-Day TSY Bill rate as the risk-free rate? What is the appropriate "Market-risk Premium" to use? Explain. Review "Estimating Market Risk Premium" on pages 324-326, especially "Forward-looking Risk Premiums.

3. Market Bounce Data: $SPXA50 (Level 100?), 10-day MA of $CPCE (Range .72 to .75?), and 60-day MA of $CPC (Level of 1.05+)

4. Technical Analysis: Price Set-ups for TLT

5. Beta Analysis: Group Endeavor

6. Million Dollar Challenge Update

Thursday, March 15, 2007

FINC 431 Finance

1. Read pages 359-366 of your text on the "Capital Asset Pricing Model (CAPM) and Securities Market Line (SML).

2. Read Chapter 13 on "Risk and Capital Budgeting."

Have a great Spring Break!

Saturday, March 03, 2007

Market Bounce! From What Level?

1. The first is the number of S&P 500 stocks above their 50-day MA ($SPXA50). Levels of 100 or lower are usually associated with market lows. As of Friday, March 2, it stood at 170.

2. The 10-day MA of the CBOE Options Equity put/call derivative indicator ($CPCE) has been good at identifying bottoms at levels between .72 to .75. As of Friday, March 2, it stood at .73.

3. The 60-day MA of the CBOE Options Total Put/Call derivative indicator ($CPC) will "flash" a bottom above 1.05. As of Friday, March, it stood at .94.

Will these indictors "flash" a buy this time? Time will tell!

Friday, March 02, 2007

MBA 642 Financial Management: Assignments

1. Chapter 4 (Bonds) -- Problem 14

2. Chapter 7 (Financial Accounting) -- Determine the "Free Cash Flow" for AAPL. Bring to class the financial statements for AAPL.

3. Chapter 5 (Basic Stock Valuation) -- Problems 2, 3, 4, 5, 6, 9, and 11

4. Be prepared to discuss the investment events of the past week and its significance, if any. Would you be a buy/seller of TLT and/or IWO? Check the chart postings on the blog for assistance with this question.

5. Portfolio Challenge (CNBC)

6. Calculating the Odds of a Recession: Go to the following site that is entitled "Political Calucations" and make you forecast. Use the data from Bloomberg in making your forecast. This is a very interesting exercise.

DJIA Performance: Average Third Year of Presidential Cycle

Tuesday’s market plunge of over 400 Dow points has drawn a lot of attention from the media. However, on a relative basis the decline was 3.3%, which, in fact, was the first significant decline since this “bull” rally started approximately five years ago. Typically, corrections during bull markets are anywhere from 10% to 12%. This 3% decline is nowhere near other bull market corrections. Don’t let all the media hype about this correction lose site of the fact that we are still in a bull market.

Look at above chart and recognize that two of the best performing months are March and April during the third year of the Presidential Cycle. Also, go back and revisit the “Halloween Indicator.”

Now, at what levels on the DJIA and S&P 500 will negate or call into question this current bull market? For the DJIA, the level is 11,783, or 4.5% from the current level. For the S&P 500, the level is 1,358 or 3.2% from the current level. At these levels, I would definitely become concern.

Wednesday, February 21, 2007

Calculating Free Cash Flow (FCF)

The relevancy of free cash flow is that it represents “real cash,” earnings do not.

Calculation for free cash flow is as follows:

1. FCF = NOPAT – Net Investment in Operating Capital

a. NOPAT = EBIT(1-Tax Rate)

b. Net Investment in Operating Capital = [Cash + Accounts Receivable + Inventories – (Accounts Payable + Accruals)] (Net Operating Working Capital) + Operating Long-term Assets (Net Plant and Equipment)

2. FCF = (NOPAT + Depreciation) – Gross Investment in Operating Capital

a. NOPAT = EBIT(1-Tax Rate)

b. Gross Investment in Operating Capital = [(Net Operating Working Capital + Operating Long-term Assets) + (Depreciation)]

Uses of FCF

1. Pay interest to debt-holders

2. Repay debt-holders

3. Pay dividends to shareholders

4. Repurchase stock from shareholders

5. Purchase marketable securities or other non-operating assets

MBA 642 Financial Management: Million Dollar Challenge!

Once the facilitator is selected, he or shee will register his/her team on CNBC for the “Portfolio Challenge.” See instruction below. I will the computer lab open so that each group can start the million dollar process. Good luck!

1. Go to CNBC (http://www.cnbc.com)

2. Click-on “Investing Tool.”

3. Click-on “Portfolio Challenge” to register.

4. Complete the registration procedure.

5. Challenge starts March 5, 2007

Stock Market Rallies

As the following chart indicates, the current bullish rally is approximately 4.5 years in duration, which is long by previous market rallies. In addition, its current performance during this rally is approximately +75% over the past 4.5 years, which is lags behind previous market rallies. Also, the current rally is below its linear-regression trend line. Will we have a revision to the mean (point on the line) or will this market rally continue to underperform?

Monday, February 05, 2007

Fama and French Three-Factor (Predictor) Model

Fama and French started with the observation that two classes of stocks have tended to do better than the market as a whole: (1) small caps [SML] and (2) stocks with a high book-value-to-price ratio [HML]. When they tested their hypothesis, they found small companies and companies with high B/M ratios had higher rates of return than the average stock (just as they hypothesized). Somewhat surprising by their research, however, they found no relation between beta and return.

They added two additional factors (predictors) to CAPM to reflect a portfolio’s exposure to size and B/M. The three-factor model is as follows:

ri = rf + bi(MRP) + ci(SMB) + di(HML) + alpha

One thing that is interesting is that Fama and French still see high returns as a reward for taking on high risk. For example, if returns increase with B/M, then stocks with high B/M ratio must be more risky than low B/M. Why?

Buy, Hold, or Sell

OER or It's All About Data Analysis

Sunday, February 04, 2007

January Indicator of Future Stock Performance

Saturday, January 13, 2007

Declining CRB Index Signifies Economic Weakness

In their latest weekly update, Comstock Partners, Inc. provided an interesting analysis of their findings of the recent decline in the "CRB Index." Quote:

"The idea that falling crude oil prices will boost the economy and overcome the plunge in housing is yet another instance of hope replacing reality. Despite its great importance, oil is just another commodity that goes up and down with the business cycle. When the economy begins to weaken commodity prices go down; when the economy is strong commodity prices go up.

Since its May high the CRB commodity index has dropped 22%, only the 7th time this has happened since 1974. According to ISI, since 1974 every decline in the index of 20% or more has been associated with either a recession, a significant slowdown or a financial crisis. Each of these periods has also occurred following a period of tight money and an inverted yield curve. In this regard it is also noteworthy that oil has not been the only commodity declining in price. Recent months have featured significant declines in a wide assortment of commodities such as copper, gold, sugar, hogs, wheat and corn. It is therefore likely that the oil price decline is itself a result of economic softening rather than an impetus to growth.

ISI also points out a number of other factors historically associated with significant economic slowdowns including the lagged effect of 17 rate hikes; the decline of house prices; the plunge in mortgage equity withdrawals (MEW); the inverted yield curve; significant slowing in the leading indicators; tightening by foreign central banks; and nominal GDP growth under the fed funds rate.

Source: http://www.comstockfunds.com

Friday, December 01, 2006

The Economy

"On CNBC, the pundits are talking about how the most recent spate of data has put Goldilocks scenario in danger. I must admit to finding it amusing how much faith so many players had put into Goldilocks, a most unusual and unlikely scenario.

The latest data forces me to revise my 50% possibility of a recession in 2007/08 up to 60%. GDP for Q4 '06 is likely to be between 0.5% - 1.5% (or worse, if Holiday sales keep trending softer).

As far as the Fed, this data suggests that the jawboning about inflation will remain just that -- while we still expect the Fed to cut before 2007 comes to an end, the odds of a hike anytime soon have just dropped significantly.

Given the awful PMI and ISM data -- they both broke the key "50" demarcation -- one may be wondering how GDP data ended up getting revised upwards. The answer comes from the way GDP is constructed. But even more importantly, observe which the components that increased the revised GDP -- these are symptomatic of a slowing economy:

Inventory build, government spending and imports, was responsible for virtually all of the 0.6% upward revision in GDP. Consumption, 70% of the US economy, is slowing.Revised higher:

Government spending (0.05%)

Inventory Build (0.26%)

Imports (0.39%)

Revised lower:

Exports were revised 0.2% lower.Consumption was revised 0.14% lower

Why are Businesses inventories increasing? Some pundits have claimed this is a bullish sign, an "anticipation of increased demand." I doubt this. We have seen recent CEO surveys which point to major negative sentiment amongst the usually cheery Execs; Durable Goods tumbled 8%, and Housing and Autos are likely already in a recession. My guess is that Just-in-time-inventory is easier to ramp than it is to slow down.

And while Reuters reported that "Business spending on inventories rose, increasing sharply to a $58 billion rate from the $50.7 billion earlier estimated." Inventories builds have increased at a faster than usual pace -- implying that this was (whoops!) unintentional.

Given the drop in both Durables and Capex, I am somewhat incredulous over Business spending being revised upward to show a 7.2% gain (versus 6.4% advance)."

Source: http://bigpicture.typepad.comSaturday, November 25, 2006

Determination of Exchange Rates

What is going on with the extreme weakness in the dollar (at a 19-month low)? What is causing the $USD to be so weak? From Chapter 21, which is entitled International Financial Management, we can make an inference as to the recent $USD weakness. Read pages 603-611 that provide insight for each of the following exchange rate determinates of the $USD: Income and taste, Changes in relative interest rates, Changes in relative price levels, Changes in fiscal and monetary policies, Changes in Balance of Payments, and Other Factors such as Oil Prices and SOX or SarbOX Act.

For Tuesday, October 28, be ready to discuss the causes for the $USD weakness.

Saturday, November 11, 2006

Yield Curve Says "Probable" 2007 Recession

John Mauldin notes:

"The yield curve became more inverted this week, with the negative differential between the 3-month and the 10-year at -49 basis points and a -76 basis point differential between the 10-year and the Feds fund rate. According to a Fed paper, that level of an inversion suggests there is now an over 40% probability of recession next year. This same model only predicted a 50% chance of recession in 2000, and as the paper authors acknowledge, the model probably understates risk in recent decades."

The yield curve and interest-rate data looks like this, which is from Bloomberg.com:

Source:

John Mauldin

Investor Insight, November 10, 2006

http://www.frontlinethoughts.com/article.asp?id=mwo111006

Thursday, November 02, 2006

Free Cash Flow (FCF)

To calculate FCF, go to a firm's cash flow statement. There you will find the line item entitled "Total Cash Flow From Operating Activities." From this number, subtract the number from 'Capital Expenditure," which is found in the next section of the Cash Flow statement entitled "Investing Activites."

For your firm, calculate the FCF for the past three fiscal/calendar years and trend the data. What is the trend? Keep-in-mind that a negative FCF is not necessary bad. It could be the result of some large capital expenditures, which in itself could prove to be highly profitable.

Thursday, October 26, 2006

Halloween Indicator

Wednesday, October 25, 2006

Risk and Capital Budgeting

Saturday, October 21, 2006

History Lesson

Thursday, October 19, 2006

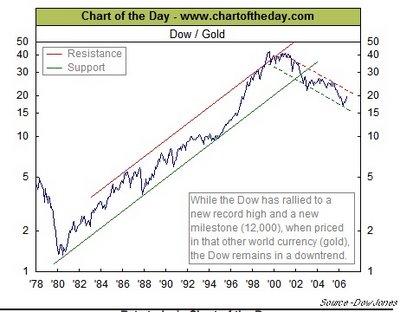

All Time High for the DJIA, or Is It?

May be we should be purchasing gold, like GLD or GDX, and not equity stocks. What do you think? Make your comments during the coming week.

Saturday, October 07, 2006

Goldilocks' Rally?

The reason that I present this chart is because the stock market is indeed anticipating that the Fed will soon be reducing its "Fed Funds" rate (January or March) with the market making a "new" this past week. In addition, the rate on the Ten Year TSY (4.75%) is below the Fed Funds rate (5.25%), which in the past has been an excellent harbinger of lower rates. Go to Bloomberg at http://www.bloomberg.com/markets/rates/index.html to see the current interest rate structures. Also, the decline in energy prices, especially oil and natural gas, along with the expectations that corporate earnings for the third quarter are going to be very robust have helped propel the market higher. But, the stock market has completely ignored the recent inflationary comments by several Federal Reserve members, which does not bode well for a cut in interest rates, along with signs that the economy is slowing, as discussed in last week's post.

On Tuesday, Fed Vice Chairperson Donald Kohn stated that he is more concerned about inflation than slowing economic growth because a recession is unlikely. On Thursday, Charles Plosser, Federal Reserve Chairperson of the Federal Reserve Bank of Philadelphia, stated that the Fed's very credibility was at stake when it came to keeping prices under control. He was clearly concerned that the core PCE inflation is above 2%, and he expressed the need to raise the Fed Funds rate, not lower it. Please remember that he, who has the gold, in this case the money, makes all the rules! And the Fed has all the money, therefore, it makes all the rules as it pertains to the financial markets and the economy. Therefore, don't count on the Fed reducing rates unless inflation, as measured by the PCE, comes down below 2%.